Extreme fear in January, euphoric greed by December—that’s your 2023 market review in a nutshell.

The most predicted recession has become the most postponed one. The economy proved to be more resilient than expected, despite the aggressive rate hikes by the Federal Reserve.

The stock market had its scary dips early in the year. However, when things turned around, investors who bought fear were pleasantly surprised with their returns later in the year.

In this 2023 market review, we’ll dissect the major themes that defined the year. From the overall stock market performance to the dramatic movements in major currencies, gold, and oil. Finally, we will have a small glimpse of what 2024 might hold.

2023 Market Review: US Stocks

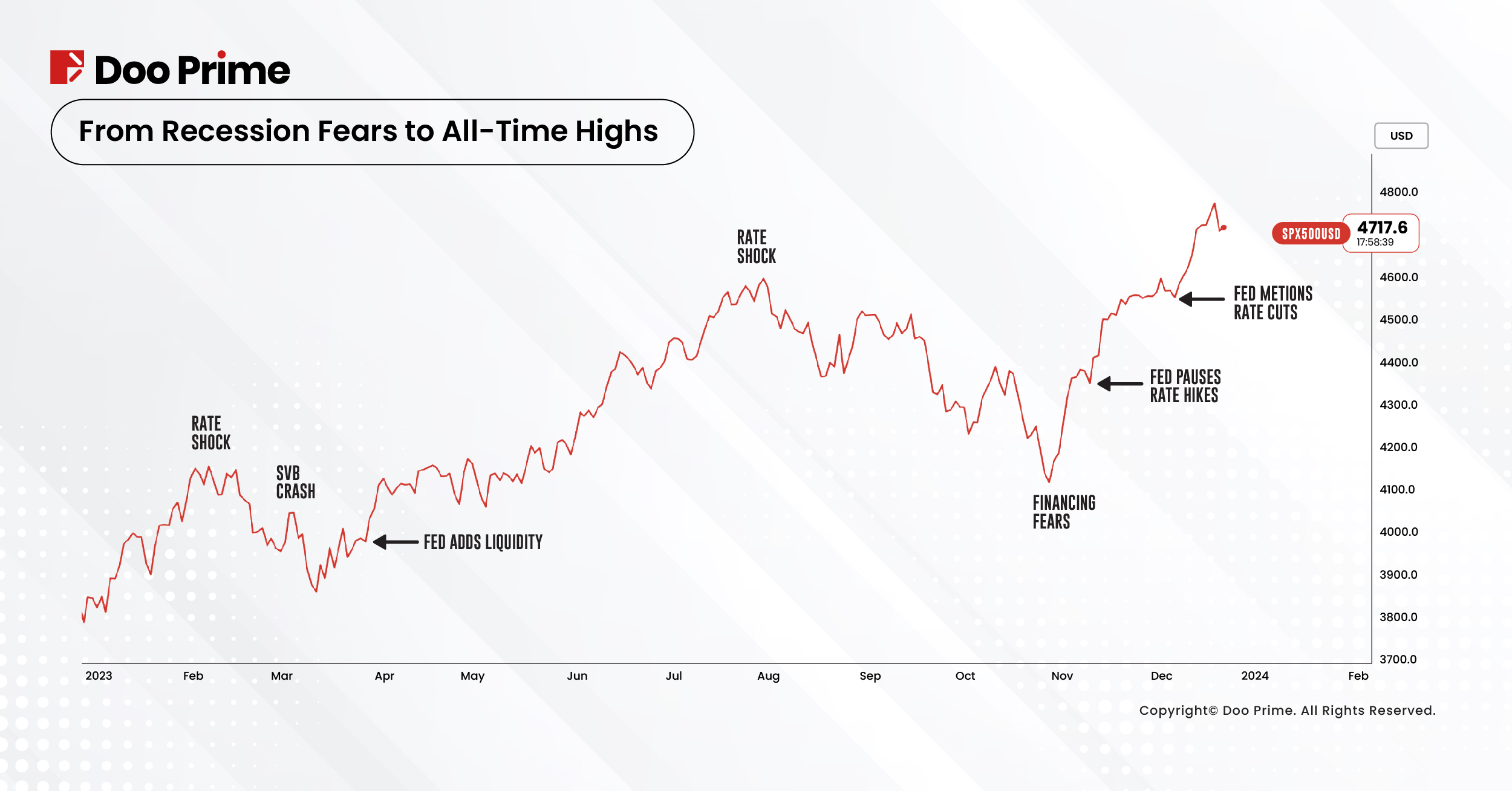

The scariest moment of the year was when the Silicon Valley Bank collapsed in early March. This was the result of the Federal Reserve increasing interest rates to a 20-year high range of 5.25%–5.50%.

The equity markets saw significant selloffs, particularly in tech stocks.

Most investors, including Michael Burry, thought that was it. The recession is here!

However, the Fed had to pull out its guns by adding liquidity to the market to keep things under control and avoid a recession.

For the first time in history, the Fed simultaneously executed both Quantitative Tightening and Quantitative Easing policies.

This was a bold strategy from the Fed, but it proved effective. The market rallied to new yearly highs, squeezing all the short-sellers.

The bulls charged for months, but the rally eventually ran out of steam. The Fed cannot simultaneously conduct two different monetary policies over an extended period.

With inflation remaining high, the primary purpose of QT is to reduce liquidity in the market and slow it down.

When fear of higher interest rates came back, it brought volatility back with it. Once again, the market started to pullback, and the Fed had to act.

As the market showed early signs of weakness, the Israel-Hamas war broke out in the Middle East.

That is where the 10-year Treasury yields found resistance at 5% and reversed back down below 4%.

