The U.S. Federal Reserve is teetering on the brink of a pivotal shift in its monetary policy for 2024, hinting at potential interest rate cuts. The upcoming year might witness a departure from the aggressive tightening witnessed in 2022 and 2023, with the Fed eyeing a more accommodative approach amid receding inflationary pressures.

Projected Rate Cuts: Analyzing Market Expectations

At the close of December, Federal Reserve officials projected three rate cuts for the ensuing year. However, market sentiment is veering toward a more assertive stance, with expectations leaning heavily towards a double-digit adjustment, potentially commencing as early as March. According to the CME FedWatch tool, markets are pricing in a 33% probability of rates falling below 3.75% by year-end, a substantial leap from previous estimations.

The market’s immediate reactions to the Fed’s announcements have been noteworthy. For instance, the S&P 500 surged 1.4% on December 13th, 2023, coinciding with the Fed’s forecast of rate cuts. This trend underscores the significant influence of rate-related decisions on market dynamics.

Fed’s Assessment: Balancing Inflation And Employment

A crucial aspect of the Fed’s deliberations revolves around striking a delicate balance between curbing inflation and maintaining employment stability. Despite recent rate hikes, inflation decelerated in the past year without inducing a corresponding rise in unemployment. This success has emboldened discussions about achieving a “soft landing,” a scenario where inflation is controlled without detrimental effects on employment.

Stock Market Outlook: Assessing Impact And Anticipated Dovishness

The potential implications of rate cuts on the stock market remain a subject of intense scrutiny. Historical parallels are imperfect, but the current market, already at all-time highs, suggests that investors may have factored in the anticipated rate adjustments. This situation could necessitate a more pronounced dovish stance from the Fed to drive stock markets higher than initially expected.

However, caution is advised, as current stock prices may already reflect the market’s anticipation of rate cuts. Nevertheless, factors such as robust corporate earnings, positive economic data, and advancements in generative AI could sustain the upward momentum of stocks.

