In recent months, the Houthi rebels in Yemen have escalated their attacks on shipping in the Red Sea. The once tranquil waters of the Red Sea have now become a cauldron of tension since the Israel-Hamas conflict. These Houthi rebel attacks on shipping have not only triggered economic concerns and regional destabilization, but are now a threat to a vital artery for global trade.

The effects are widespread, with potential geopolitical tensions, disruptions to maritime trade, and the looming possibility of a surge in 2024 energy prices and inflation. These strikes have the potential to drive up oil prices and more alarmingly, spark broader conflicts in the volatile Middle East. As the situation continues to unfold, it becomes crucial to examine the intricate details of this crisis and understand its multifaceted impact on the global economy.

Brief History of Yemen’s Conflict and the Rise of the Houthis

Connections with Iran

To understand the rise of the current crisis, we need to look back at the prolonged civil war in Yemen. Since 2014, the Houthi movement, supported by Iran, has been engaged in armed conflict with a coalition led by Saudi Arabia, backing the internationally recognized government.

The Houthis control a substantial part of Yemen, including the vital port city of Hodeidah, a crucial entry point for humanitarian aid and essential goods. Additionally, the Houthis play a significant role in the “Axis of Resistance,” an alliance backed by Iran, opposing Israel and the West. This coalition includes Hamas, Hezbollah, and the Houthis.

Motivations and Actions

Capitalizing on the global registry of shipping in international waters, the Houthi paramilitary has selectively targeted vessels with supposed ties to Israel, regardless of their flag. This directive came after the Supreme Leader in Tehran called for a blockade of goods to Israel. Moreover, reportedly supplied generously with drones and missiles by Iran, they have effectively turned the narrow Red Sea into a restricted zone for merchant vessels. Even sea lanes along the Indian mainland have not been spared, with merchant ships en route to Indian ports facing attacks approximately 250 km from the coastline.

While the Houthis claim that their attacks on Red Sea shipping routes demonstrate support for the Palestinians and Hamas — the Islamist group in control of Gaza, Yemen experts argue that Houthi motivations are primarily driven by domestic considerations. Regardless, the undeniable consequence is that the Suez Canal, responsible for 15% of the world’s seaborne trade, is now gripped by fear and risk.

A Ripple Effect Through Global Trade

The immediate consequences of the Houthi attacks are tangible and far-reaching, posing a grave threat to the smooth flow of global trade:

