“Black Myth: Wukong” sparked a global sensation on its first day of launch. As China’s highly anticipated triple-A game, it quickly surpassed 4.5 million copies sold across all platforms, generating a sales record of 1.5 billion yuan in revenue. Within just a few days, total sales exceeded 10 million units.

Beyond capturing the gaming community, “Black Myth: Wukong” also made waves in the capital markets, earning recognition as a “phenomenal work.” This article delves into the reasons behind its worldwide acclaim, its impact, and a detailed analysis of its role within the gaming industry and capital markets.

Why Did “Black Myth: Wukong” Make Such a Breakthrough?

Simply put, “Black Myth: Wukong” has caused a buzz because it has reached levels that the Chinese gaming industry has never achieved before.

This game is China’s first true triple-A blockbuster, backed by significant investments of money, resources, and time, showcasing top-tier production quality, advanced technology, and broad market influence. Beyond its impressive technical skills and gameplay design, it draws heavily from the classic Chinese literature “Journey to the West,” which has resonated with players worldwide. This perfect blend of technology, art, and business has disrupted the long-standing dominance of Europe and the United States in the triple-A game sector, marking a milestone in China’s gaming industry.

As a buyout single-player game, “Black Myth: Wukong” was launched in a market dominated by commercial mobile games, facing challenges like limited returns and uncertain market demand. Yet, it emerged as if it were a legend sprung from stone, highlighting the vast potential of China’s gaming industry.

How Did “Black Myth: Wukong” Impact the Capital Market?

The success of “Black Myth: Wukong” has rippled into the capital markets, driving up stocks in the A-share gaming sector, triggering widespread brand collaborations, and boosting hardware sales.

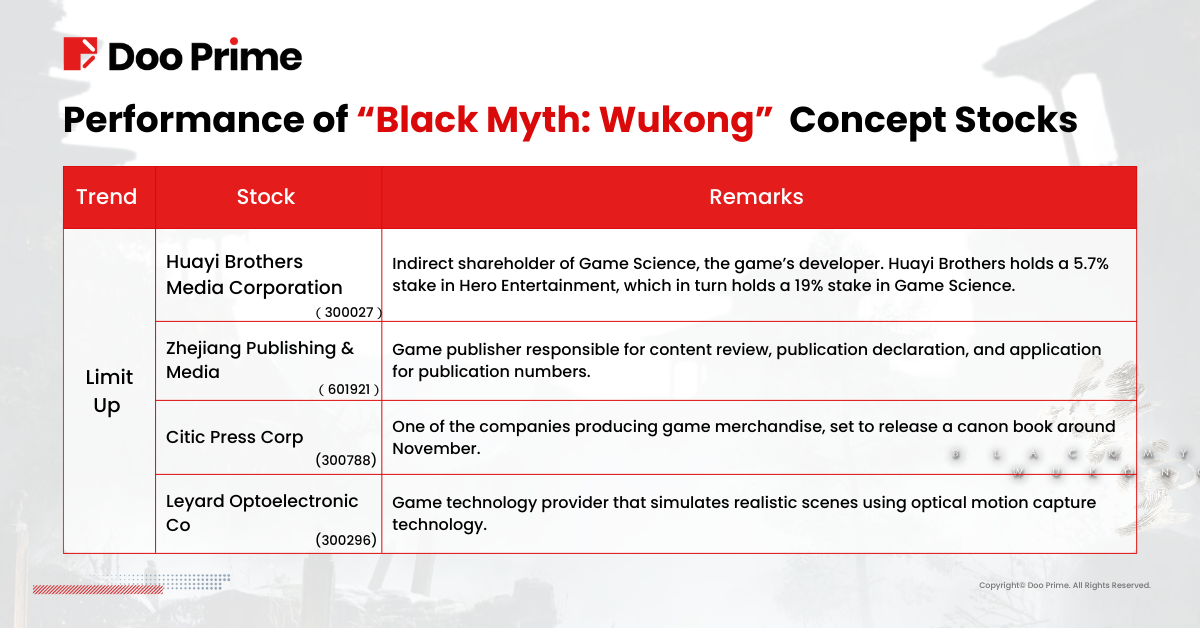

- “Black Myth: Wukong” Concept Stocks Hit Daily Limits

On August 20, stocks directly linked to “Black Myth: Wukong,” such as Huayi Brothers, Zhejiang Media, Citic Press, and Leyard Optoelectronic, hit their daily upper trading limits. Even concept stocks without direct partnerships saw a surge in value.

- Brand Collaborations

More than 10 brands, including NVIDIA, Hisense, Lenovo, DiDi Bike, Luckin Coffee, and JD.com, have announced their collaboration with Black Myth: Wukong, covering all major sectors including clothing, food, housing and transportation, taking advantage of the situation to make a steady profit from the traffic of game IPs. Additionally, the game’s filming location, Shanxi, China, has seen a boom in tourism.