Recessionary Concerns: Historical Precedents And Indicators

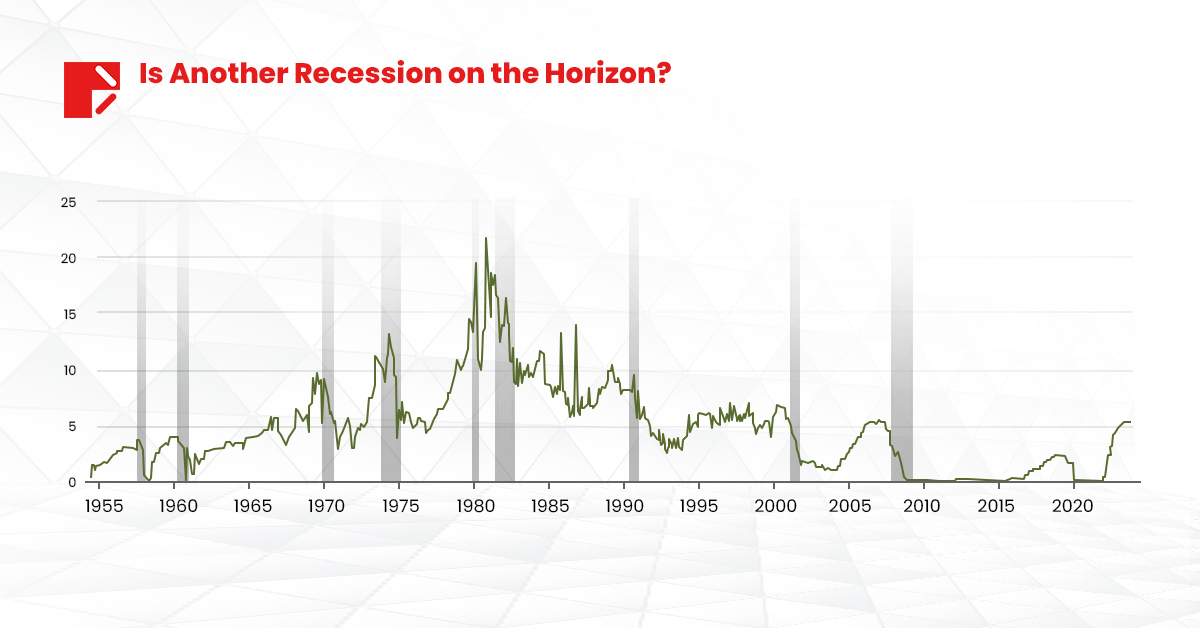

Historical data reveals a common pattern: the conclusion of a Fed tightening cycle often precedes an economic downturn, as depicted in the grey areas on the accompanying chart.

Federal Funds Effective Rate – Shaded areas indicate U.S. recessions.

Source: Board of Governors of the Federal Reserve System (U.S.)

However, the pressing question remains: could this time be different? Are we hurtling toward a recession this year?

Should a recession materialize, historical precedents suggest an anticipated response from the Fed. Traditionally, during economic downturns, the Fed has resorted to lowering rates to zero and initiating quantitative easing (QE) operations to stimulate the economy.

10-Year Treasury Constant Maturity Minus 2-Year Treasury Constant Maturity

Shaded areas indicate U.S. recessions.

Source: Federal Reserve Bank of St. Louis

Moreover, another indicator warranting attention is the yield curve inversion. Each instance of yield curve inversion historically preceded a recession.

Insights from Financial Experts On Rate Cuts

Over and above, the anticipation surrounding potential interest rate cuts in 2024 has garnered widespread attention, marked by contrasting predictions and perspectives from prominent figures within the financial landscape.

Anticipating Early Rate Adjustments

Conor Sen, Founder of Peachtree Creek Investments

Sen’s recent Bloomberg column advocates for early rate reductions in 2024. He points to unexpectedly slower inflation and declining unemployment since the Fed’s September economic projections. Sen suggests potential rate cuts as soon as March, citing their potential to sustain the ongoing economic expansion initiated by earlier rate hikes.

UBS: Cuts Amidst Foreseen Economic Downturn

UBS, the investment bank, anticipates rate cuts in March while simultaneously predicting a significant economic downturn. Their outlook emphasizes a substantial 2.75% reduction in Fed interest rates, aligning with expectations of a looming recession in the second quarter. These cuts aim to proactively mitigate the expected economic turbulence.

Bill Ackman, Pershing Square Capital Management

Ackman echoes sentiments for first-quarter rate cuts. He warns of the risks posed by elevated real interest rates amidst declining inflation, expressing concerns about potential rapid economic deceleration leading to a recession if rates remain unchanged.

Differing Views on the Timing of Rate Adjustments

Sam Millette, Director at Commonwealth Financial Network

Millette offers a contrasting timeline, suggesting a likelihood of rate adjustments in the latter half of 2024. He challenges market estimates, projecting post-July or September Fed actions based on sustained signs of economic slowdown and moderated inflation in the initial half of the year.

Bill Adams, Chief Economist at Comerica Bank

Adams underscores mounting evidence pointing towards an impending shift in interest rate policies. Factors like a slowdown in job creation and sluggish growth in personal consumption expenditures inform Comerica Bank’s forecast. They anticipate a 25 basis point rate cut in June 2024, expecting a cumulative 0.75 percentage point reduction over the year.

Raphael Bostic, President of the Atlanta Federal Reserve

Bostic adopts a more cautious stance, envisioning sustained elevated rates until at least late 2024. He emphasizes the economy’s current momentum, suggesting that while inflation may slow down, a sharp decline is improbable. Bostic foresees a gradual transition to rate cuts in alignment with the economy’s progression toward the Fed’s 2% inflation target.

An Adaptive Approach Amidst Uncertainty

The year 2024 looms as a pivotal chapter for the U.S. economy, heavily influenced by the Federal Reserve’s policy decisions. While projections and historical data offer insights, the evolving global economic landscape calls for adaptive strategies and vigilant observation of unfolding events. The intersection of monetary policy, market reactions, and economic indicators will shape the trajectory of various sectors in the coming months.