Maritime Disruption

Image Source: The Washington Institute

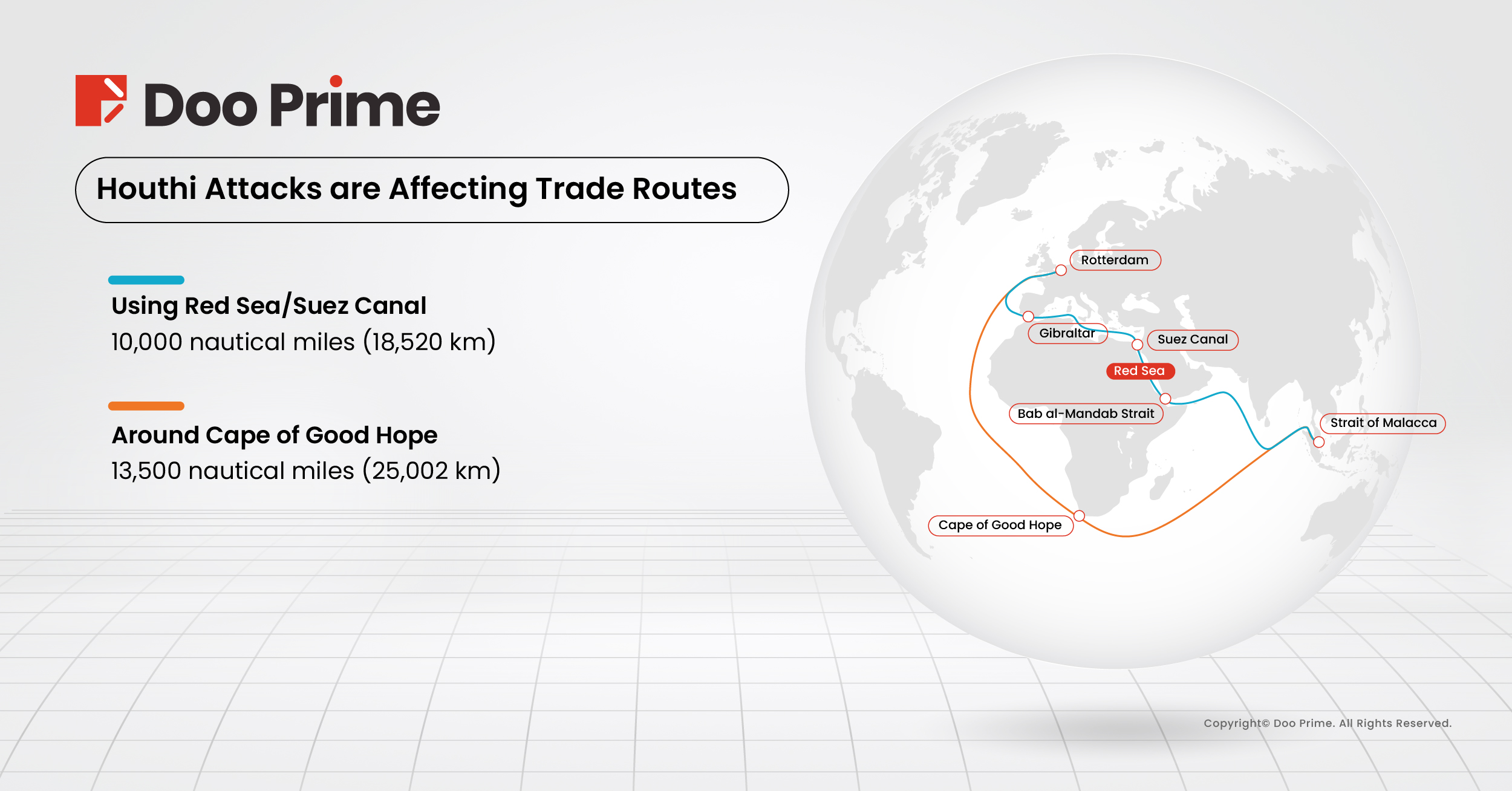

The recent disruptions in maritime activities, fueled by Houthi rebel attacks in the Red Sea and Suez Canal, have presented a significant challenge to global trade. These attacks have led to an 85% reduction in vessel traffic, forcing ships to seek alternative routes, particularly rerouting to a much longer East-West route via the southern tip of Africa, through the Cape of Good Hope.

