In today’s turbulent capital markets – driven by surging inflation, record high interest rates, and geopolitical uncertainties – investors are turning to the earnings season for a dose of positivism in the markets.

The third-quarter earnings season is now in full swing, and all eyes are on two pivotal sectors that play a significant role in the global economy: Big Tech and the banking industry. Investors and market enthusiasts alike are keen to assess their earnings reports, hoping to gauge their performance and broader impact.

In a landscape where interest rates have climbed substantially in comparison to a year ago, some banks have witnessed a noticeable upswing. Yet, the financial sector’s performance is diverse, with many banks not only meeting but exceeding analyst estimates.

Moreover, with a growing list of stock market worries, investors in search of a positive outlook turn to a familiar source of hope: Big Tech, as highlighted by Bloomberg.

Let us delve into the key takeaways from these earnings reports.

Big Tech’s Earnings Surge In The Face Of Market Challenges

The strategy of focusing on Big Tech stocks remains well-justified, especially considering the remarkable performance of the Nasdaq-100, which has surged by nearly 40%, even in the face of the recent pullback that’s characteristic of the typical August and September slowdown.

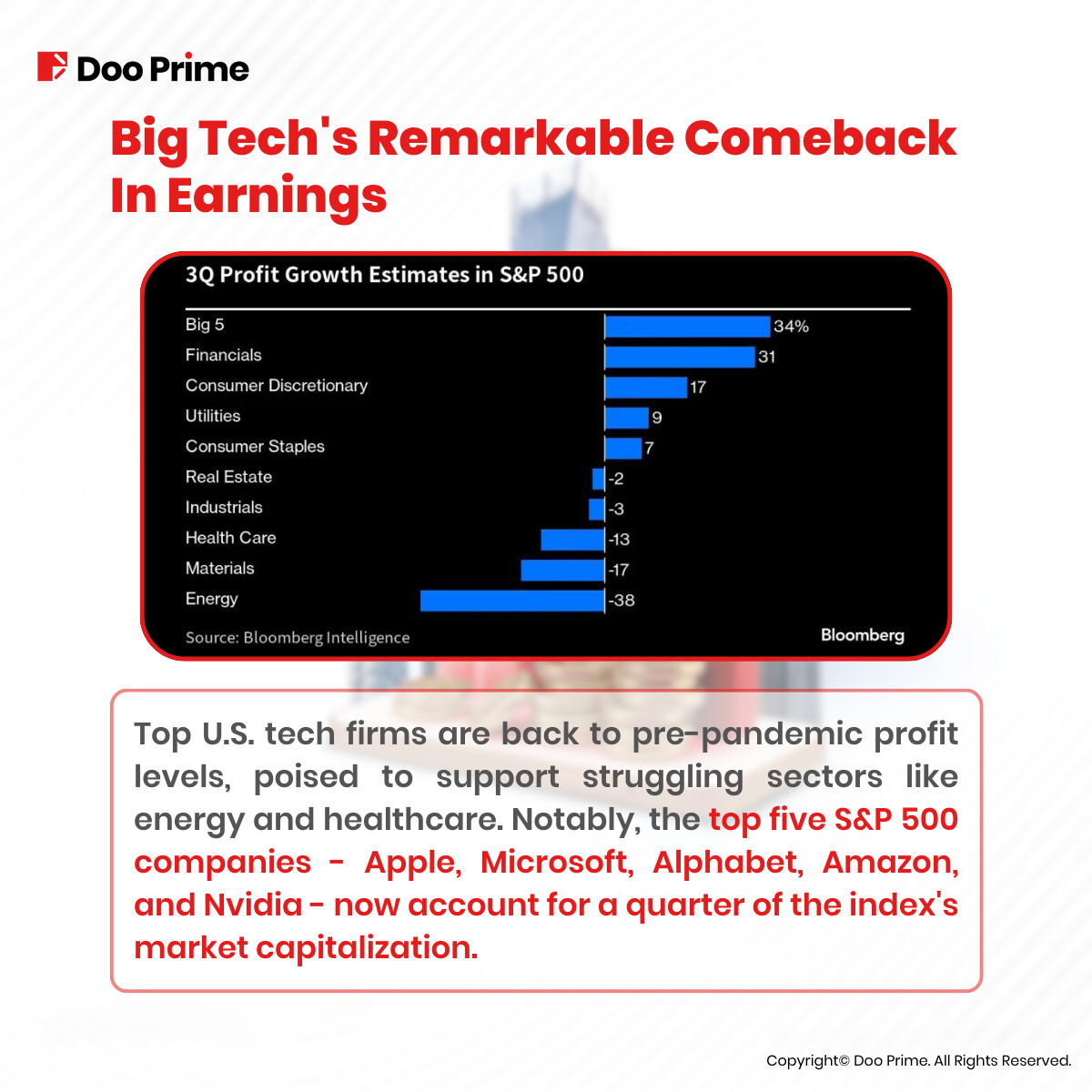

Fundamentally, the tech giants have managed to overcome the post-pandemic downturn and are reaffirming their market dominance in 2023.

These major U.S. technology and internet companies have not only weathered the storm but are now generating profits on par with those from two years ago when the pandemic fueled a surge in digital services and electronic device sales.

It is now expected that they will step in to compensate for lagging industries such as energy and healthcare, which are still grappling with an earnings slump.

Remarkably, the five largest companies in the S&P 500 Index—Apple Inc., Microsoft Corp., Alphabet Inc., Amazon.com Inc., and Nvidia Corp.—constitute approximately a quarter of the benchmark’s market capitalization.

Analyst estimates compiled by Bloomberg Intelligence project their earnings to increase by an average of 34% compared to the previous year.

In contrast, the overall S&P 500’s profit outlook is far less robust. While the index as a whole is expected to see relatively stagnant profits, without the contributions of these five tech giants, it would face a potential drop of around 5%.

Unveiling Big Tech Giants’ Q3 Earnings

Let’s unpack the Q3 earnings of prominent Big Tech companies and look into how they influence investors’ sentiment and market dynamics. We begin with a focus on Microsoft’s standout performance, followed by an examination of Alphabet, the parent company of Google, Meta and Amazon.

