On Friday, Bitcoin completed its much-anticipated halving, sparking the cryptocurrency community with anticipation and speculation. Set on the 19th of April, this event notably marks Bitcoin’s fourth halving, a significant milestone in its history. Completing its “halving” process, which occurs approximately every four years, Bitcoin’s supply dynamics undergo a transformative shift.

With this landmark event now concluded, market dynamics and investor sentiment are experiencing significant shifts. In this article, we’ll delve into the intricacies of Bitcoin’s halving and its impact on the cryptocurrency market, including insights into the Bitcoin dip.

What is the Bitcoin Halving?

The Bitcoin halving, also known as “halvening,” is a significant event in the Bitcoin network’s protocol. It serves as a fundamental mechanism for managing inflation and preserving scarcity within the Bitcoin ecosystem. By halving the rewards cryptocurrency miners receive for creating new tokens, this process effectively increases the cost of introducing new bitcoins into circulation. This scarcity is integral to Bitcoin’s value proposition as a decentralized digital store of value.

Programmed by Satoshi Nakamoto, these halving events occur approximately every four years, exerting a profound influence on Bitcoin’s supply dynamics and overall market valuation. From its inception, Bitcoin’s pseudonymous creator has integrated the halving mechanism into the cryptocurrency’s code as a strategic measure to moderate the pace at which new bitcoins are generated, ensuring the long-term sustainability and scarcity of the digital asset.

Market Dynamics and Investor Sentiment

Following the completion of Bitcoin’s fourth halving, the cryptocurrency market has experienced notable fluctuations in trading activity and investor sentiment. According to Reuters, Bitcoin surged to an all-time high of USD 73,803.25 in March, marking a significant milestone in its price trajectory. This surge came after a period of gradual recovery throughout much of 2023 following the dramatic plunge experienced in 2022.

However, in the lead-up to the halving event, the world’s biggest cryptocurrency BTC was trading at USD 63,800 as of Thursday. According to Coin Metrics data, Bitcoin’s price has been volatile, with fluctuations of a 4% drop observed within a single week. This volatility underscores the uncertainty surrounding the event’s outcome and its potential impact on market dynamics.

Chris Gannatti, global head of research at WisdomTree, has emphasized the significance of the halving, describing it as “one of the biggest events in crypto this year.” Despite this acknowledgment, investor sentiment remains cautiously optimistic, with expectations of potential price surges following the halving. However, the prevailing market volatility suggests that investors are navigating uncertain terrain as they await the event’s unfolding.

Impact on Miners and Hash Rates

This event is a big test for mining companies. Since Bitcoin’s inception in 2009, miners have gradually seen their rewards decrease. Initially, miners were rewarded with 50 Bitcoin every 10 minutes. Following the last halving, this figure decreased to 6.25. With the upcoming halving, this number will further decline to 3.125 Bitcoin every 10 minutes. This reduction represents a significant supply cut in the Bitcoin ecosystem, which effectively reduces the daily supply of new bitcoin from around 900 to 450.

Hash rates, which measure the computational power used to process transactions on the Bitcoin network, are crucial for miners’ revenue opportunities. In a recent note to investors, JPMorgan analyst Reginald Smith highlights that “the halving will cut industry revenues in half, triggering a wave of consolidation and business closures”. However, Smith maintains optimism that the halving will rationalize the network hash rate and industry capital expenditure, ultimately benefiting the remaining operators.

Additionally, it’s essential to recognize that the total Bitcoin supply is capped at 21 million, leaving approximately 1.45 million bitcoins left to mine. However, it will be some time before these remaining bitcoins enter the market. With subsequent halvings, the final Bitcoin is not expected to be generated until 2140, although there’s a possibility it could occur slightly earlier than projected.