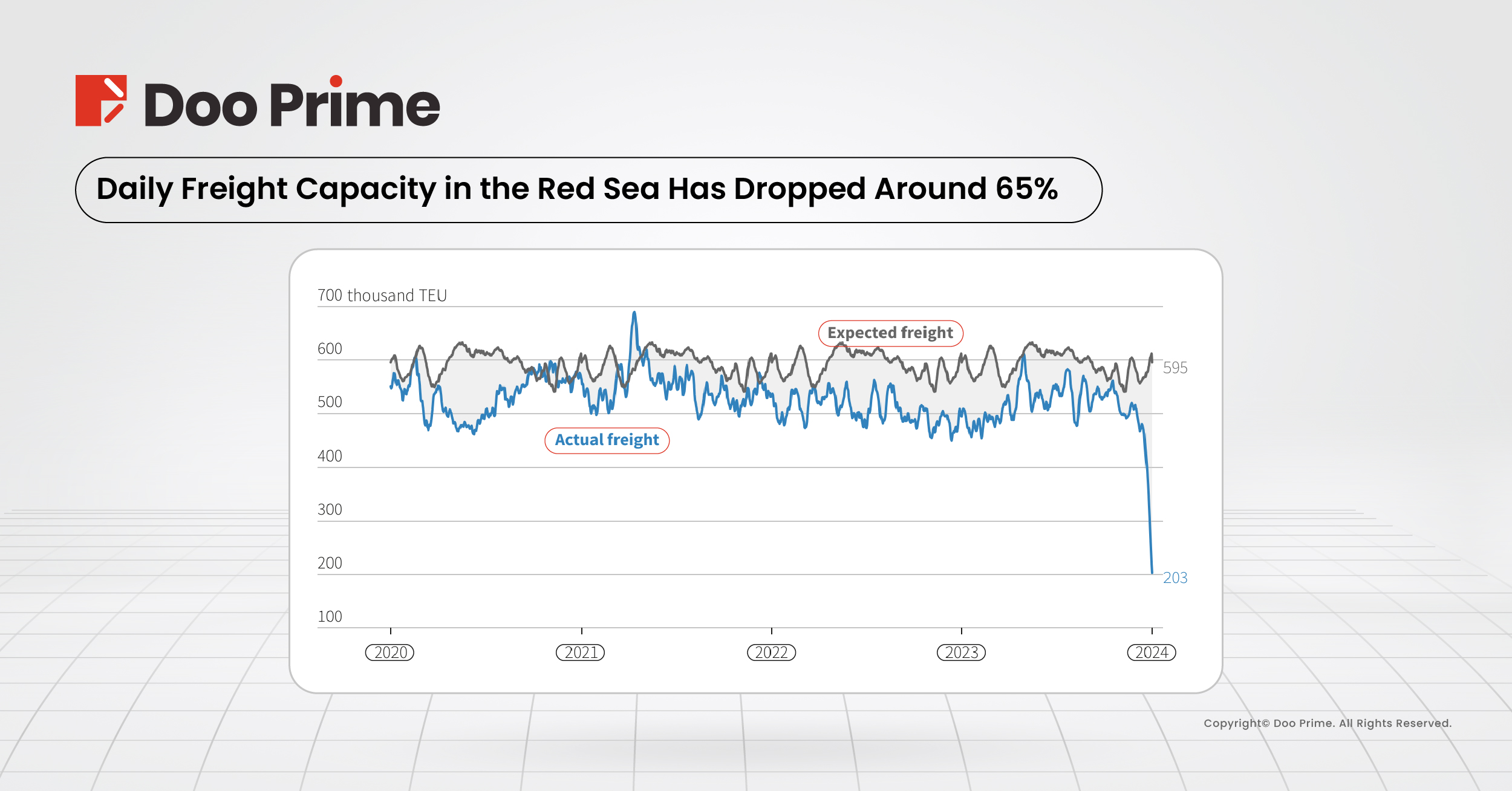

This has resulted in a two-week increase in travel times, significantly impacting shipping fuel, freight, and insurance rates. Notably, freight container volumes have taken a substantial hit, plummeting by approximately 65%, well below anticipated levels.

Image Source: Reuters

Osama Rabie, the Head of the Canal Authority, has also reported a 40% decline in dollar revenues from Egypt’s Suez Canal compared to the beginning of this year, in contrast to 2023. Additionally, there has been a significant 30% decrease in ship traffic between January 1st and January 11th, compared to the same period last year. The number of vessels navigating through the Suez Canal has notably decreased to 544 this year, down from 777 during the equivalent period in 2023.