Microsoft

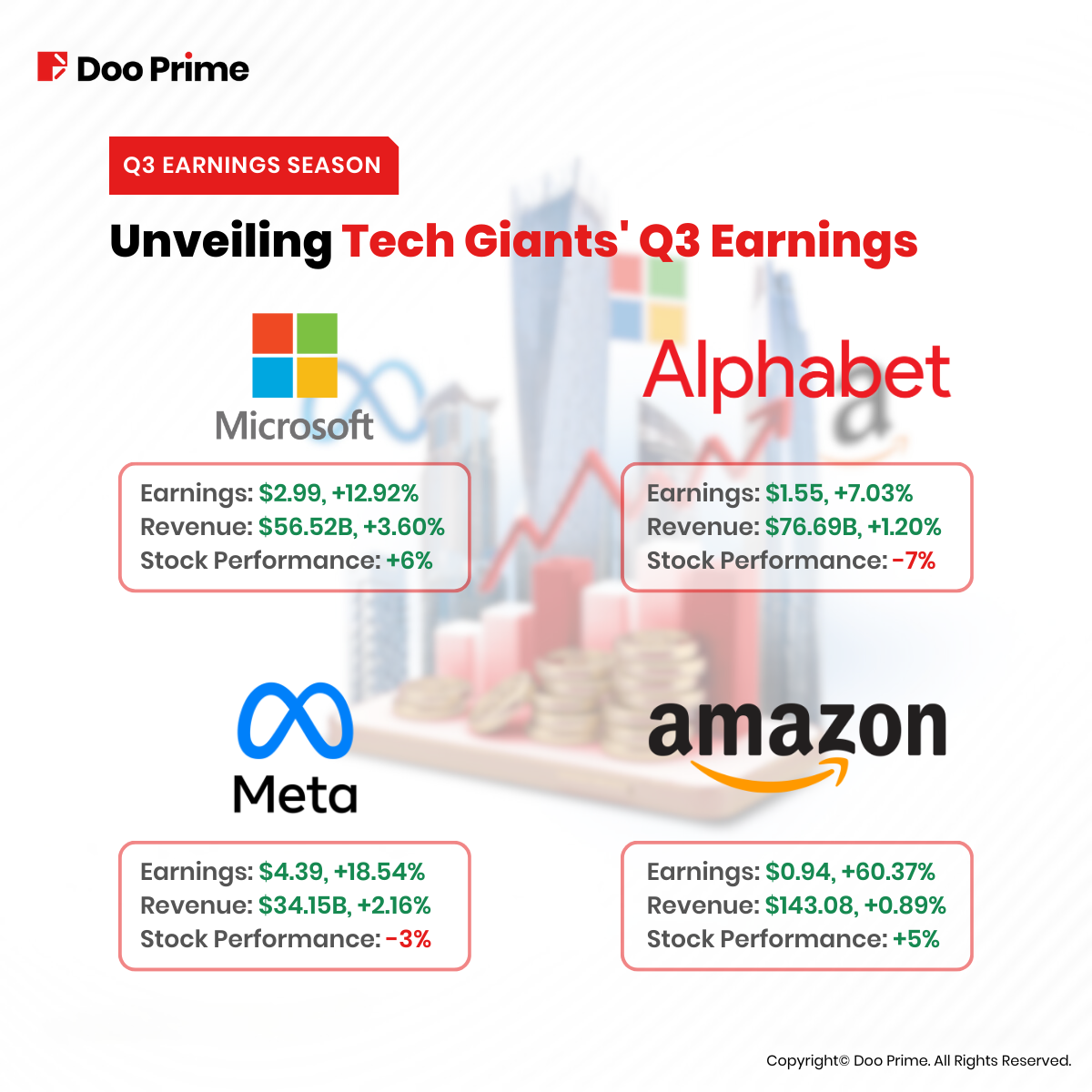

Microsoft made a significant impact on the stock market during Q3, with its shares surging by an impressive 6% in extended trading following the release of their fiscal first-quarter results and quarterly revenue guidance. The company not only outperformed Wall Street estimates but also reported substantial profit growth due to effective cost management.

Key Highlights:

Earnings And Revenue Triumph

Microsoft’s earnings per share surpassed expectations, standing at an impressive $2.99, outshining the projected $2.65 by LSEG (formerly known as Refinitiv).

Their quarterly revenue also exceeded estimates, reaching $56.52 billion, compared to the anticipated $54.50 billion. These robust figures significantly contributed to Microsoft’s stock market surge.

Market Performance

Despite after-hours stock price movements, Microsoft’s shares have witnessed a robust 38% increase this year, significantly outperforming the S&P 500 index, which experienced an 11% gain during the same period.

| Earnings Per Share (USD) | ||

| Expected 2.65 | Reported 2.99 | Surprise 12.82% |

| Revenue (USD) | ||

| Expected 54.55B | Reported 56.52B | Surprise 3.60% |

Alphabet (Google)

Alphabet, the parent company of Google, made headlines in the third quarter with an impressive 11% increase in revenue. This substantial growth, driven primarily by a resurgence in advertising, marked a significant milestone for the company and had noticeable effects on the stock market.