The Fed had to pivot on their monetary policy decision. They went from “higher rates for longer” to “temporarily pausing rate hikes” to finally “rate cuts in 2024.” This marked a dramatic change in their stance within a short timeframe.

Chairman Powell’s surprise announcement of a potential rate cut in 2024 sent the Nasdaq, Dow Jones, and S&P 500 to rally towards all-time highs within a month.

Sector Winners and Losers

While the overall market rebounded, individual sectors experienced vastly different fortunes.

- The technology sector. Powered by the resilience of the Magnificent 7 stocks staged a remarkable comeback.

- Healthcare and consumer staples remained defensive plays, offering relative stability throughout the year.

- Energy and defense stocks soared amidst the ongoing geopolitical tensions and oil price fluctuations.

2023 Market Review: US Dollar Stayed Strong

The US dollar may end the year down 1-2%. However, despite a growing challenge from the BRICS countries, the world reserve currency held its ground in 2023.

- Reasons why the dollar stayed strong against other major currencies:

- Higher interest rates and a hawkish Fed.

- Europe and the UK’s economies were not growing so fast.

- Japan’s central bank didn’t want to raise interest rates to fight inflation, which made their currency weaker.

- Despite the worries about bank crashes and the US national debt ceiling, investors saw the US dollar as a safe place to put their money during uncertain times.

- The US credit rating downgrade caused less damage to the dollar than some investors anticipated. Even a credit rating downgrade couldn’t knock the US dollar down.

The main victims were the emerging markets. Many emerging market currencies faced depreciation pressures due to rising interest rates in the US and slower economic growth in their own countries. This led to capital flight and increased financial vulnerability for some emerging economies.

However, despite its recent strength, the US dollar could weaken in early 2024. The Fed cutting rates next year could lead to the stabilization of most major and emerging market currencies in the first half of the year.

