Over the course of 2022, the global market has experienced multiple turbulence, including the Russia-Ukraine war, energy shortage, and the U.S. Federal Reserve’s aggressive interest rate hikes along with a series of crises that have pushed assets to their edge.

Even gold, which has always been regarded as a “safe-haven asset” by investors, was not spared in this year’s bear market.

Whenever the global market sees turbulence, gold prices tend to fluctuate dramatically, and this year is no exception. Compared to the beginning of the year, gold prices have seen a surge of more than 13% in March and saw a downturn of nearly 10%.

In this year’s highly volatile market, what valuable information could investors gather to plan for next year’s investment? This article will guide you on.

What Are The Fundamental Factors That Affect Gold Prices

Before we dwell into this year’s gold price trend, let us first elaborate what are the basic factors that will influence the fluctuation in the gold price. Through this, we shall gradually peel away the appearance of the price and deeply analyze the real connotation behind the gold price trend.

Gold has always played an important role in the development of human history because of its beautiful, rare, precious and stable characteristics. Generally speaking, among the many attributes of gold, the basic elements that affect the price movement of gold mainly lie in the following three aspects.

1. Financial Investment Property

For the longest time, one of the key factors that have made gold a popular trading product sought after by many traders is that it has financial investment properties.

Since holding gold itself does not generate dividends or interest income like stocks or bonds, the only source of profit for investors is to wait for the gold price itself to rise. If investors are inclined to buy other financial assets such as stocks, there is little opportunity for the gold price to rise. Therefore, the price of gold is usually closely related to the overall financial market situation.

As a benchmark of the financial markets, “interest rates” often have a direct impact on the performance of many financial assets at the macro level.

When interest rates rise, the return on holding risk-free bonds such as treasury bonds will rise, thus attracting investors to buy such assets, which is negative for gold prices. And vice versa.

The negative correlation between gold prices and interest rates can also be seen in the figure below, which shows the relationship between gold prices and U.S. 10-year Treasury yields over the past five years.

2. Value Preservation & Hedging Properties

Gold, as a general equivalent, has long been recognized as a safe hedging asset in the long history of mankind. Whenever a major catastrophic event occurs in society, such as a crisis in the credit of the national currency, or a political event such as war, the credit currencies tend to depreciate in value, thus stimulating the public to buy gold as a hard currency.

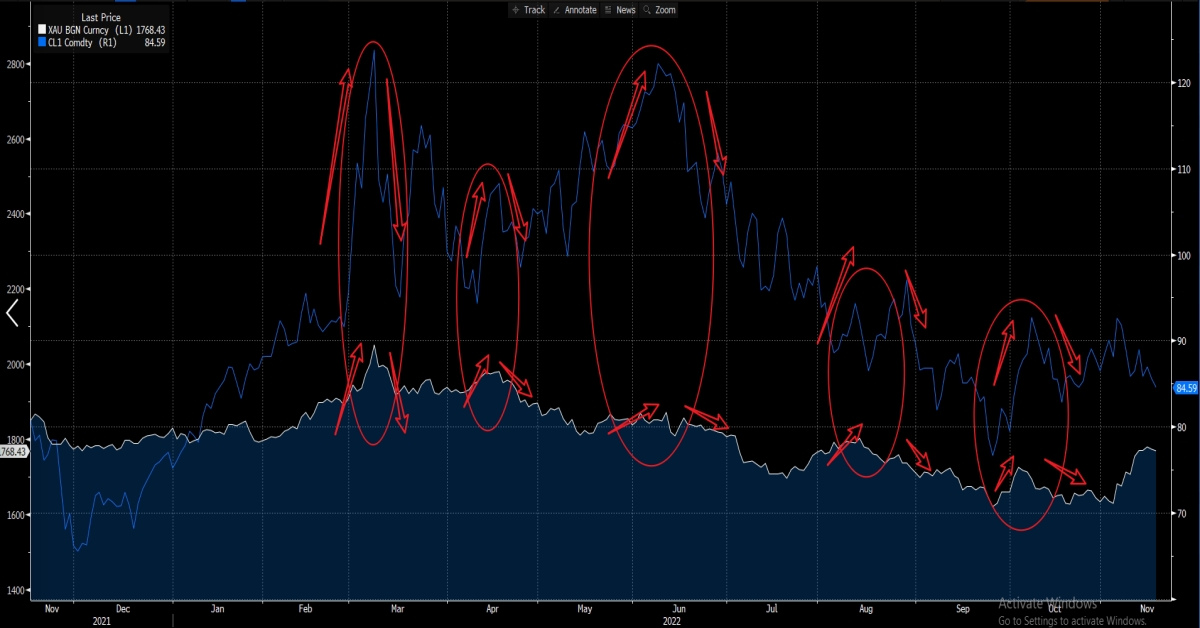

In other words, if an economy experiences inflation or a credit crisis that causes the purchasing power of money to decline, then the value of gold as a hard currency will rise. This is very similar to crude oil, which also has the property of hard currency.

As we can see from the figure below, the price movements of crude oil and gold, which are both hard currencies, show a similar positive correlation.