Supply Chain Domino Effect

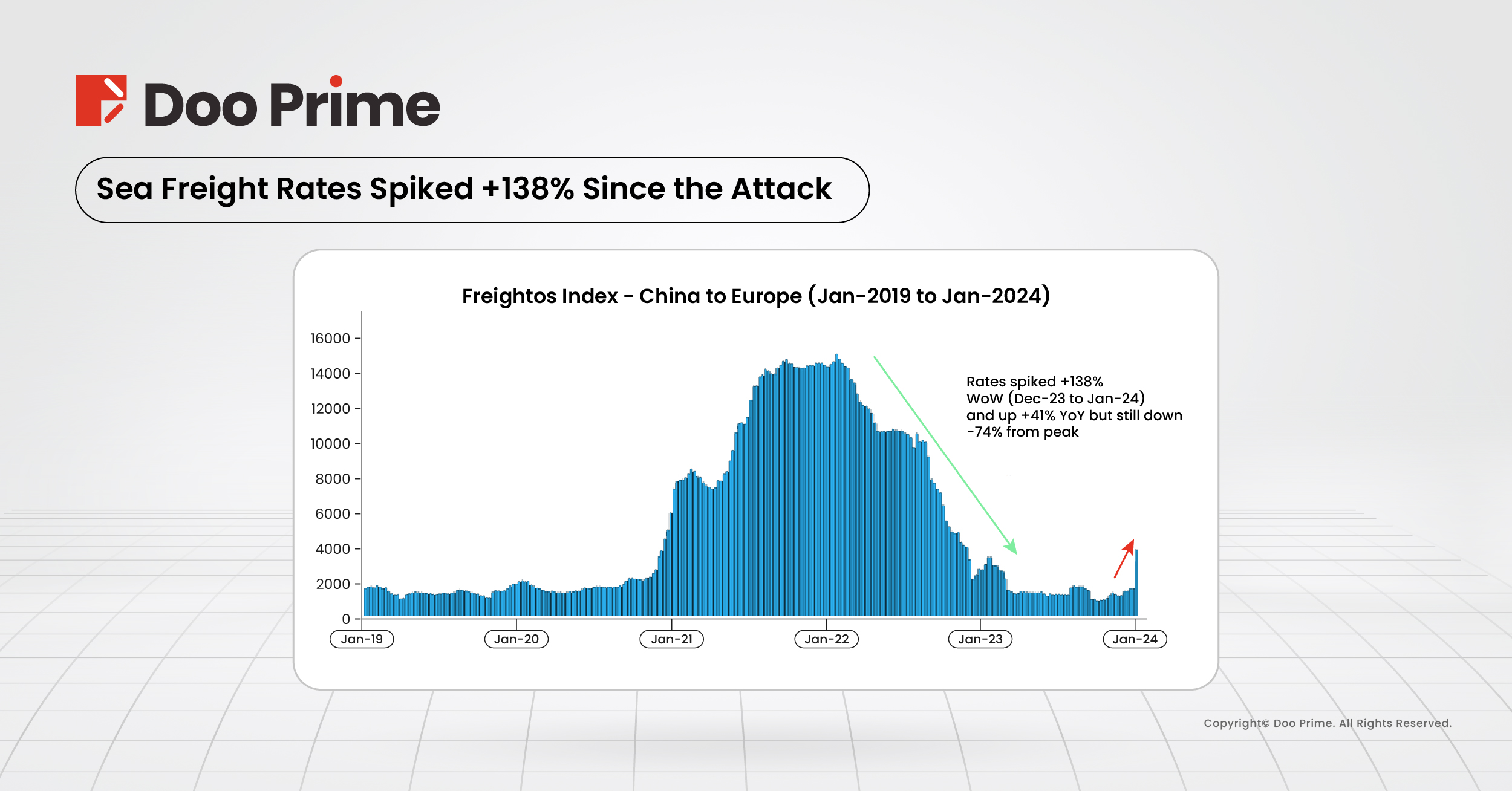

Amidst escalating tensions, the economic impact of Houthi attacks is rippling across the globe, creating a domino effect within the supply chain. According to data from Bernstein, there has been a significant surge of 138% in freight rates since the attacks commenced. This surge is straining global trade, resulting in a twofold increase in aggregate and a threefold increase on crucial routes since early December.

Image Source: Bernstein

Initially, the brunt of this impact was felt in Asia-Europe trade. However, these heightened costs are now spreading across vital trade routes connecting Europe, the Indian subcontinent, and Asia to the U.S. East Coast.

Retailers, dealing with doubled or tripled shipping expenses, have little choice but to pass these rising costs on to consumers. This situation aligns with the World Bank’s warning in its semi-annual Global Economic Prospects Report, indicating a potential surge in energy prices and inflation if the crisis continues.

This situation could worsen, leading to larger backlogs and constraints on empty container availability in Asia. Insights from Bernstein highlight the significant economic strains on major brands like Nike, Adidas, and Capri, especially those heavily invested in the European market. At the same time, brands relying on Suez routes, like Lululemon, are at risk of increased costs and operational disruptions.