The Beginning Stages of Gold Rush

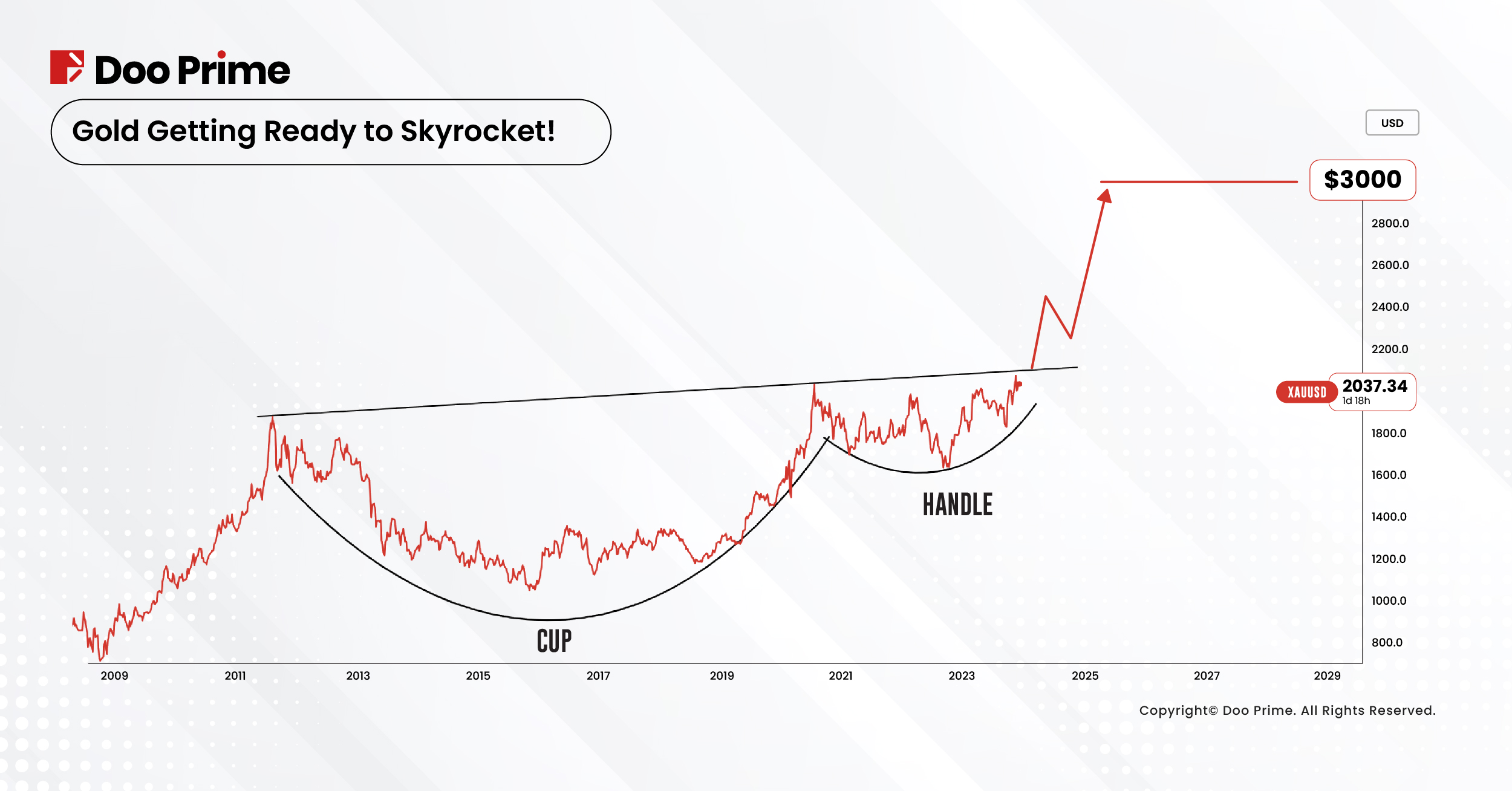

Gold, the traditional hedge against uncertainty, gained over 12% in 2023 as investors sought refuge from volatile markets, inflation risks, and geopolitical tensions.

The precious metal touched new record highs this year, despite the fastest interest rate hikes in history.

The gold chart reveals a popular Cup & Handle price pattern, suggesting a possible rally towards $3000 if the 2100–2150 resistance levels are broken.

The Fed is planning to cut interest rates next year. This could increase the likelihood of gold breaking this decade-long resistance level in 2024.