Key Highlights:

Earnings Beat

Alphabet’s earnings per share exceeded expectations, coming in at $1.55, surpassing the anticipated $1.45 per share as projected by LSEG. This earnings outperformance was a key driver behind the stock market’s response.

Revenue Success

The tech giant’s quarterly revenue reached an impressive $76.69 billion, surpassing the expected $75.97 billion. This surge in revenue showcased Alphabet’s strong financial performance and growth.

Key Figures

Alphabet also reported essential figures that further solidified its performance, including:

- YouTube advertising revenue: $7.95 billion (vs. expected $7.81 billion)

- Google Cloud revenue: $8.41 billion (slightly below the expected $8.64 billion)

- Traffic acquisition costs: $12.64 billion (vs. expected $12.63 billion)

Market Performance

Following Alphabet’s earnings announcement, the company’s shares experienced a notable drop of almost 7% in extended trading. The market response reflected the significance of these results, as investors and analysts weighed the company’s performance, especially in the cloud business.

| Earnings Per Share (USD) | ||

| Expected 1.45 | Reported 1.55 | Surprise 7.03% |

| Revenue (USD) | ||

| Expected 75.78B | Reported 76.69B | Surprise 1.20% |

Meta Platforms (formerly Facebook)

Meta, formerly known as Facebook, has reported better-than-expected results for the third quarter, showcasing a remarkable 23% increase in revenue. This growth represents the fastest rate of expansion since 2021.