2024 Oil Market Volatility

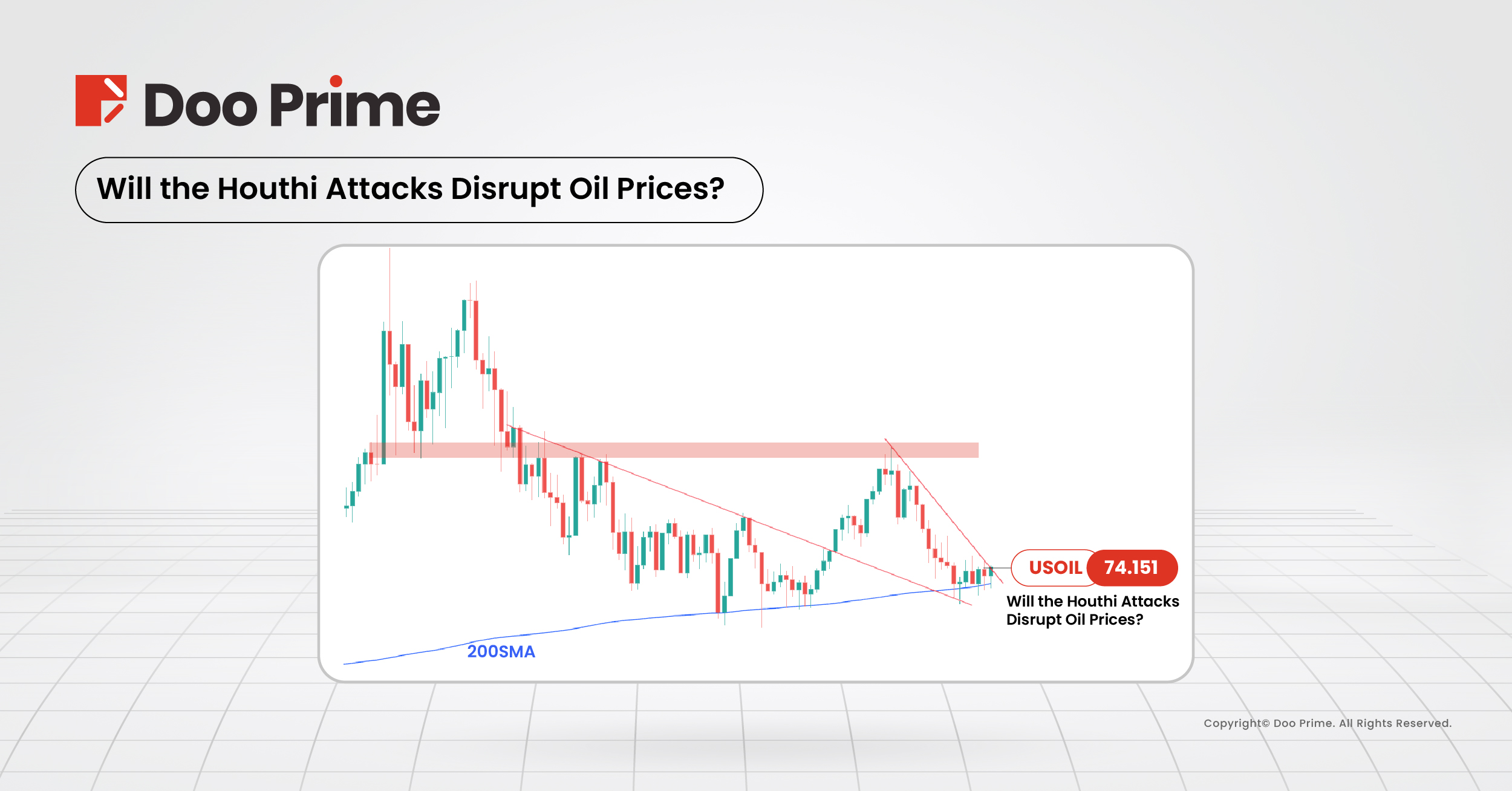

The Houthi’s attempt to block supplies to Israel has introduced an additional layer of volatility to the oil market. Because of the disrupted supply chain, oil tankers are expected to face higher costs and increased risks during transportation. This disruption is likely to exert an upward pressure on oil prices due to the resulting scarcity.

At the World Economic Forum in Davos, Switzerland, Chevron CEO Michael Wirth expressed surprise at crude oil trading below USD 73 per barrel within the U.S. oil market. Discussions ensued regarding the surplus in U.S. production compared to consumption and its role in stabilizing oil prices. In fact, data from the U.S. Energy Information Administration (EIA) reported production reaching 102.92 quads in 2022, outpacing consumption at 100.41 quads.