Bitcoin Halves, Price Surges

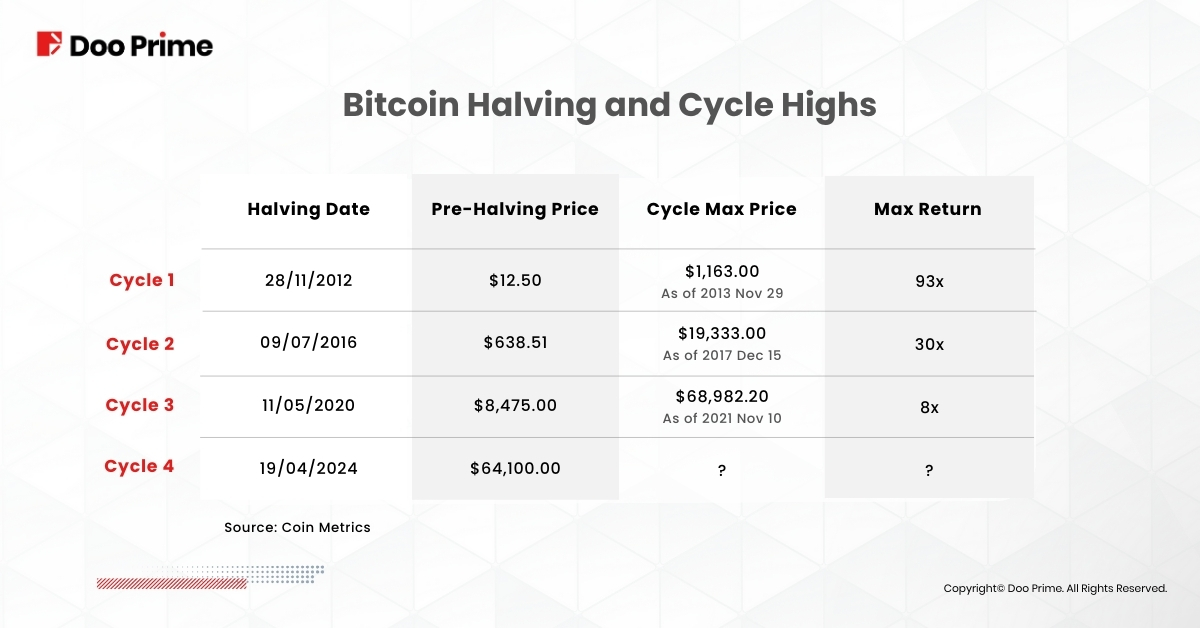

Bitcoin Halving and Cycle Highs

Bitcoin’s halving events have historically coincided with notable price movements, often leading to significant price appreciation in the months ahead. Looking back at previous halving events, historical data reveals substantial price surges. After the 2012, 2016, and 2020 halvings, Bitcoin’s price surged approximately 93x, 30x, and 8x respectively, from its halving day price to its cycle peak. While the halving itself may not immediately affect the price of Bitcoin, many investors anticipate significant gains in the months ahead based on historical data and market trends.

