In the fast-paced realm of the stock market, the semiconductor industry is currently at an all-time high, featuring standout players like Super Micro Computer Inc (SMCI) and Nvidia (NVDA). This surge, marked by an exponential trajectory, prompts a crucial exploration into the potential onset of a market mania. History warns us that manias, while exhilarating, often lead to challenging market corrections.

This article takes a closer look at the psychology behind the semiconductor mania, contemplating the sustainability of players like NVDA amidst this surge and raising essential questions about the industry’s future projection.

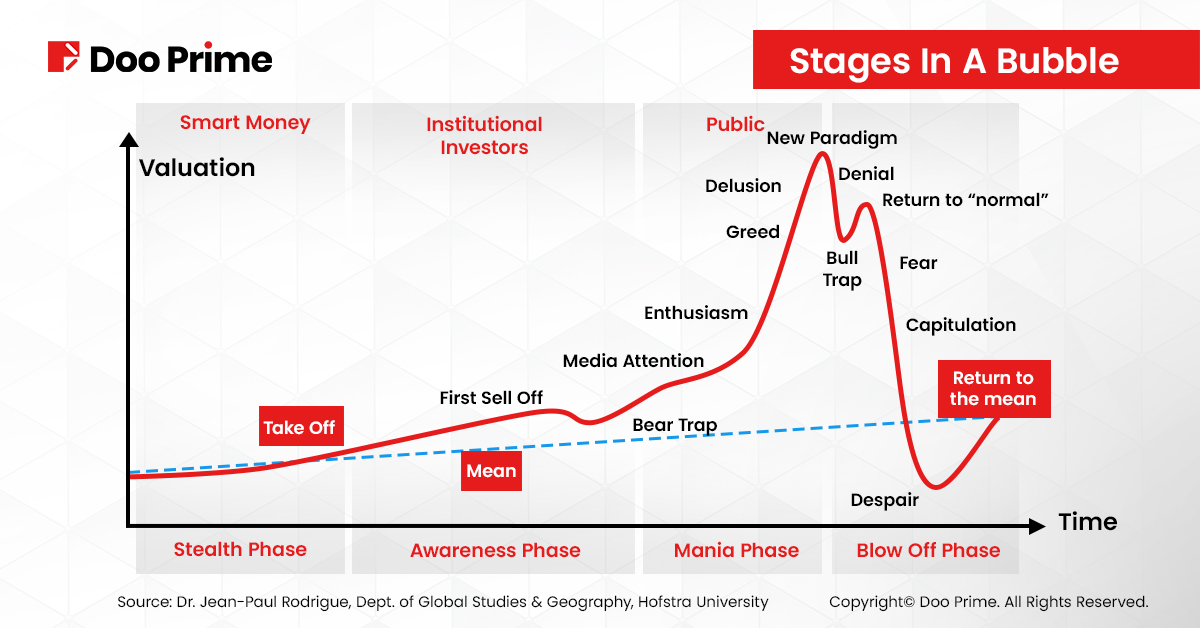

Stages In A Bubble

Bubbles, or financial manias, often follow a well-defined pattern, shaped by 500 years of economic history. Though each bubble is unique, they typically unfold in four distinct phases:

1. Stealth Phase

At the outset, savvy investors recognize an emerging opportunity for substantial future gains. Referred to as the “smart money,” they cautiously invest, armed with speculative assumptions. Prices quietly rise, yet largely escape the notice of the wider population.

2. Awareness Phase

As momentum builds, more investors catch wind of the potential, injecting additional capital and driving prices higher. Short-lived selloffs may occur, providing opportunities for early investors to capitalize on profits. Media coverage begins, attracting a wave of less sophisticated investors.

3. Mania Phase

Public awareness comes in, drawing in a broader audience who see the opportunity as a once-in-a-lifetime chance. Expectations of future gains become unquestionable, fuelled by a linear inference mentality. A flood of money pours in, propelling prices to astronomical levels. Unbeknownst to the public caught in the frenzy, the “smart money” begins to exit positions quietly.

4. Blow-off Phase

The pinnacle of the bubble is reached when a moment of realization triggers a paradigm shift. Confidence wavers, and denial sets in. The bubble collapses rapidly, with prices plummeting faster than the initial inflation. Latecomers find themselves holding depreciating assets, while the smart money exited long ago.

It is important to recognize these phases, especially with the semiconductor’s wild rise. The impact of bubbles extends beyond financial markets, taking a significant toll on human psychology. As we delve into the success story of NVDA and SMCI, it becomes imperative to understand these phases, considering their potential influence on market dynamics and the psyche of investors, where factors like greed and delusion can come into play.

A Closer Look at Nvidia’s Soaring Success

Fuelled by the burgeoning demand for AI-driven technologies, Nvidia’s recent quarterly earnings report showcased a staggering 3x increase in revenue and an impressive 12x surge in net profit year-on-year. The diluted shares per earnings experienced exponential growth, escalating by 854% for the second quarter and a notable 1,274% for the third quarter.