- Surge in Hardware Sales

Following the game’s launch, sales of hardware products such as PS5 consoles, computers, graphics cards, and keyboards skyrocketed. According to data released by Kuaishou e-commerce, on August 20th, the GMV (Gross Merchandise Value) for all-in-one PCs, desktops, and similar products increased by 122% month-on-month. The GMV for gaming laptops saw a 40% daily increase, and DIY computer products like monitors recorded a 74% daily jump in sales.

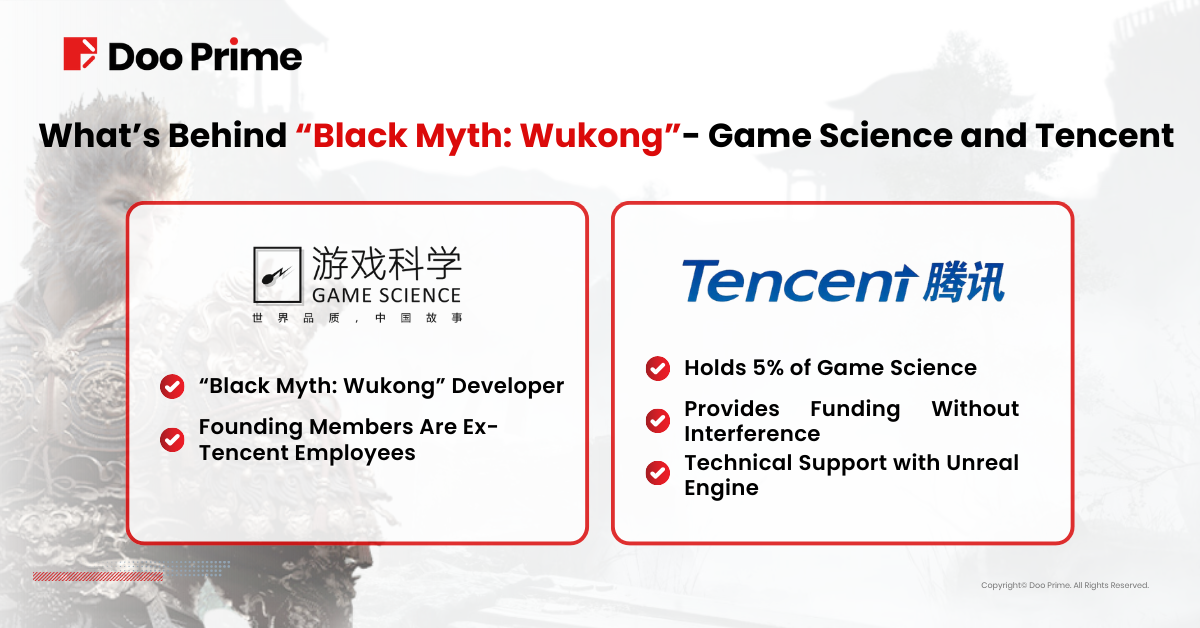

What’s Behind “Black Myth: Wukong”? – Game Science and Tencent

The game “Black Myth: Wukong” is developed by Shenzhen Youke Interactive Technology Co., Ltd., commonly referred to as Game Science. Established in June 2014, the company’s seven founding members, including CEO Feng Ji, all came from Tencent, and the team has only about 140 people.

Game Science CEO Feng Ji holds a total of 76% of the shares, Hero Interactive Entertainment holds 19% through Tianjin Hero Financial Holding Technology Co., Ltd., and Tencent holds 5% of the shares.

However, the ties between Game Science and Tencent go beyond mere shareholding.

After Game Science released a trailer for “Black Myth: Wukong” on August 20, 2020, Tencent quickly reached out, and by March 2021, it announced an investment in Game Science. Tencent committed to the “Three No(s)” principle: no interference in business decisions, no dominance over projects, and no involvement in publishing or operations.

In addition to financial backing, Tencent also provided technical support to the main creative team. Game Science used Unreal Engine’s game engine for “Black Myth: Wukong”.

For Tencent, investing in “Black Myth: Wukong” might be more about strategically positioning itself in the single-player game market than just a financial endeavor.