Over the course of the past year, gold and crude oil have shown similar price movements many times although the factors that affect their prices may be slightly different.

In short, the performance of financial market sentiment will determine the movement of gold to some extent.

3. Reserve Currency

As German philosopher Karl Marx once said, “Although gold and silver are not by nature money, money is by nature gold and silver.”.

Before the collapse of the Bretton Woods system, the dollar was directly linked to gold. Even in the post-Bretton Woods era, governments have been holding large gold reserves.

According to the latest data from the World Gold Council (WGC), central banks bought nearly 400 tons of gold in the third quarter of this year, a surge of about 300% year-on-year. The reserve and payment function of gold as a currency is evident.

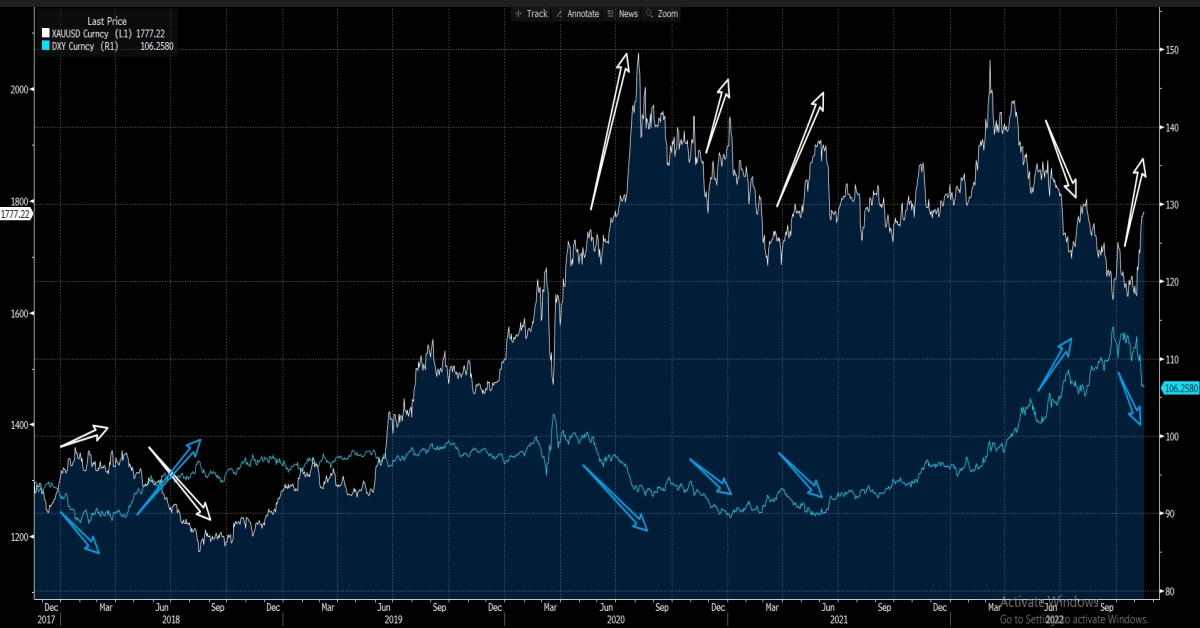

As gold possesses monetary properties, there is a mutual substitution effect with other countries’ official currencies. For example, if the value of the U.S. dollar rises, gold falls, and vice versa. The figure below shows how the two have been negatively correlated many times over the past five years.

How Major Events Impact Gold

So far this year, major political and economic events have occurred around the world, bringing a wide-ranging impact on the price movements of many financial assets. Gold has no exception.

1. Aggressive Rate Hikes By The U.S. Federal Reserve Board of Governors (“Fed”)

In order to save the stubbornly high inflation in the U.S., the Fed has raised interest rates several times this year. In May, the Feds broke market expectations, raising rates for the first time in years by as much as 50 basis points, followed by a continuous aggressive pace of rate hikes by 75 basis points.

In the midst of aggressive rate hikes in the U.S. dollar, the value of the U.S. dollar naturally soars all the way up.

As we can see from the figure below, so far, the gold price trend for this year has basically gone down gradually with the appreciation of the U.S. dollar.

However, the latest CPI data released by the U.S. on 10th November was lesser than expected, revealing a glimpse that the current inflation in the U.S. may have turned around.

Under this expectation, the market rekindled the hope that the Fed may slow down the pace of interest rate hikes soon, and gold prices turned higher.

2. Russia-Ukraine War

Major political events such as wars and conflicts often trigger panic in the market, which causes funds to flow into gold and other safe-haven assets, pushing up the price of gold assets.

After the Russia and Ukraine war broke out on 24th February this year, the price of gold rose quickly in the short term. In addition, in order to place sanctions on Russia, the United States blatantly froze its large amount of U.S. dollar foreign exchange reserves, which also rang the alarm to governments of all countries.

Therefore, central banks of various countries have also allocated gold to hedge risks.

However, with the prolonged war, the market gradually digested the impact of the risk of war.

At the same time, the U.S. Fed continued to aggressively raise the interest rates, pulling up the value of the U.S. dollar. Eventually, the influence of the Russia-Ukraine war on the trend of gold prices faded gradually.

