A recent internal conflict at OpenAI made headlines, reportedly stemming from a clash between AI security and commercialization efforts. Allegations of a lack of transparency caused the company to let go of CEO Sam Altman. This came after researchers made a significant breakthrough in the AI model Q*, suggesting that Artificial General Intelligence (AGI) might be on its way. Although the matter has settled, it underscored the global significance of AI cyber security.

Notably, cybersecurity agencies from the U.S. and U.K. jointly released the “Security AI System Development Guide.” This collaborative effort involving 18 countries and 23 cybersecurity organizations like Microsoft, Google, OpenAI, Anthropic, and Scale AIaims to fortify AI systems’ security across design, development, deployment, and operations stages.

AI’s impact on cyber security is dual-edged. While it introduces novel threats, it also holds potential to significantly bolster defense mechanisms. To counter AI-related security risks, reliance on AI-driven protection is imperative. This article delves into the threats posed by AI to network security and examines how companies like Microsoft, Palo Alto, Fortinet, CrowdStrike, and Zscaler utilize AI to reinforce network defense systems.

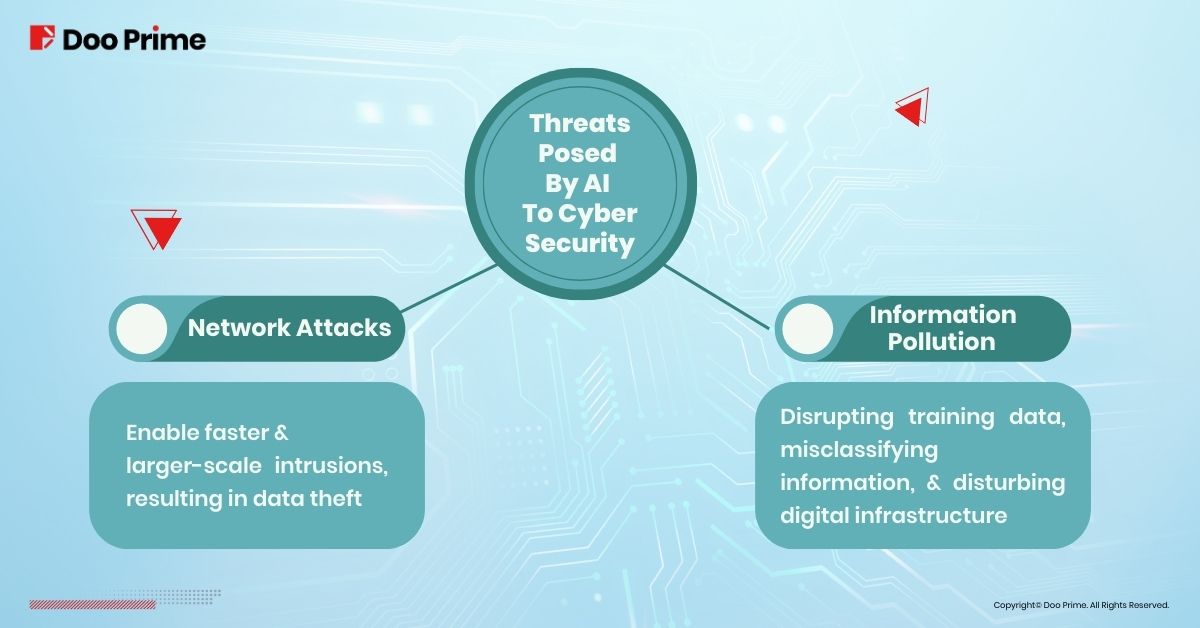

Threats Posed By AI To Cyber Security

Advancing technology empowers cybercriminals with unprecedented threats, as noted by Microsoft’s Security Chief Vasu Jakkal. AI compromises network security primarily through:

- Network Attacks:

- AI-customized phishing methods and replicated malicious software enable faster and larger-scale intrusions, resulting in data theft.

- Hackers can leverage AI to design, execute disruptive code, and tamper with training data, creating new attack vectors.

- Information Pollution:

- AI-generated fake content, like ultra-realistic bots and deepfakes, presents significant dangers. These tools can manipulate news, propagate false information, and disrupt vital systems such as financial markets and legal frameworks. Such misinformation may escalate conflicts and pose threats to national security.

Statista projects that cybercrime losses will reach $11.5 trillion this year and are expected to exceed $23 trillion by 2027 due to cloud migration and connected devices, highlighting the pivotal role of cybersecurity.

