Amidst the backdrop of rising global interest rates and the impending U.S. debt ceiling deadline (June 1st 2023), the probability of a deeper global

recession becomes increasingly apparent. In such a challenging market environment, investors encounter heightened complexities as they strive for profitable returns and strive to navigate the marketplace with finesse.

Uncertain economic times demand astute navigation of market volatility and identification of avenues for growth. Fortunately, there are strategies available that empower investors to deftly maneuver within this ambiguity and optimize their investment portfolios.

An approach that has garnered significant attention is investing in growth stocks. These stocks represent companies with the potential for exceptional growth in both revenue and earnings. Embracing growth stocks, particularly in the face of an impending recession, presents an opportunity for investors to potentially benefit from their resilience and tendency to outperform other market segments.

The objective of this article is to comprehensively explore the numerous advantages associated with investing in growth stocks during periods of uncertainty. Additionally, it aims to provide invaluable insights on effectively identifying promising opportunities within specific sectors. By delving into these topics, investors can equip themselves with the knowledge and strategies needed to thrive in volatile market conditions and make informed investment decisions.

Exploring Growth Stocks

During economic recessions, certain sectors and industries have historically demonstrated the ability to outperform the overall market. Examples of these sectors include Healthcare, Utilities, and Consumer Staples. These companies typically offer products or services that remain in high demand, even in the midst of a recession.

While these sectors can be attractive investment options during downturns, it is important to note that growth stocks are generally considered higher-risk investments.

The suitability of a particular investment type depends on individual investment goals and risk tolerance. If your aim is to pursue the potential for high returns, growth stocks may align with your investment objectives. Conversely, if you prefer a more conservative approach, value stocks or dividend stocks might be a better fit.