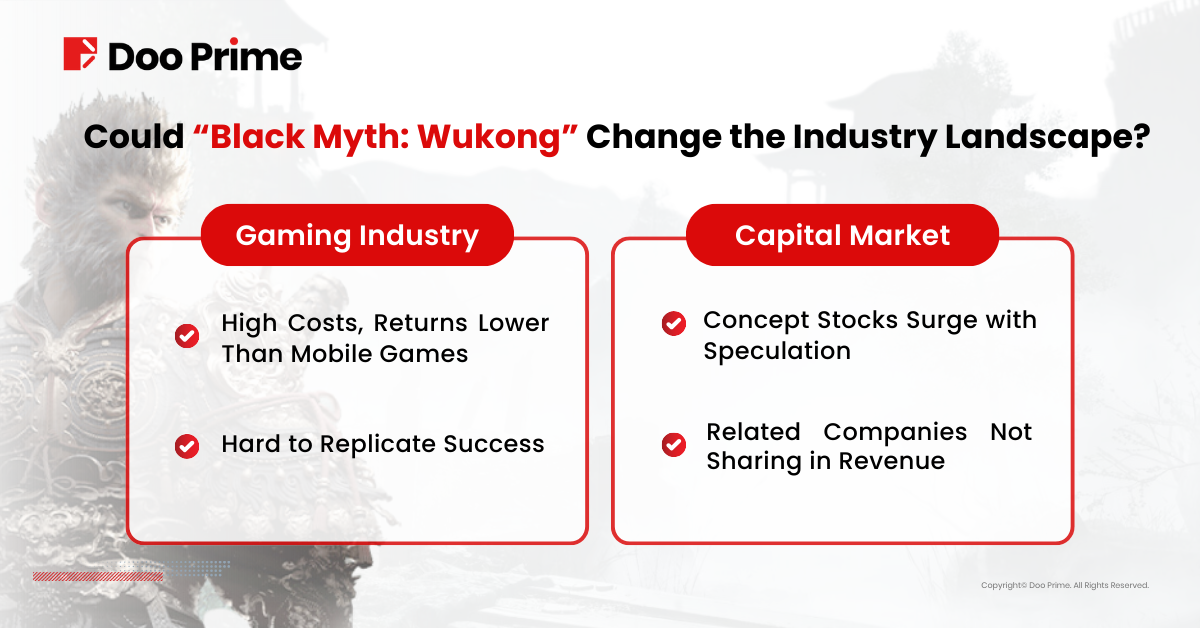

Could “Black Myth: Wukong” Change the Industry Landscape?

As a triple-A game with high development costs, long development cycles, and intensive resource consumption, “Black Myth: Wukong”, remains a risky investment even with projected sales of 10 million units, with returns not fully matching the high stakes involved.

- Impact on the Gaming Industry

In the gaming industry, the success of Black Myth: Wukong has set a benchmark for the quality of China’s domestic triple-A games, which is expected to drive more game innovation, R&D investment, and promote the technological progress across the industry.

However, despite its success, the game’s revenue is far from rivaling the substantial and steady profits of popular mobile games. The entire development process of “Black Myth: Wukong” took seven years, with development cost totaling at least 400 million yuan.

The life cycle of triple-A games is generally shorter than that of online and mobile games, with revenues typically peaking early before declining. The buyout model of single-player games is not as lucrative as the continuous monetization of online and mobile games. According to the “Report on China’s Game Industry in the First Half of 2024,” the actual sales revenue of China’s domestic game market from January to June this year was as high as 147.267 billion yuan, while the actual sales revenue of the console game market of the same period was only 797 million yuan, accounting for only 0.5%.

Even the rapidly growing mobile game market has shown signs of reaching its peak, with increasingly discerning users leading to many costly projects failing to recover investments, highlighting the expanding challenges within the gaming industry.

“Black Myth: Wukong” succeeded by being in the right place at the right time with the right people, but this path is difficult to replicate.

- Impact on the Capital Market

In the capital market, with game sector valuations near historical lows, the success of phenomenal games like “Black Myth: Wukong” is expected to boost market sentiment. This may increase investor interest in companies capable of developing triple-A titles, potentially expanding investment in buyout single-player projects.

However, the sharp fluctuations in concept stocks related to “Black Myth: Wukong” are largely driven by short-term hype. Media coverage often highlights the rapid gains in these stocks, making it seem like a guaranteed profit. But when viewed over the long term, these stocks often reveal themselves to be speculative “bubbles.”

For example, the game’s publisher, Zhejiang Media, reported that its publishing income from “Black Myth: Wukong” was less than 1 million yuan, did not participate in revenue sharing, and accounted for less than 1% of the company’s operating income and net profit in the first half of 2024, having minimal impact on its overall financials. Other stocks that spiked on August 20 have since seen sharp corrections.

Is This Just the Beginning?

Game Science is reportedly planning future installments for the “Black Myth” series, having successfully registered several trademarks, including “Black Myth Jiang Ziya,” “Black Myth Zhong Kui,” “Black Myth Soshen,” “Black Myth Xiaoqian,” and more. While “Black Myth: Wukong” has garnered significant attention and success, the market will ultimately decide whether future titles can maintain this level of popularity.

The impact of a popular game on industry development or the upward momentum of the gaming sector in the stock market depends on numerous factors. As Feng Ji said, “Embarking on the road of learning scriptures is more important than reaching Lingshan.”

For investors looking to tap into the gaming sector or diversify their portfolios to mitigate risks, Doo Prime offers a wide range of investment opportunities tailored to their strategies. With professional analysis tools like Trading Central, Doo Prime enables global users to deeply analyze market trends, spot hyped concept stocks, optimize investment portfolios, and enhance decision-making quality.

Risk Disclosure:

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer:

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.