Oil’s Rollercoaster Ride

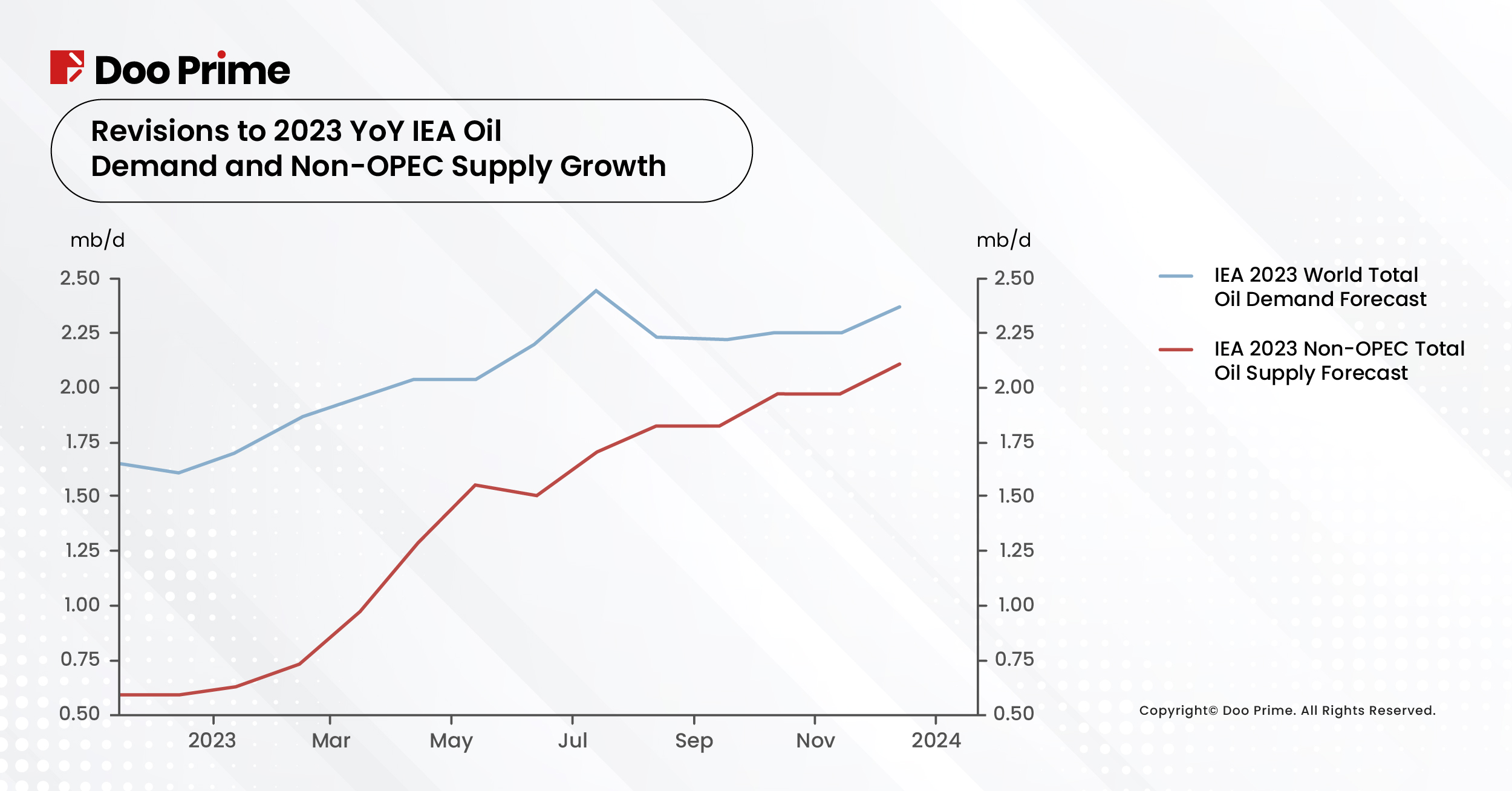

Oil prices had a rollercoaster year in 2023, starting below $65 a barrel in January because of recession fears. But suddenly, things took a surprising twist.

OPEC cuts and a price surge:

- OPEC members and Russia cut production, aiming to boost prices.