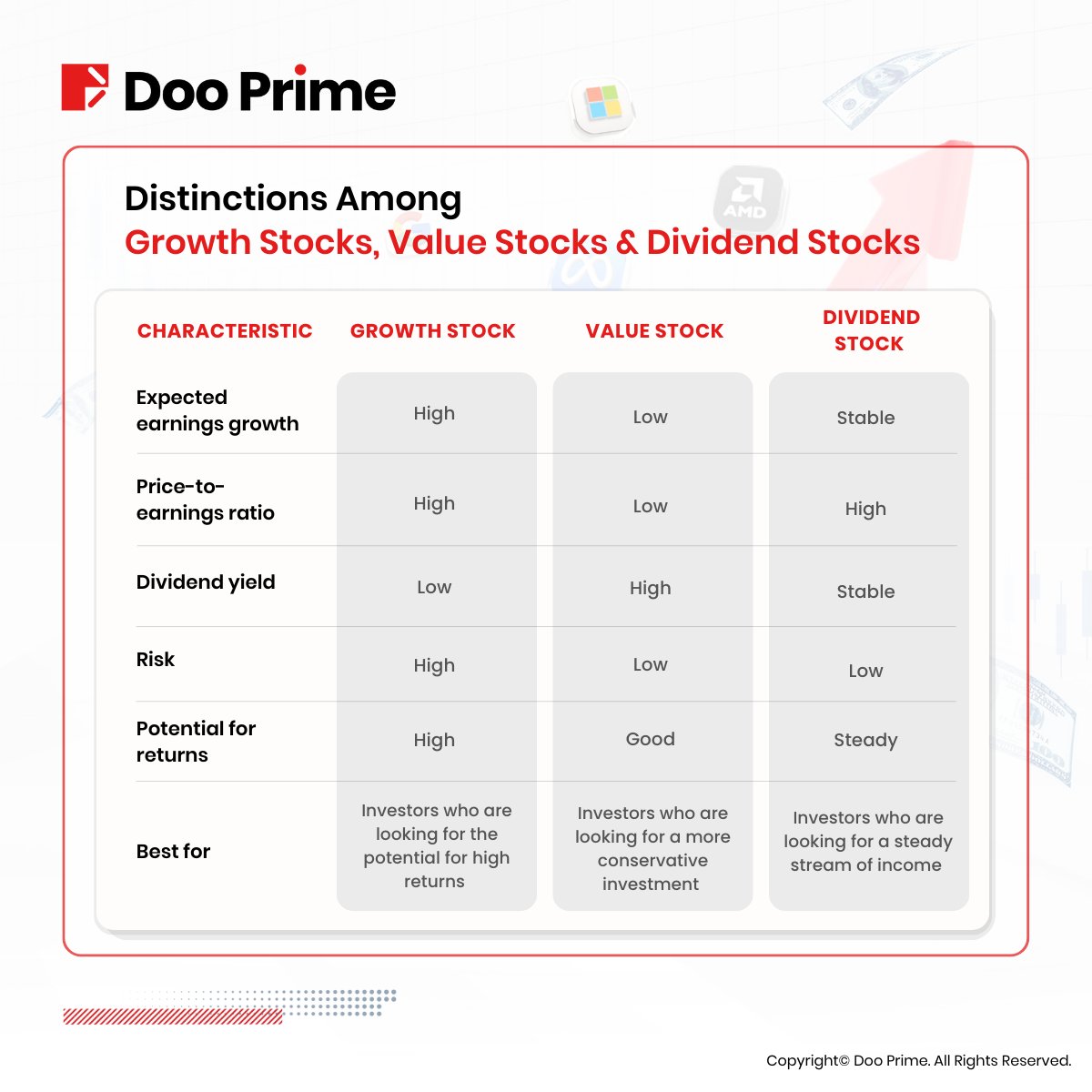

To provide a clearer understanding of the distinctions among growth stocks, value stocks, and dividend stocks, the following table summarizes their key differences:

Benefits Of Growth Stocks During A Recession

When the economy experiences subpar growth rates, investors tend to pay a premium for growth stocks. This demand drives the prices of growth stocks higher, leading to stronger gains.

In fact, historical data reveals that growth stocks have performed their best when the economy’s growth rate is below 0.5%.

With this, growth stocks offer the opportunity to be bought below their fair value during a recession with the potential for capital appreciation. When everyone is panicking and selling off their fundamentally sound investments, long-term investors buy at a discount.

Another benefit is resilience. Growth stocks can be more resilient in challenging market conditions than other types of stocks. For example, during the 2008 financial crisis, many growth stocks, such as Apple & Amazon, continued to perform well, even as the overall market declined.

Identifying Promising Growth Stocks

Identifying promising growth stocks requires careful analysis and evaluation. Several factors contribute to the growth potential of a company, including its revenue growth rates, earnings growth potential, competitive advantages, and market trends.

Investors should conduct thorough research, examine financial statements, and assess the company’s growth prospects relative to its industry and the broader market. By focusing on companies with strong growth fundamentals and a solid track record, investors can increase their chances of identifying potential winners.

However, it is important to note that each recession is unique, and the investment strategies that prove successful can vary. Sometimes, investors prioritize factors such as revenue growth and competitive advantages, while in other instances, they ride the waves of industry trends.

In the current looming recession, characterized by the emergence of the Artificial Intelligence (AI) revolution, investors are predominantly focusing on the Technology and Communication Services sectors. This exemplifies the impact of an industry trend unfolding right before our eyes. To gain further insight, refer to the chart provided below.

This divergence between AI stocks and the rest of the market is likely to continue as AI continues to grow and mature.

Sector Opportunities And Bullish Factors For Growth Stocks

Analyzing the sector composition of growth and value indices reveals valuable insights into potential outperforming sectors. Growth indices tend to exhibit significant overweight positions in technology, healthcare, and energy sectors.

Notably, the technology sector stands out with its double exposure compared to the value index. This sector’s composition, featuring mega-cap tech and discretionary stocks, positions growth stocks for potential outperformance, particularly in uncertain macro environments.

In addition to sector opportunities, growth stocks offer other bullish factors that contribute to their potential. Healthcare presents an opportunity for dependable growth at a reasonable price, as the demand for medical services remains resilient irrespective of economic conditions.

Furthermore, the energy sector, currently trading at a low valuation, provides an attractive risk-reward profile, potentially leading to an oil rebound. This presents growth stocks within the energy sector with the possibility of generating significant returns.

Moreover, growth stocks’ limited exposure to underperforming cyclical sectors like financials, real estate, and utilities further strengthens their leadership potential.

By strategically considering these sector opportunities and bullish factors, investors can position themselves to capitalize on the growth potential of specific sectors within the growth stock universe.

