On 16th September 2022, FedEx warned that a global recession is looming, as the demand for shipment volumes around the world slumped. This is a consequence of a significantly worsening global economy.

To add, the warning has also triggered a broad sell-off in U.S. stocks. The Dow Transportation Index fell 5%, while shares of FedEx’s rival, UPS (UPS) closed about 5% lower.

The 21% single-day loss for FedEx shares easily tops their 16% plunge on the day of the 1987 stock market crash and a 15% drop during the stock sell-off in March 2020 in the early days of the pandemic. At length, the shares of FedEx are now down 38% so far this year.

Based on this, we can see that the market and investors’ behaviors are traceable to the U.S. recession fears.

Before we dwell deeper on how the markets and investors have been reacting to the looming recession. Let’s break down what exactly a recession is.

What Is Recession

Recessions are formally declared by the National Bureau of Economic Research (NBER). A recession is recognized when a significant economic downturn is spread across the economy and lasts more than a few months.

In other words, it is also when the gross domestic product (GDP) drops for two consecutive quarters.

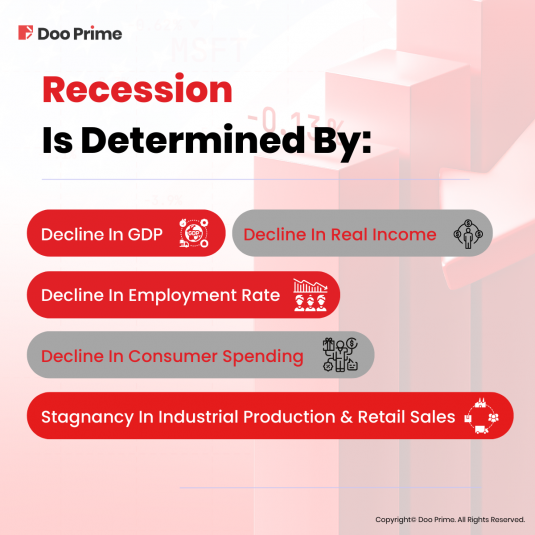

Of course, a recession is not determined just by the fall in GDP but also by the drop in real income, employment rate, and consumer spending alongside the stagnancy in industrial production and retail sales.

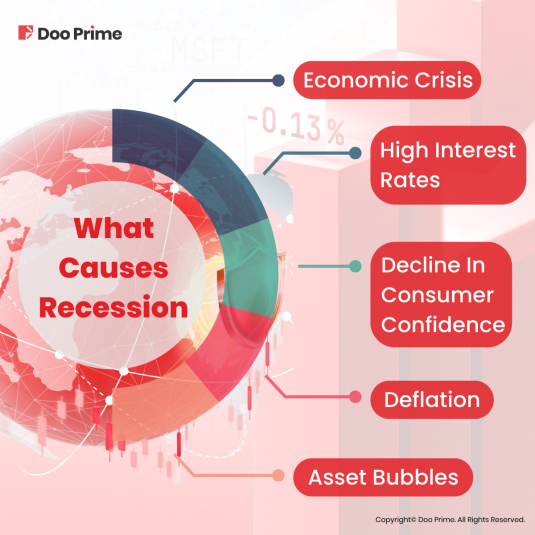

What Causes A Recession

In general, an economic growth and expansion rate cannot be long drawn out.

A significant decrease in economic activity is usually stimulated by intricate, and associated factors, including:

Economic Crisis

An unforeseeable occurrence that drives widespread economic interference, such as a natural disaster or a terrorist attack. A recent example would be the Covid-19 outbreak that has led to a transient recession.

Decline In Consumer Confidence

On the occasion that consumers are concerned about the health of the economy, they would eventually spend their money conservatively and save as much as they could.

This is because approximately 70% of the GDP pivots on consumer spending. Thus, when there is a decline in consumer spending, the economy can be slowed down dramatically as a whole.

High Interest Rates

Naturally, high interest rates lead to higher costs for loaning money from banks. By this, consumers will eventually spend less, particularly on great purchases like properties or cars.

Besides, companies will also lower their expenditure and business expansions as the capital required will be increased accordingly.

As discussed in our previous write-up – U.S. inflation surge and the Inflation Trade, we witnessed how the aggressive rate hikes imposed to curb the rapidly worsening economic trends have rattled anxious investors.

Deflation

Deflation is the opposite of inflation. Deflation is when the overall level of prices falls because of a large drop in demand.

As demand falls, so will prices as sellers try to attract buyers. In turn, consumers will take advantage of this downward trend, waiting for prices to drop. This in turn will further reduce demand.

As a result, this deterioration cuts down economic activities and decreases employment. With a continuation of these, the damage to the economy and unemployment will be greater.

Asset Bubbles

An asset bubble is a period when the prices of investments like tech stocks in the dot-com bubble or real estate bubble before the Great Recession rise rapidly, far beyond their fundamentals.

These inflated prices are pushed only by artificially inflated demand, which eventually disperse, and the bubble bursts.

During this time, the masses could go under, and confidence will crumple. Thus, consumers and companies will reduce their spending, leading the economy into recession.