Key Highlights:

Earnings And Revenue

Meta reported earnings per share of $4.39, surpassing the expected $3.63 as projected by LSEG. The company’s revenue reached $34.15 billion, outshining the expected $33.56 billion as projected by LSEG.

Growth And Competitive Trajectory

Meta’s core digital advertising business has experienced robust growth, marking a notable recovery from a challenging 2022. Year-over-year, sales have surged to $27.71 billion, and net income has seen an impressive 164% increase, reaching $11.58 billion.

Meta’s business performance outpaces competitors. Google parent company Alphabet reported approximately 9.5% growth in ad revenue in its recent earnings report, while smaller rival Snap achieved revenue growth of 5%.

Market Performance

The stock initially rose during extended trading following the report. However, it later reversed course, falling by more than 3% due to cautionary comments from finance chief Susan Li about potential ad softness linked to the Middle East conflict.

In the stock market, Meta has shown remarkable resilience and growth, with its stock price surging by about 150% this year. It is the second-best performer in the S&P 500, trailing only AI chipmaker Nvidia.

| Earnings Per Share (USD) | ||

| Expected 3.68 | Reported 4.39 | Surprise 18.54% |

| Revenue (USD) | ||

| Expected 33.5B | Reported 34.15B | Surprise 2.16% |

Amazon

Amazon reported third-quarter earnings and revenue that exceeded analysts’ estimates, leading to a positive market response.

Key Highlights:

Earnings And Revenue Surpass Expectations

Amazon reported earnings per share of 94 cents, surpassing the expected 58 cents as projected by LSEG. The company’s revenue reached $143.1 billion, outperforming the expected $141.4 billion as projected by LSEG.

Revenue Growth And Business Acceleration

Revenue jumped by 13% in the third quarter, indicating that Amazon is experiencing an acceleration in its business performance after a challenging 2022 marred by soaring inflation and rising interest rates.

Amazon’s results come on the heels of better-than-expected numbers from Alphabet and Meta earlier in the week. However, shares of both of those companies fell after their earnings reports, reflecting the complex nature of the tech sector.

Market Performance

Amazon shares experienced a decline of over 6% over the past two trading days, in response to the earnings reports of Alphabet and Meta, which impacted their mega-cap tech peers.

However, Amazon’s stock had shown exceptional performance year-to-date, rising by 42% through Thursday’s close, far outpacing the benchmark S&P 500. Shares of Amazon popped by 5% immediately in after-hours trading following the earnings report.

The stock had briefly dipped into the red leading up to the earnings call but regained momentum, turning green as the call progressed.

| Earnings Per Share (USD) | ||

| Expected 0.59 | Reported 0.94 | Surprise 60.37% |

| Revenue (USD) | ||

| Expected 141.82B | Reported 143.08B | Surprise 0.89% |

Banking Sector Amidst Economic Challenges

In the financial world, the earnings of major U.S. banks were historically regarded as a dependable indicator of the broader economy’s well-being. While JPMorgan Chase & Co. traditionally set the tone for corporate America with its quarterly reports, the tech sector now shares the spotlight in shaping market trends alongside the banking industry.

As the U.S. economy grapples with a host of challenges, including the looming specter of rising interest rates (exemplified by the 10-year Treasury yield approaching 5%), concerns about government spending, and the potential for a second war, cast shadows over the nation’s fiscal health.

The ever-looming budget deficit poses questions about its impact on the Gross Domestic Product (GDP).

These uncertainties have notably reverberated through the real estate market, where the average 30-year fixed mortgage rate has surged past the 8% mark, effectively pricing many aspiring homeowners out of the market.

The National Association of Home Builders has pointed out that a significant portion of households now find themselves unable to afford the average cost of a new home.

Moreover, consumer confidence appears to be wavering, with a sharp decline in the expectations component, signaling that consumers are increasingly basing their spending decisions on their current financial situation rather than future prospects.

Unpacking Bank Earnings In Economic Context

Banks have traditionally served as a barometer for the broader economy. While their earnings reports remain critical, it is becoming increasingly evident that large Wall Street firms are more aligned with high-income consumers and corporate clients.

Bank of America, for instance, has focused on lending to creditworthy individuals, resulting in borrowers with near-perfect credit scores. The divide between large Wall Street banks and smaller regional banks is widening, with the latter facing greater pressure to maintain profitability amidst changing regulations.