In the third quarter, the Data Center segment witnessed a remarkable 279% year-on-year revenue increase, totalling USD 14,514 million. Simultaneously, the Gaming segment soared with an 81% year-on-year surge, generating USD 2,856 million.

Key Milestones and Surging Demands

Nvidia’s ascent is nothing short of historic, reflected in its market capitalization reaching a staggering USD 1.83 trillion, surpassing tech giants Amazon and Google. Over the last decade, Nvidia’s stock has witnessed an astonishing 17,000% gain, making it the standout performer on the S&P 500. Analysts project a third consecutive quarter of record sales and profits, solidifying Nvidia’s dominance in the semiconductor space.

The surge in Nvidia’s stock is closely tied to trends and demand capacity in the semiconductor industry, particularly in the GPU sector. Notably, Bank of America analyst Ruplu Bhattacharya cites that over 50% of Nvidia’s revenues are now tied to accelerators, such as GPUs. However, while market shortages have driven stock prices to unprecedented highs, the semiconductor chip business faces a challenge – it is not prepared to deliver sustained spikes in demand. This lack of preparation is particularly evident in long-term planning, where chip allocations are mapped out years in advance.

While this surge has propelled prices to new heights, it carries the risk of a market correction. The semiconductor sector’s semi-cyclical nature suggests that the current surge might just be the beginning, with a potential drop in demand on the horizon.

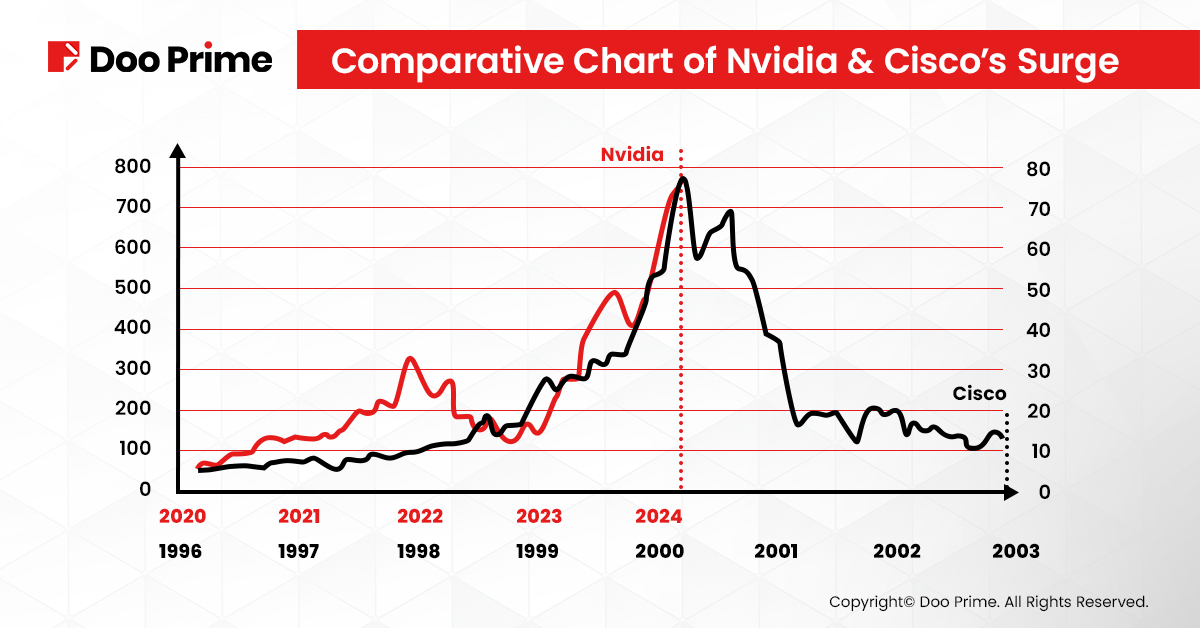

Learning From The Past: CISCO’s Cautionary Tale

To provide context to potential risks and rewards, drawing parallels with historical events is crucial. A comparison between Cisco’s trajectory during the dot-com crash in 2000 and Nvidia’s current progress serves as a reminder. Like Nvidia, Cisco experienced a surge followed by a significant crash. This historical reference serves as a cautionary tale, urging investors to approach the current surge with a discerning eye.

SMCI’s Meteoric Rise and Recent Challenges

Few stocks in 2024 have experienced a more remarkable start than Super Micro Computer, Inc. (SMCI). This company, specializing in high-performance storage solutions within the modular and open architecture sector, has undergone a remarkable surge in its share price, soaring by an impressive 139.8% year-to-date as of 6th February 2024. Looking back to the beginning of 2023, SMCI has exhibited an outstanding growth rate of 730.2%.

However, the recent market dynamics present a contrasting picture for SMCI, as the stock made a sharp bearish reversal, triggering a significant sell-off. On February 16, 2024, Super Micro Computer’s stock took a downturn after reaching the 1,000 level and achieving an all-time high earlier that morning. This abrupt change in direction sent investors into a scramble, with the stock opening higher but witnessing gains vanish in the first half-hour of trading.