AI’s Contribution To Enhanced Cyber Security

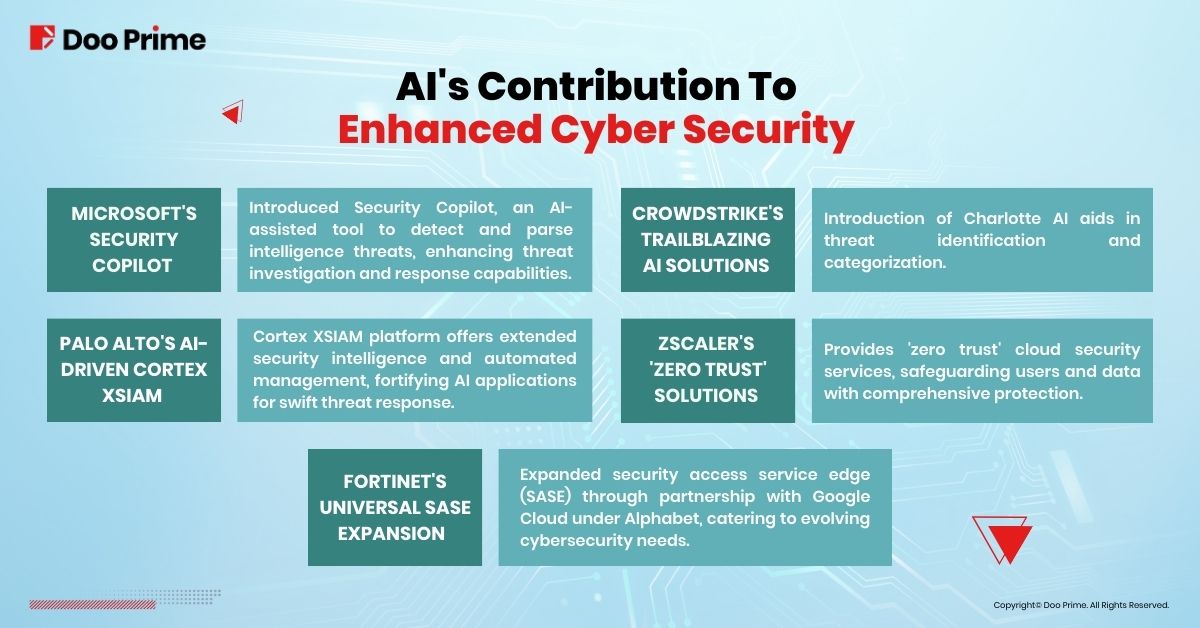

Palo Alto, Fortinet, CrowdStrike, and Zscaler are seasoned leaders in cybersecurity, each contributing significantly to the industry’s evolution.

Microsoft made a strategic move into AI-driven network security following its investment in OpenAI. Leveraging AI capabilities, these companies break through human limitations, revolutionizing monitoring capabilities and accelerating threat response mechanisms.

Microsoft’s Security Copilot

In the inaugural ‘Microsoft Secure’ conference earlier this year, Microsoft introduced the Security Copilot, a cutting-edge tool aimed at detecting and analyzing intelligence threats. Powered by an AI assistant, this tool enables security analysts to more efficiently investigate threats, providing defenders with crucial tools for rapid threat detection and response. Operating on the Azure cloud platform, Security Copilot ensures enterprise-level security and privacy compliance.

Palo Alto’s AI-Driven Cortex XSIAM

Palo Alto’s Cortex XSIAM platform stands as a pinnacle in cybersecurity, integrating advanced security intelligence and automated management to drive cutting-edge AI applications.

This innovation significantly expedites threat response times, complementing their suite of 35 AI-powered products tailored for cloud security, network security, and operations. Their investments in AI tech have propelled stock to historic highs, signaling significant growth prospects.

CrowdStrike’s Trailblazing AI Solutions

CrowdStrike’s Falcon platform, a cloud-based cybersecurity solution, harnesses the power of AI, machine learning, and behavioral analysis to proactively detect, prevent, and counter network threats. Notably, their recent introduction of Charlotte AI, specifically designed for Falcon-related queries, automates threat identification and task execution, addressing the shortage of cybersecurity experts.