While the surplus may contribute to stability, Wirth sounded a cautionary note, suggesting that if tensions were to further escalate in the Middle East, the Red Sea crisis would pose a serious threat to oil flows and prices. Despite the sufficiency of current U.S. oil production, any disruption in the supply-demand equilibrium could trigger a surge in oil prices. He further commented that the situation is “very serious and seems to be getting worse.”

Image Source: Legendary Trades

Geopolitical And Regional Instability

The ongoing attacks on Red Sea shipping not only directly threaten regional stability but also have the potential to escalate into a larger conflict. Following recent strikes by the U.K. and the U.S. against Houthi rebels in Yemen, tensions are escalating, especially with Houthi officials issuing stern warnings of retaliation. Turkey and Iran have expressed dissatisfaction with the recent U.S.-led attacks.

Global tensions are rising as nations are choosing alliances. The escalation of this matter is raising questions about whether the Israel-Hamas conflict will indirectly extend to other nations. This situation carries significant implications for global security and economic stability, with nations worldwide closely monitoring the evolving scenario.

Future Challenges Ahead

In conclusion, the Red Sea crisis triggered by Houthi attacks poses a severe threat to global trade, energy prices, and regional stability. As the situation continues to evolve, the world faces a challenge of navigating economic uncertainties, supply chain disruptions, and geopolitical tensions. The adaptability and resilience of nations and businesses will be crucial in addressing the multifaceted impact of these attacks on the once-tranquil waters of the Red Sea.

| About Doo Prime

Our Trading Products

Securities | Futures | Forex | Precious Metals | Commodities | Stock Indices

Doo Prime, an international preeminent online broker under Doo Group, strives to provide professional investors with global CFD trading products in Securities, Futures, Forex, Precious Metals, Commodities, and Stock Indices. At present, Doo Prime is delivering the finest trading experience to more than 130,000 clients, with an average trading volume of more than USD 51.223 billion each month.

Doo Prime entities respectively hold the relevant financial regulatory licenses in Seychelles, Mauritius, and Vanuatu with operation centers in Dallas, Sydney, Singapore, Hong Kong, Dubai, Kuala Lumpur, and other regions.

With robust financial technology infrastructure, well-established partnerships, and an experienced technical team, Doo Prime boasts a safe and secure trading environment, competitive trading costs, as well as deposit and withdrawal methods that support 20+ different currencies. Doo Prime also incorporates 24/7 multilingual customer service and extremely fast trade execution via multiple industry-leading trading terminals such as MT4, MT5, TradingView, and Doo Prime InTrade, covering over 10,000 trading products.

Doo Prime’s vision and mission are to become a financial technology-focused broker, streamlining international global financial products investment.

For more information about Doo Prime, please contact us at:

Phone:

Europe: +44 11 3733 5199

Asia: +852 3704 4241

Asia – Singapore: +65 6011 1415

Asia – China: +86 400 8427 539

E-mail:

Technical Support: en.support@dooprime.com

Account Manager: en.sales@dooprime.com

Forward-looking Statements

This article contains “forward-looking statements” and may be identified by the use of forward-looking terminology such as “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “hope”, “intend”, “may”, “might”, “plan”, “potential”, “predict”, “should”, or “will”, or other variations thereon or comparable terminology. However, the absence of such terminology does not mean that a statement is not forward-looking. In particular, statements about the expectations, beliefs, plans, objectives, assumptions, future events, or future performance of Doo Prime will be generally assumed as forward-looking statements.

Doo Prime has provided these forward-looking statements based on all current information available to Doo Prime and Doo Prime’s current expectations, assumptions, estimates, and projections. While Doo Prime believes these expectations, assumptions, estimations, and projections are reasonable, these forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond Doo Prime’s control. Such risks and uncertainties may cause results, performance, or achievements materially different from those expressed or implied by the forward-looking statements.

Doo Prime does not provide any representation or warranty on the reliability, accuracy, or completeness of such statements. Doo Prime is not obliged to provide or release any updates or revisions to any forward-looking statements.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure and Acknowledgement Notice to find out more.

Disclaimer

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, make no representation or warranties to the information displayed and shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided, and any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.