- This strategy worked, sending oil prices soaring towards $95 a barrel by mid-year.

- This price hike affected many industries and added to worldwide inflation.

Confusing turn of events:

- Just as investors had locked in their expectations of high oil prices, a new twist hit the scene.

- The Israel-Hamas war, a major event in the Middle East, didn’t have the expected impact on oil prices.

- Instead, despite the production cuts and the war, oil prices dipped more than 20% from their peak.

What factors contributed to the price drop?

- The main reason for the price drop was increased production from non-OPEC countries.

- These countries, like the United States, wanted to help control inflation by putting more oil on the market.

Lessons for the Road Ahead: 2023’s Key Takeaways for Investors

2023 proved to be a period of significant market volatility, demanding rapid adaptation from investors. Here’s what to remember as we head into 2024:

- Be ready to adapt. Markets can change fast, so stay flexible and adapt your trading strategy depending on market conditions.

- Markets are more resilient than we think. Even when things look tough, history shows that markets bounce back.

- Anticipate potential risks. Complacency breeds risk; always stay vigilant.

- Don’t follow the crowd. When everyone is on one side of the boat, consider heading to the other side. Extreme sentiments can signal contrarian opportunities, but make sure to do your research and manage your risk carefully.

By keeping these lessons in mind, we can face 2024 with confidence, knowing we’re prepared for whatever comes our way.

| About Doo Prime

Our Trading Products

Securities | Futures | Forex | Precious Metals | Commodities | Stock Indices

Doo Prime, an international preeminent online broker under Doo Group, strives to provide professional investors with global CFD trading products in Securities, Futures, Forex, Precious Metals, Commodities, and Stock Indices. At present, Doo Prime is delivering the finest trading experience to more than 130,000 clients, with an average trading volume of more than USD 51.223 billion each month.

Doo Prime entities respectively holds the relevant financial regulatory licenses in Seychelles, Mauritius, and Vanuatu with operation centers in Dallas, Sydney, Singapore, Hong Kong, Dubai, Kuala Lumpur, and other regions.

With robust financial technology infrastructure, well-established partnerships, and an experienced technical team, Doo Prime boasts a safe and secure trading environment, competitive trading costs, as well as deposit and withdrawal methods that support 20+ different currencies. Doo Prime also incorporates 24/7 multilingual customer service and extremely fast trade execution via multiple industry-leading trading terminals such as MT4, MT5, TradingView, and Doo Prime InTrade, covering over 10,000 trading products.

Doo Prime’s vision and mission are to become a financial technology-focused broker, streamlining international global financial products investment.

For more information about Doo Prime, please contact us at:

Phone:

Europe: +44 11 3733 5199

Asia: +852 3704 4241

Asia – Singapore: +65 6011 1415

Asia – China: +86 400 8427 539

E-mail:

Technical Support: en.support@dooprime.com

Account Manager: en.sales@dooprime.com

Forward-looking Statements

This article contains “forward-looking statements” and may be identified by the use of forward-looking terminology such as “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “hope”, “intend”, “may”, “might”, “plan”, “potential”, “predict”, “should”, or “will”, or other variations thereon or comparable terminology. However, the absence of such terminology does not mean that a statement is not forward-looking. In particular, statements about the expectations, beliefs, plans, objectives, assumptions, future events, or future performance of Doo Prime will be generally assumed as forward-looking statements.

Doo Prime has provided these forward-looking statements based on all current information available to Doo Prime and Doo Prime’s current expectations, assumptions, estimates, and projections. While Doo Prime believes these expectations, assumptions, estimations, and projections are reasonable, these forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond Doo Prime’s control. Such risks and uncertainties may cause results, performance, or achievements materially different from those expressed or implied by the forward-looking statements.

Doo Prime does not provide any representation or warranty on the reliability, accuracy, or completeness of such statements. Doo Prime is not obliged to provide or release any updates or revisions to any forward-looking statements.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment, and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please ensure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure and Acknowledgement Notice to learn more.

Disclaimer

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, make no representation or warranties to the information displayed and shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided, and any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.