Federal Reserve Actions: Implications For Growth Stocks

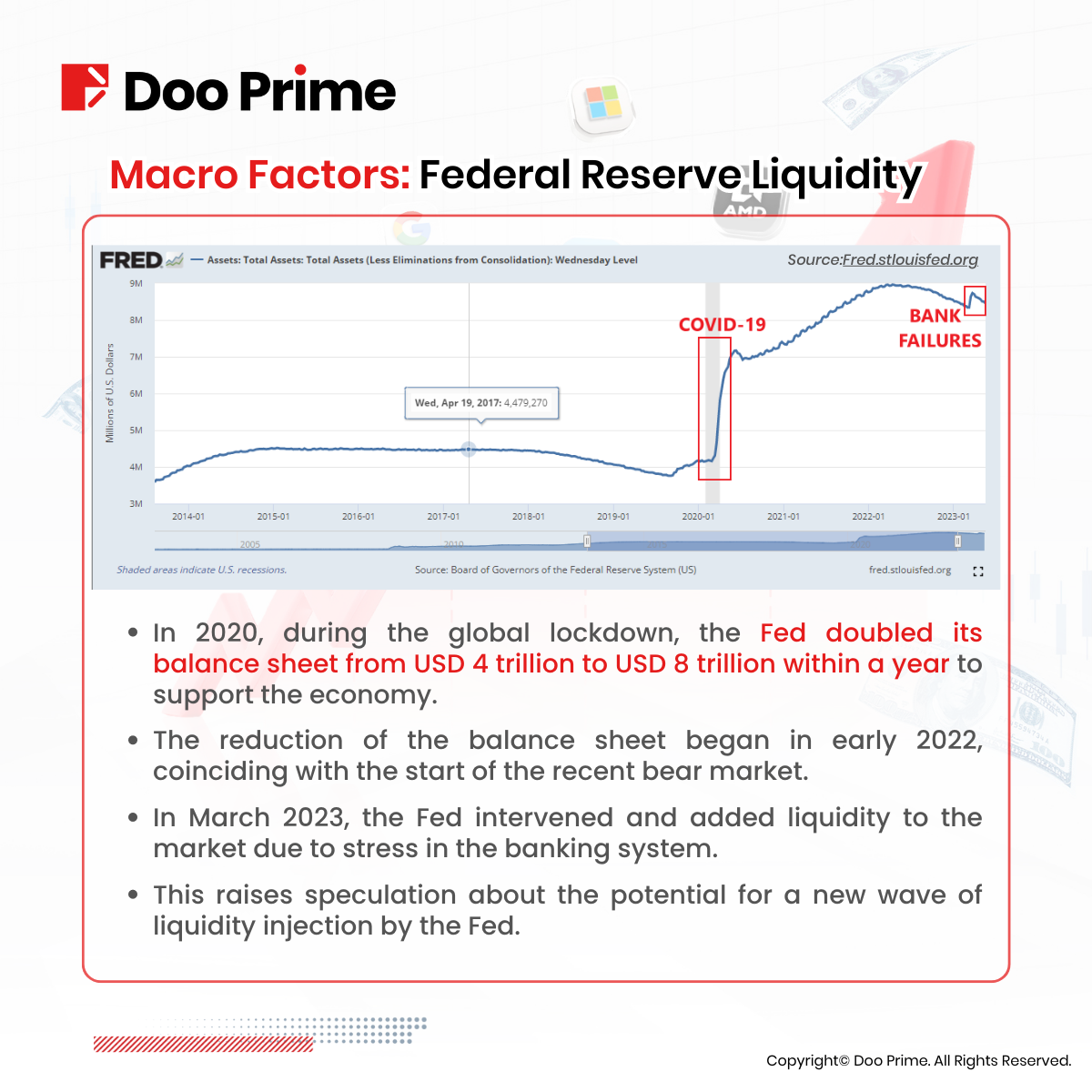

Another potential bullish signal for growth stocks emerges from the actions of the U.S. Federal Reserve. Despite the current tightening policy, the Federal Reserve recently injected a new round of liquidity into the market following three bank failures in the United States (First Republic Bank, Signature Bank, and Silicon Valley Bank).

Source: Fred.stlouisfed.org

In 2020, during the global lockdown, the Fed’s balance sheet doubled from USD 4 trillion to USD 8 trillion within a year to support the economy. Although they began reducing the balance sheet at the start of 2022, it coincided with the unfolding of the recent bear market.

In March 2023, due to stress in the banking system, the Fed was compelled to intervene and provide liquidity to the market. This raises the question: could this mark the beginning of a significant new wave of liquidity injections by the Fed?

The recent bank failures serve as a reminder that the economy is not immune to risks. However, viewed from another perspective, this new wave of liquidity injection could be interpreted as a bullish signal to investors, at least in the short term.