What’s Next: Gold’s Forecast Analysis

How will the gold price trend be next year? This will require us to consider various factors and focus on the following three areas:

1. The U.S. Dollar Trend

The chances of the Fed slowing down the pace of interest rate hikes in the future will directly affect the next move of the U.S. dollar. As we have explained above, since gold tends to have a negative correlation with the U.S. dollar, if the U.S. dollar starts to fall, it will be good for gold in the short term.

On 10th November, the U.S. Bureau of Labor Statistics (BLS) released the latest CPI for the U.S. economy for the month of October, up 7.7%, a sharp drop from the previous value of 8.2%, the lowest level since January this year.

As soon as the data was released, market expectations for the Fed to slow down the pace of interest rate hikes rose sharply. In addition, Vice Chair of the Fed, Lael Brainard, also said in November that the Fed may slow down the pace of interest rate hikes soon.

Of course, the exact timeline for the Fed to slow rate hikes is unknown until the Fed actually starts to shift policy and slow down the rate hike boots.

Investors are advised to keep an eye on the core PCE price index, which will be released on 1st December 2022. The index and CPI are both price indices, but since the core PCE price index is not only for individual consumers, survey on businesses is done as well, the Fed will also focus on the core PCE price index when weighing the country’s inflation situation.

2. Economic Recession

If the Fed does follow current market expectations and starts to gradually slow down interest rate hikes, it will boost gold in the short term.

But from a medium-term perspective, the Fed’s move to slow down interest rate hikes, and even turn to lower interest rates does not necessarily guarantee that the gold prices will rise.

As the current U.S. economy is not bright, tech giants such as Twitter, Meta, and Amazon have laid off employees, and GDP growth has stagnated. This puts the U.S. at risk of economic recession.

If the U.S. economy falls into a recession crisis in the future, it may be too late for the Fed to reduce the interest rates, and it may be difficult to boost market confidence in the future.

If this is the case, then even if the U.S. dollar enters the channel of interest rate cuts, gold may be sought after again under the condition of shrinking market confidence, thereby driving up the price of gold.

3. Black Swan Theory

The world is currently in the midst of major changes unprecedented in a century, and the global structure is undergoing dramatic changes.

In recent years, the black swan theory, also known as the black swan event, that broke the market’s previous perception, has occurred frequently, which constantly disturbs the trend of financial asset prices.

Looking ahead to next year’s situation, investors are advised to pay attention to the market dynamics in a timely manner, take precautions beforehand and respond accordingly to potential black swan events.

| About Doo Prime

Our Trading Instruments

Securities | Futures | Forex | Precious Metals | Commodities | Stock Indices

Doo Prime is an international pre-eminent online broker under Doo Group, which strives to provide professional investors with global CFD trading products in Securities, Futures, Forex, Precious Metals, Commodities, and Stock Indices. At present, Doo Prime is delivering the finest trading experience to more than 90,000 clients, with an average trading volume of more than USD51.223 billion each month.

Doo Prime entities respectively holds the relevant financial regulatory licenses in Seychelles, Mauritius, and Vanuatu with operation centers in Dallas, Sydney, Singapore, Hong Kong, Dubai, Kuala Lumpur, and other regions.

With robust financial technology infrastructure, well-established partnerships, and an experienced technical team, Doo Prime boasts a safe and secure trading environment, competitive trading costs, as well as deposit and withdrawal methods that support 10 different currencies. Doo Prime also incorporates 24/7 multilingual customer service and extremely fast trade execution via multiple industry-leading trading terminals such as MT4, MT5, TradingView, and InTrade, covering over 10,000 trading products.

Doo Prime’s vision and mission are to become a financial technology-focused broker, streamlining international global financial products investment.

For more information about Doo Prime, please contact us at:

Phone:

Europe : +44 11 3733 5199

Asia : +852 3704 4241

Asia – Singapore: +65 6011 1415

Asia – China : +86 400 8427 539

E-mail:

Technical Support: en.support@dooprime.com

Account Manager: en.sales@dooprime.com

Forward-looking Statements

This article contains “forward-looking statements” and may be identified by the use of forward-looking terminology such as “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “hope”, “intend”, “may”, “might”, “plan”, “potential”, “predict”, “should”, or “will”, or other variations thereon or comparable terminology. However, the absence of such terminology does not mean that a statement is not forward-looking. In particular, statements about the expectations, beliefs, plans, objectives, assumptions, future events, or future performance of Doo Prime will be generally assumed as forward-looking statements.

Doo Prime has provided these forward-looking statements based on all current information available to Doo Prime and Doo Prime’s current expectations, assumptions, estimates, and projections. While Doo Prime believes these expectations, assumptions, estimations, and projections are reasonable, these forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond Doo Prime’s control. Such risks and uncertainties may cause results, performance, or achievements materially different from those expressed or implied by the forward-looking statements.

Doo Prime does not provide any representation or warranty on the reliability, accuracy, or completeness of such statements. Doo Prime is not obliged to provide or release any updates or revisions to any forward-looking statements.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure and Acknowledgement Notice to find out more.

Disclaimer

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, make no representation or warranties to the information displayed and shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided, and any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.