Smaller banks, particularly regional institutions, play a crucial role in serving small businesses, commercial real estate, and retail customers.

They are more exposed to customer withdrawals driven by the pursuit of higher deposit rates. This environment is expected to continue to challenge smaller banks in the coming quarters. The possibility of consolidation in the banking industry looms large as new regulations necessitate scale to offset compliance costs.

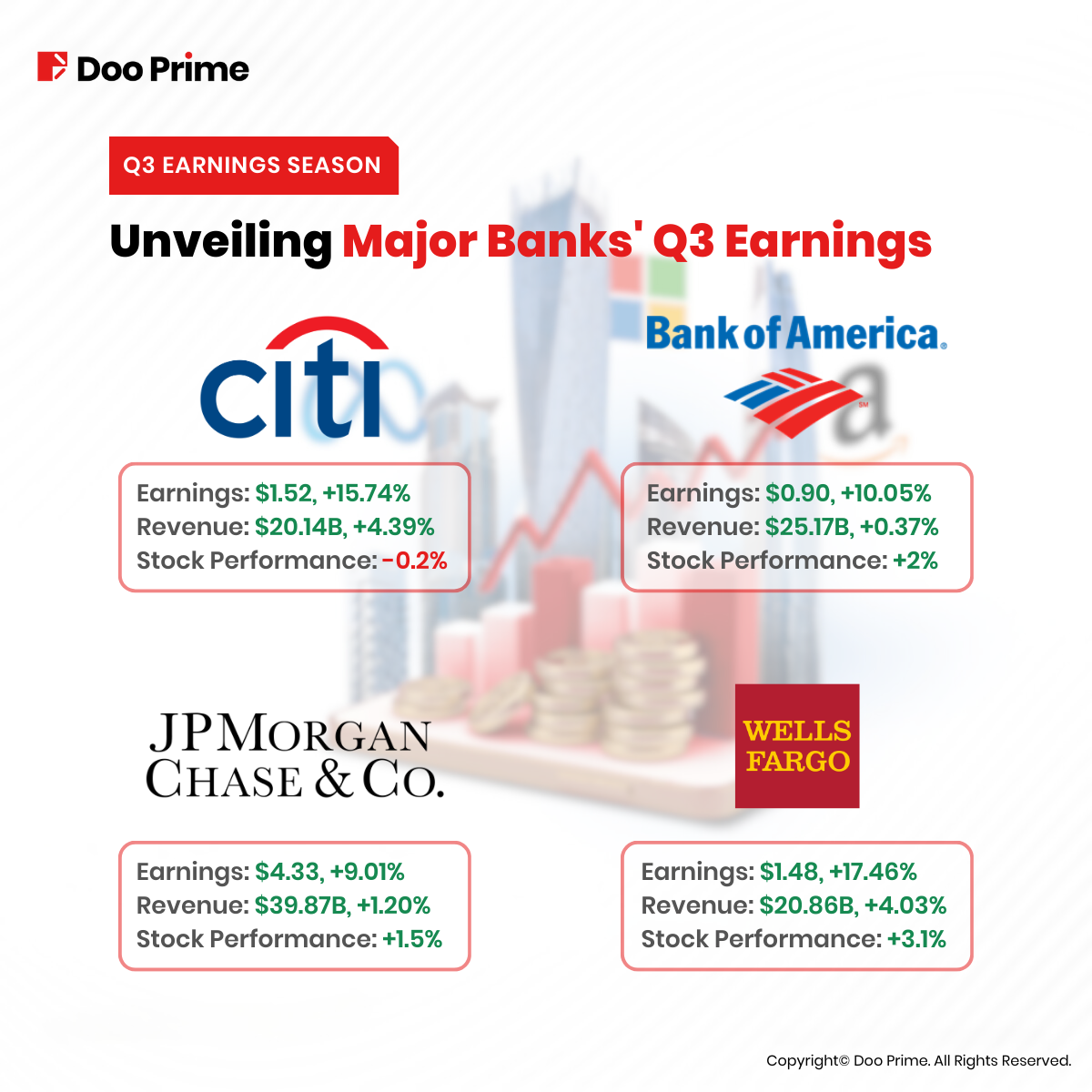

Major Banks’ Q3 Earnings Overview

Here’s a glimpse into the third-quarter earnings of some major banks:

Citigroup Inc.: Citigroup reported earnings of $1.52 per share and generated revenue totaling $20.1 billion, exceeding analyst expectations. CEO Jane Fraser acknowledged global macro concerns, particularly regarding lower FICO consumers.