How A Recession Could Affect Investors

After learning the definition of recession and the variations of what causes it, we will now look into how it could affect investors.

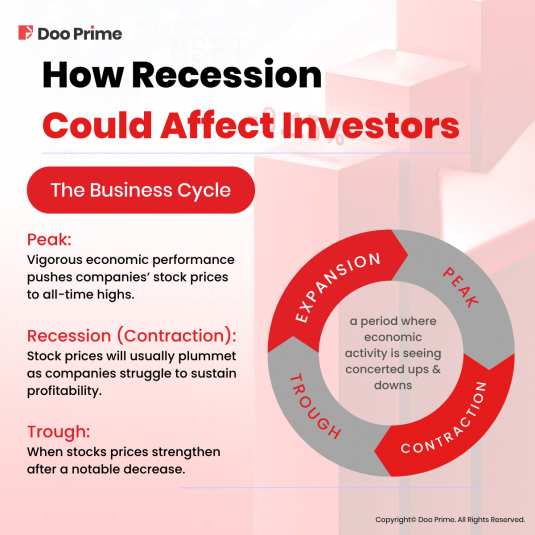

With an eye toward grasping the economy’s predicament and how recessions could affect investors, it boils down to the business cycle.

The Business Cycle

The business cycle implies a period where economic activity is seeing concerted ups and downs.

The business cycle comprises of four stages: expansion, peak, contraction (recession), and trough.

During the peak of the business cycle, the economy is blooming and developing. With this, the vigorous economic performance will be reflected in stocks prices and dividend payout, pushing companies’ stock prices to all-time highs.

However, when the business cycle is in the recession stage, the rate of incomes and employment will experience a decrease consequently. That said, stock prices will usually plummet as companies struggle to sustain profitability.

In due course, when stocks prices strengthen after a notable decrease, it indicates that the economy is headed to the trough stage.

How Investors React During Recession

Nonetheless, figuring out the business cycle may be unavailing provided that investors look into these windows and strengthen their portfolio returns.

Thus, when a recession is looming, it is instinctive that investors start to have concerns about possible declining stock prices and the effects on investment returns.

During this interval, what should an investor do? Well, there will be different reactions and methods depending on different classes of investors.

First and foremost, take into account that a bear market does not indicate that returns are impossible.

There are cases where investors could capitalize on falling markets by short selling stocks. Which is to say, investors are earning when share prices are dropping and losing when share prices are climbing.

In essence, losses from short selling are technically immeasurable given that there is no specific benchmark to what extent the stock’s value could go.

However, only experienced investors would practice this approach as it possess a high risk.

Meanwhile, some investors would see the recession as a lowered price marketplace.

During a recession, certain investors would employ value investing, where they would be on the lookout for falling share prices and buy them at a lower than usual price.

Investors using this strategy are practically making the most of the bear markets by buying premier company stocks at a lower price.

On the other hand, some investors do not react to the recession at all. This group of investors is the long-term investors, who buy-and-hold their positions in the market, as they are confident that this temporary volatility will do little to their investment.

What’s Next

Up until now, the U.S. GDP has declined at an annual rate of 1.6% in the first quarter, followed by 0.9% in the second quarter of 2022.

Based on this, the U.S. economy has met the traditional definition of a recession.

However, the jobs market has been showing signs of persistent strength, proving that this cycle is different from every other six-month period of negative GDP since 1947.

Ultimately, U.S. falling into a recession is yet to be official until the National Bureau of Economic Research declares it.

| About Doo Prime

Our Trading Instruments

Securities | Futures | Forex | Precious Metals | Commodities | Stock Indices

Doo Prime is an international pre-eminent online broker under Doo Group, which strives to provide professional investors with global CFD trading products in Securities, Futures, Forex, Precious Metals, Commodities, and Stock Indices. At present, Doo Prime is delivering the finest trading experience to more than 60,000 professional clients, with an average trading volume of more than USD51.223 billion each month.

Doo Prime entities respectively holds the relevant financial regulatory licenses in Seychelles, Mauritius, and Vanuatu with operation centers in Dallas, Sydney, Singapore, Hong Kong, Dubai, Kuala Lumpur, and other regions.

With robust financial technology infrastructure, well-established partnerships, and an experienced technical team, Doo Prime boasts a safe and secure trading environment, competitive trading costs, as well as deposit and withdrawal methods that support 10 different currencies. Doo Prime also incorporates 24/7 multilingual customer service and extremely fast trade execution via multiple industry-leading trading terminals such as MT4, MT5, TradingView, and InTrade, covering over 10,000 trading products.

Doo Prime’s vision and mission are to become a financial technology-focused broker, streamlining international global financial products investment.

For more information about Doo Prime, please contact us at:

Phone:

Europe : +44 11 3733 5199

Asia : +852 3704 4241

Asia – Singapore: +65 6011 1415

Asia – China : +86 400 8427 539

E-mail:

Technical Support: en.support@dooprime.com

Account Manager: en.sales@dooprime.com

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure and Acknowledgement Notice to find out more.

Disclaimer

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, make no representation or warranties to the information displayed and shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided, and any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.