In midday trading, SMCI shares were down about 12%, accompanied by heavy volume nearly six times its average. This bearish reversal raised concerns among investors, indicating a potential shift in market sentiment.

Analysts suggest that explosive moves like the remarkable ascent of SMCI cannot be sustained indefinitely. The stock had tripled from its breakout at 357 in January, and the recent downturn may signal a need for caution. Investors are now faced with a decision point, contemplating whether to take profits amidst the topping signals displayed by the stock.

Several indicators point to the characteristics of a climax top in SMCI’s recent surge. The stock climbed for 18 out of the last 20 days to reach its peak, all amid heavy trading and wide price spreads. Additionally, being more than 200% above its 200-day moving average and over 100% beyond its 50-day moving average further underscore the potential overheating of the stock. Coming out of a late-stage base, which is more prone to failure than an early-stage one, adds another layer of consideration for investors navigating SMCI’s current market situation.

As SMCI faces this bearish reversal and potential signs of a climax top, keen-eyed investors must carefully evaluate their positions and consider the inherent risks associated with the stock’s recent meteoric rise.

The Road Ahead For NVDA And SMCI

As Nvidia gears up to report its fiscal fourth-quarter earnings for 2024 on February 21st, analysts are poised for significant revelations. Projections suggest an astronomical revenue of USD 20.38 billion for the final quarter, more than triple the revenue from the same period a year ago. Net income is expected to reach a staggering USD10.4 billion, up from USD 1.41 billion in the fiscal fourth quarter of 2023, with an estimated earnings per share (EPS) of USD 4.18, compared to 57 cents in the same period a year earlier.

In summary, although the semiconductor surge holds promise, a thorough examination of its sustainability is essential. Recognizing the mania stage and understanding the psychological factors shaping market dynamics are key considerations. Ahead of Nvidia and SMCI’s earnings, investors should keep a watchful eye on broader market trends and be ready for potential shifts in the volatile semiconductor landscape.

The cyclical nature of the market and historical patterns serve as reminders that every surge may be followed by a correction, highlighting the importance of vigilance in navigating the dynamic stock market. While the surge may bring excitement, maintaining a clear and rational mindset amidst market fluctuations is fundamental.

| About Doo Prime

Our Trading Products

Securities | Futures | Forex | Precious Metals | Commodities | Stock Indices

Doo Prime, an international preeminent online broker under Doo Group, strives to provide professional investors with global CFD trading products in Securities, Futures, Forex, Precious Metals, Commodities, and Stock Indices. At present, Doo Prime is delivering the finest trading experience to more than 130,000 clients, with an average trading volume of more than USD 51.223 billion each month.

Doo Prime entities respectively hold the relevant financial regulatory licenses in Seychelles, Mauritius, and Vanuatu with operation centers in Dallas, Sydney, Singapore, Hong Kong, Dubai, Kuala Lumpur, and other regions.

With robust financial technology infrastructure, well-established partnerships, and an experienced technical team, Doo Prime boasts a safe and secure trading environment, competitive trading costs, as well as deposit and withdrawal methods that support 20+ different currencies. Doo Prime also incorporates 24/7 multilingual customer service and extremely fast trade execution via multiple industry-leading trading terminals such as MT4, MT5, TradingView, and Doo Prime InTrade, covering over 10,000 trading products.

Doo Prime’s vision and mission are to become a financial technology-focused broker, streamlining international global financial products investment.

For more information about Doo Prime, please contact us at:

Phone:

Europe: +44 11 3733 5199

Asia: +852 3704 4241

Asia – Singapore: +65 6011 1415

Asia – China: +86 400 8427 539

E-mail:

Technical Support: en.support@dooprime.com

Account Manager: en.sales@dooprime.com

Forward-looking Statements

This article contains “forward-looking statements” and may be identified by the use of forward-looking terminology such as “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “hope”, “intend”, “may”, “might”, “plan”, “potential”, “predict”, “should”, or “will”, or other variations thereon or comparable terminology. However, the absence of such terminology does not mean that a statement is not forward-looking. In particular, statements about the expectations, beliefs, plans, objectives, assumptions, future events, or future performance of Doo Prime will be generally assumed as forward-looking statements.

Doo Prime has provided these forward-looking statements based on all current information available to Doo Prime and Doo Prime’s current expectations, assumptions, estimates, and projections. While Doo Prime believes these expectations, assumptions, estimations, and projections are reasonable, these forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond Doo Prime’s control. Such risks and uncertainties may cause results, performance, or achievements materially different from those expressed or implied by the forward-looking statements.

Doo Prime does not provide any representation or warranty on the reliability, accuracy, or completeness of such statements. Doo Prime is not obliged to provide or release any updates or revisions to any forward-looking statements.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure and Acknowledgement Notice to find out more.

Disclaimer

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, make no representation or warranties to the information displayed and shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided, and any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.