JPMorgan Chase & Co.: JPMorgan Chase posted strong results for the third quarter, reporting earnings per share of $4.33 and revenue amounting to $39.9 billion, surpassing analyst predictions. Chairman and CEO Jamie Dimon emphasized the current state of U.S. consumers and businesses, while also addressing the potential challenges posed by elevated inflation and interest rates.

Bank of America Corporation: Bank of America announced third-quarter earnings of $0.90 per share, illustrating robust revenue growth and strong performance across various business lines. Chairman and CEO Brian Moynihan offered insights into the state of the economy, forecasting a soft landing in the near future.

Wells Fargo & Company: Wells Fargo delivered a robust third-quarter performance, marked by a surge in earnings per share year-over-year. CEO Charlie Scharf highlighted solid net income and revenue growth, while acknowledging challenges tied to the slowing economy and loan balances.

Big Tech And Bank Earnings Remain Resilient

The Q3 earnings season promises to shed light on the performance of Big Tech and the banking industry, providing critical insights into the broader economic landscape.

The resilience of technology giants and their commitment to AI innovation, coupled with the challenges faced by the banking sector, will shape investor sentiment and market trends.

As we navigate the complex economic terrain, the earnings reports of this season remain a vital focal point for investors seeking to make informed decisions in a rapidly evolving market.

| About Doo Prime

Our Trading Products

Securities | Futures | Forex | Precious Metals | Commodities | Stock Indices

Doo Prime, an international preeminent online broker under Doo Group, strives to provide professional investors with global CFD trading products in Securities, Futures, Forex, Precious Metals, Commodities, and Stock Indices. At present, Doo Prime is delivering the finest trading experience to more than 130,000 clients, with an average trading volume of more than USD 51.223 billion each month.

Doo Prime entities respectively hold the relevant financial regulatory licenses in Seychelles, Mauritius, and Vanuatu with operation centers in Dallas, Sydney, Singapore, Hong Kong, Dubai, Kuala Lumpur, and other regions.

With robust financial technology infrastructure, well-established partnerships, and an experienced technical team, Doo Prime boasts a safe and secure trading environment, competitive trading costs, as well as deposit and withdrawal methods that support 20+ different currencies. Doo Prime also incorporates 24/7 multilingual customer service and extremely fast trade execution via multiple industry-leading trading terminals such as MT4, MT5, TradingView, and Doo Prime InTrade, covering over 10,000 trading products.

Doo Prime’s vision and mission are to become a financial technology-focused broker, streamlining international global financial products investment.

For more information about Doo Prime, please contact us at:

Phone:

Europe: +44 11 3733 5199

Asia: +852 3704 4241

Asia – Singapore: +65 6011 1415

Asia – China: +86 400 8427 539

E-mail:

Technical Support: en.support@dooprime.com

Account Manager: en.sales@dooprime.com

Forward-looking Statements

This article contains “forward-looking statements” and may be identified by the use of forward-looking terminology such as “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “hope”, “intend”, “may”, “might”, “plan”, “potential”, “predict”, “should”, or “will”, or other variations thereon or comparable terminology. However, the absence of such terminology does not mean that a statement is not forward-looking. In particular, statements about the expectations, beliefs, plans, objectives, assumptions, future events, or future performance of Doo Prime will be generally assumed as forward-looking statements.

Doo Prime has provided these forward-looking statements based on all current information available to Doo Prime and Doo Prime’s current expectations, assumptions, estimates, and projections. While Doo Prime believes these expectations, assumptions, estimations, and projections are reasonable, these forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond Doo Prime’s control. Such risks and uncertainties may cause results, performance, or achievements materially different from those expressed or implied by the forward-looking statements.

Doo Prime does not provide any representation or warranty on the reliability, accuracy, or completeness of such statements. Doo Prime is not obliged to provide or release any updates or revisions to any forward-looking statements.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure and Acknowledgement Notice to find out more.

Disclaimer

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, make no representation or warranties to the information displayed and shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided, and any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.