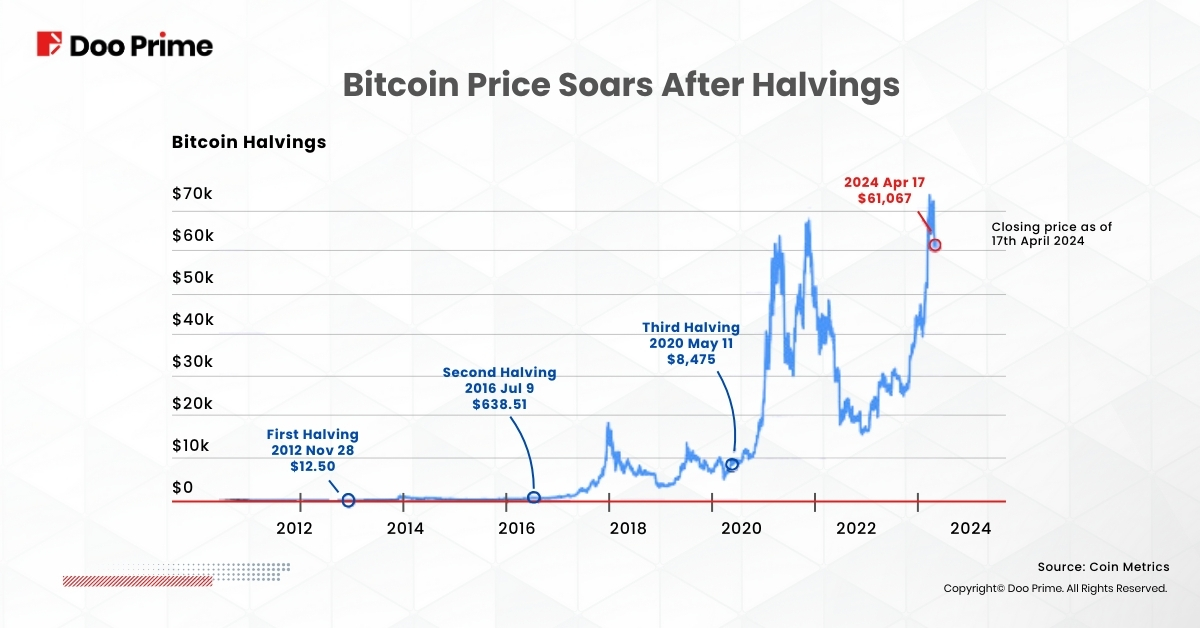

A Recurring Pattern: Bitcoin Price Soars After Halvings

Historical data reveals a compelling trend: Bitcoin prices tend to soar after halving events. This phenomenon is vividly illustrated in the chart above, demonstrating a remarkable price appreciation following each halving cycle. Despite initial scepticism, Bitcoin’s value has consistently surged in the months and years following halving events, reinforcing its status as a store of value and investment asset.

Projection and Speculation

Bitcoin analysts and experts have offered various projections and speculations regarding the potential trajectory of Bitcoin’s price following the 2024 halving. Noelle Acheson, a prominent bitcoin analyst and author of the Crypto is Macro Now newsletter, presents compelling insights based on historical performances. Acheson suggests that if Bitcoin follows a similar trajectory to the previous cycle, it could reach USD 450,000 within a year, or USD 270,000 if the current cycle resembles that of 2016, citing Bloomberg data.

However, alternative projections based on Axios data paint a slightly different picture. Acheson indicates that according to Axios data, Bitcoin’s price could potentially reach USD 350,000 by using the previous cycle as a guide. Furthermore, applying the performance of the 2016 cycle could result in an astonishing USD 1.8 million valuation, potentially giving Bitcoin a staggering USD 35 trillion market cap. These projections highlight the wide range of possibilities and the significant impact that Bitcoin’s halving events can have on its price trajectory and market capitalization.

Buy the Bitcoin Dip?

According to Sanford Bernstein, now might be “the” moment for investors who have missed out on the 2024 rally. They anticipate a potential further correction of 10-15%, equivalent to a 30% decline from recent highs in BTC before the halving. Despite this, they view these dips as worth considering.

The current sell-off is attributed to the cleanup of leveraged trades and increasing funding costs for longing on futures. Investor caution prevails ahead of the halving on April 20th, exacerbated by negative sentiment surrounding ETH ETF approval.

However, Bernstein reassures investors that the current price movement is not unexpected. They highlight the historical pattern of pre-halving dips presenting favorable buying opportunities in BTC. This perspective encourages investors to focus on the long-term potential of Bitcoin amidst short-term market fluctuations.

In conclusion, Bitcoin’s 2024 halving is a significant event with the potential to impact the market in various ways. While historical trends suggest price increases after halvings, other factors can influence the market. Remember, the cryptocurrency market remains inherently volatile, so proper risk management and thorough research are crucial before making any investment decisions.

Looking ahead, the next halving is expected to occur in 2028, when the block reward will fall to 1.625 BTC. As of April 2024, about 19.69 million bitcoins were in circulation, leaving just around 1.31 million to be released via mining rewards.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure and Acknowledgement Notice to find out more.

Disclaimer

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, make no representation or warranties to the information displayed and shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided, and any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.