Zscaler’s ‘Zero Trust’ Solutions

Zscaler, similar to CrowdStrike, specializes in cloud security services, emphasizing ‘zero trust’ tools that treat all entities as potential threats. Their solutions—Internet Access and Private Access—have earned authorization from the Federal Risk and Authorization Management Program (FedRAMP), fortifying user, data, and workload security for global government agencies and corporations.

Fortinet’s Universal SASE Expansion

Fortinet’s dominance in the cybersecurity market extends beyond firewalls, encompassing the creation of proprietary chips empowering these defenses. Through collaboration with Google Cloud under Alphabet, Fortinet’s Universal SASE extends their Security Access Service Edge (SASE), marking a significant stride in their security offerings.

Investing In AI-Powered Cyber Security: A Lucrative Opportunity?

The ongoing surge in AI technology stands as one of the foremost advancements of 2023, coinciding with a growing emphasis on fortifying network security among enterprises.

According to a Morgan Stanley survey, cybersecurity software witnessed the most substantial surge in spending among all IT product categories in the third quarter of this year. This surge, coupled with AI’s rapid evolution, positions network security as a promising long-term growth market for the next half-decade.

Broadly speaking, the five aforementioned cyber security companies exhibit generally positive outlooks. Fortinet reported a weaker performance in their latest quarterly report due to a cybersecurity business slowdown, impacting their stock prices. Conversely, other players in the cybersecurity domain displayed commendable performance, anticipated to accelerate growth with robust AI integration.

However, despite the promising trajectory of AI-driven cyber security, prospective investors should consider several crucial factors. These include the symbiotic growth of AI alongside the sector, associated technological costs, revenue models, and a comprehensive assessment of potential investment risks. Balancing these factors will be crucial for informed investment decisions in this burgeoning field.

| About Doo Prime

Our Trading Products

Securities | Futures | Forex | Precious Metals | Commodities | Stock Indices

Doo Prime, an international preeminent online broker under Doo Group, strives to provide professional investors with global CFD trading products in Securities, Futures, Forex, Precious Metals, Commodities, and Stock Indices. At present, Doo Prime is delivering the finest trading experience to more than 130,000 clients, with an average trading volume of more than USD 51.223 billion each month.

Doo Prime entities respectively hold the relevant financial regulatory licenses in Seychelles, Mauritius, and Vanuatu with operation centers in Dallas, Sydney, Singapore, Hong Kong, Dubai, Kuala Lumpur, and other regions.

With robust financial technology infrastructure, well-established partnerships, and an experienced technical team, Doo Prime boasts a safe and secure trading environment, competitive trading costs, as well as deposit and withdrawal methods that support 20+ different currencies. Doo Prime also incorporates 24/7 multilingual customer service and extremely fast trade execution via multiple industry-leading trading terminals such as MT4, MT5, TradingView, and Doo Prime InTrade, covering over 10,000 trading products.

Doo Prime’s vision and mission are to become a financial technology-focused broker, streamlining international global financial products investment.

For more information about Doo Prime, please contact us at:

Phone:

Europe: +44 11 3733 5199

Asia: +852 3704 4241

Asia – Singapore: +65 6011 1415

Asia – China: +86 400 8427 539

E-mail:

Technical Support: en.support@dooprime.com

Account Manager: en.sales@dooprime.com

Forward-looking Statements

This article contains “forward-looking statements” and may be identified by the use of forward-looking terminology such as “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “hope”, “intend”, “may”, “might”, “plan”, “potential”, “predict”, “should”, or “will”, or other variations thereon or comparable terminology. However, the absence of such terminology does not mean that a statement is not forward-looking. In particular, statements about the expectations, beliefs, plans, objectives, assumptions, future events, or future performance of Doo Prime will be generally assumed as forward-looking statements.

Doo Prime has provided these forward-looking statements based on all current information available to Doo Prime and Doo Prime’s current expectations, assumptions, estimates, and projections. While Doo Prime believes these expectations, assumptions, estimations, and projections are reasonable, these forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond Doo Prime’s control. Such risks and uncertainties may cause results, performance, or achievements materially different from those expressed or implied by the forward-looking statements.

Doo Prime does not provide any representation or warranty on the reliability, accuracy, or completeness of such statements. Doo Prime is not obliged to provide or release any updates or revisions to any forward-looking statements.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure and Acknowledgement Notice to find out more.

Disclaimer

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, make no representation or warranties to the information displayed and shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided, and any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.