If the Fed is willing to intervene whenever a banking crisis occurs, it signals the government’s commitment to maintaining financial stability. This assurance may lead to increased investment and short-term economic growth, benefiting growth stocks and creating favorable conditions for investors.

Bringing It All Together

Considering the macroeconomic landscape, growth stocks are expected to continue outperforming in an uncertain environment. The combination of cooling inflation, slowing growth, and ongoing recession concerns has driven investors towards high-quality, dependable growth stocks that can thrive in a weak economy. As growth remains valuable in scarce conditions, growth stocks still have room to run and present an attractive opportunity for investors.

Leveraging Growth Stocks To Weather Market Challenges

Despite the current challenging market conditions, there are enticing opportunities for investors with a risk appetite who are seeking to invest in growth stocks.

These growth stocks, such as Microsoft, NVIDIA, Advanced Micro Devices, Alphabet, Meta, and Apple, occupy prominent positions in the rapidly evolving field of artificial intelligence (AI).

With the right support and favorable policies from central bankers, these companies have the potential to capitalize on the ever-changing AI market and achieve significant growth.

The AI landscape is characterized by constant innovation and advancements, making it crucial for companies to stay ahead of the curve. Those that can maintain their competitive edge stand to benefit greatly from the ongoing AI revolution.

By closely monitoring industry leaders like the aforementioned companies, investors can position themselves to harness the potential rewards associated with the dynamic AI sector.

To successfully navigate the market and position oneself for success in a looming recession, it is essential to comprehend the reasons behind the continued potential of these growth stocks and employ the right investment strategies.

Conducting thorough research, maintaining diversification, and adopting a long-term perspective are key elements in maximizing the benefits of investing in growth stocks during a recession.

By staying informed, exercising prudence, and capitalizing on the growth potential of these companies, investors can strive to navigate the challenges posed by uncertain market conditions and potentially achieve favorable outcomes.

| About Doo Prime

Our Trading Products

Securities | Futures | Forex | Precious Metals | Commodities | Stock Indices

Doo Prime is an international pre-eminent online broker under Doo Group, which strives to provide professional investors with global CFD trading products in Securities, Futures, Forex, Precious Metals, Commodities, and Stock Indices. At present, Doo Prime is delivering the finest trading experience to more than 90,000 clients, with an average trading volume of more than USD 51.223 billion each month.

Doo Prime entities respectively holds the relevant financial regulatory licenses in Seychelles, Mauritius, and Vanuatu with operation centers in Dallas, Sydney, Singapore, Hong Kong, Dubai, Kuala Lumpur, and other regions.

With robust financial technology infrastructure, well-established partnerships, and an experienced technical team, Doo Prime boasts a safe and secure trading environment, competitive trading costs, as well as deposit and withdrawal methods that support 20+ different currencies. Doo Prime also incorporates 24/7 multilingual customer service and extremely fast trade execution via multiple industry-leading trading terminals such as MT4, MT5, TradingView, and Doo Prime InTrade, covering over 10,000 trading products.

Doo Prime’s vision and mission are to become a financial technology-focused broker, streamlining international global financial products investment.

For more information about Doo Prime, please contact us at:

Phone:

Europe: +44 11 3733 5199

Asia: +852 3704 4241

Asia – Singapore: +65 6011 1415

Asia – China: +86 400 8427 539

E-mail:

Technical Support: [email protected]

Account Manager: [email protected]

Forward-looking Statements

This article contains “forward-looking statements” and may be identified by the use of forward-looking terminology such as “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “hope”, “intend”, “may”, “might”, “plan”, “potential”, “predict”, “should”, or “will”, or other variations thereon or comparable terminology. However, the absence of such terminology does not mean that a statement is not forward-looking. In particular, statements about the expectations, beliefs, plans, objectives, assumptions, future events, or future performance of Doo Prime will be generally assumed as forward-looking statements.

Doo Prime has provided these forward-looking statements based on all current information available to Doo Prime and Doo Prime’s current expectations, assumptions, estimates, and projections. While Doo Prime believes these expectations, assumptions, estimations, and projections are reasonable, these forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond Doo Prime’s control. Such risks and uncertainties may cause results, performance, or achievements materially different from those expressed or implied by the forward-looking statements.

Doo Prime does not provide any representation or warranty on the reliability, accuracy, or completeness of such statements. Doo Prime is not obliged to provide or release any updates or revisions to any forward-looking statements.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure and Acknowledgement Notice to find out more.

Disclaimer

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, make no representation or warranties to the information displayed and shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided, and any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.