The ongoing United Auto Workers (UAW) strike against major automakers, including General Motors, Ford, and Stellantis, has ignited a nationwide conversation about labor rights, wages, and the future of the automotive industry.

This strike, which began on September 15th, 2023, is sending shockwaves through the automotive industry, impacting major players like Ford, General Motors (GM), and Stellantis. However, its consequences extend beyond the auto giants, affecting the broader economy, stock markets, and investor sentiments.

In this analytical piece, we will delve into the intricate details of this strike and its profound economic ramifications.

Unleashing The UAW Strike: From Labor Contracts To Industry Challenge

The UAW strike is not just an isolated labour dispute but a complex challenge that confronts major players in the automotive industry. This strike, characterized as a “limited and targeted” work stoppage, initially started after the expiration of workers’ four-year contracts, encompassing General Motors and Stellantis. Ford managed to avoid immediate disruption due to progress in negotiations.

Economic Impact: Immediate Losses & Long-Term Ramifications

In this section, we delve into the immediate economic impact of the UAW strike and explore the potential long-term consequences that stretch beyond the automotive sector. The numbers and data reveal the financial complexity this strike poses.

Immediate Impact:

In the short term, the strike directly affects the automotive industry’s revenue. For instance, as of now, the strike has forced Ford, GM, and Stellantis to halt production at various facilities, leading to a production loss of approximately 20,000 vehicles per week collectively. When production lines are halted, it results in lost revenue due to unfulfilled orders and a decline in sales figures.

This can lead to layoffs among workers as manufacturers adjust their labor force to the reduced production needs. It also means that various suppliers, ranging from parts manufacturers to transportation services, experience disruptions in their revenue streams, causing a ripple effect of financial strain across the entire automotive ecosystem.

Potential Consequences:

The potential consequences of the strike have far-reaching implications for the broader economy, with one crucial factor being its impact on the Gross Domestic Product (GDP).

The automotive industry, which constitutes approximately 3% of the U.S. economy’s gross domestic product – encompassing its total production of goods and services, holds a pivotal role in this scenario.

Notably, the Detroit automakers command about half of the entire U.S. car market. This signifies that the consequences of the strike extend beyond the automotive sector, affecting a significant portion of the U.S. economy.

Although the immediate impact on GDP might appear relatively modest, some estimates suggest that it could potentially reduce U.S. GDP growth in the fourth-quarter by 0.2%. However, the overall economic landscape could face more substantial challenges if the strike persists.

As the U.S. is already grappling with inflation and supply chain disruptions, an extended strike could exacerbate these issues. It could increase inflationary pressures, which would lead to higher consumer prices, thereby reducing purchasing power and potentially curtailing consumer spending. This could ripple into other industries beyond automotive, challenging the Federal Reserve’s efforts to maintain economic stability.

Moreover, the strike’s economic implications also relate to workers’ demands. The UAW is seeking better wages, job security, and increased investments in U.S. manufacturing. While meeting these demands may improve the overall economic well-being of workers, it could also lead to higher production costs for automakers.

Some estimates indicate that a 1% increase in labour costs can translate into a 0.2% increase in vehicle prices. This could impact not only the automotive industry but also consumer choices and spending habits, potentially reducing vehicle sales further.

Stocks In Turbulence: How The Market React

The impact of the UAW strike on stock prices goes beyond the immediate decline in market value; it signifies a broader environment of investor anxiety, industry volatility, and supply chain disruptions.

Investor Sentiments:

Stock prices are often a reflection of investor sentiments and market confidence. Following the strike’s onset, Ford, GM, and Stellantis stocks saw an initial decline of approximately 5-7%. Investors are concerned about several factors:

Earnings Uncertainty:

The strike introduces uncertainty regarding automakers’ future earnings. For example, Ford announced that the strike’s impact reduced its earnings by about $2 billion for the third quarter of the year.

Investors value predictability, and when a strike disrupts production and sales, it becomes challenging to forecast financial performance accurately. This uncertainty often leads to stock price declines.

Supply Chain Risks:

The strike’s ripple effect on the supply chain creates risks for automakers and their suppliers. Disruptions in the timely delivery of parts can lead to production halts, reducing revenue. This added layer of complexity further deters investors who fear additional logistical challenges.

Duration Of The Strike:

The longer the strike persists, the more pronounced the effects on stock prices. A protracted strike could result in extended financial losses, dragging stock prices down further.

Industry Volatility:

The UAW strike is injecting turbulence into the industry. Stock prices for Ford, GM, and Stellantis oscillate in response to each twist and turn in the strike’s progress.

Each negotiation or news regarding the strike’s duration creates fluctuation. This volatility underscores the strike’s significance in the industry and its direct link to stock performance.

Implications For EV Supplier Stocks

This year has been a mixed bag for EV supplier stocks. They have managed to post a modest 4% year-to-date gain, but this pales in comparison to the S&P 500’s robust 17% increase over the same period. This comes after a challenging 2022 when these stocks endured a 21% decline.

Despite these ups and downs, the macro-environment has been relatively favorable for technology and futuristic stocks, with inflation cooling and the Federal Reserve easing its interest rate hike plans.

UAW Strike: A Setback For The Industry

However, the recent UAW strike has cast a shadow over the automotive industry. This strike marks the first time workers at all three major Detroit auto companies—Ford, General Motors, and Stellantis—have simultaneously gone on strike. The immediate consequence is a disruption in automotive production, affecting not only the companies involved but also the broader ecosystem.

EV Price Wars

In addition to the strike, price cuts in the EV space by industry giant Tesla have ignited a price war, particularly in the substantial Chinese EV market. This competitive pricing could be impacting supplier stocks, as lower selling prices may necessitate more stringent component cost management by original equipment manufacturers (OEMs).

Long-Term Outlook For EV Supplier Stocks

Despite these short-term challenges, the long-term outlook for EV supplier stocks remains promising. Counterpoint research forecasts global EV sales to reach 17 million units in 2023.

Furthermore, it is conceivable that the passenger vehicle market will transition predominantly to EVs in the coming decades, creating substantial room for expansion for EV suppliers.

Tesla’s Response To The Strike

Tesla, the EV industry leader, has not been immune to the UAW strike’s influence. Despite analysts’ predictions that Tesla, with its non-union workforce, should benefit from labour troubles at other automakers, the company’s stock has faced recent declines, losing 3.8%. This has occurred despite its production capabilities and leading market-share position.

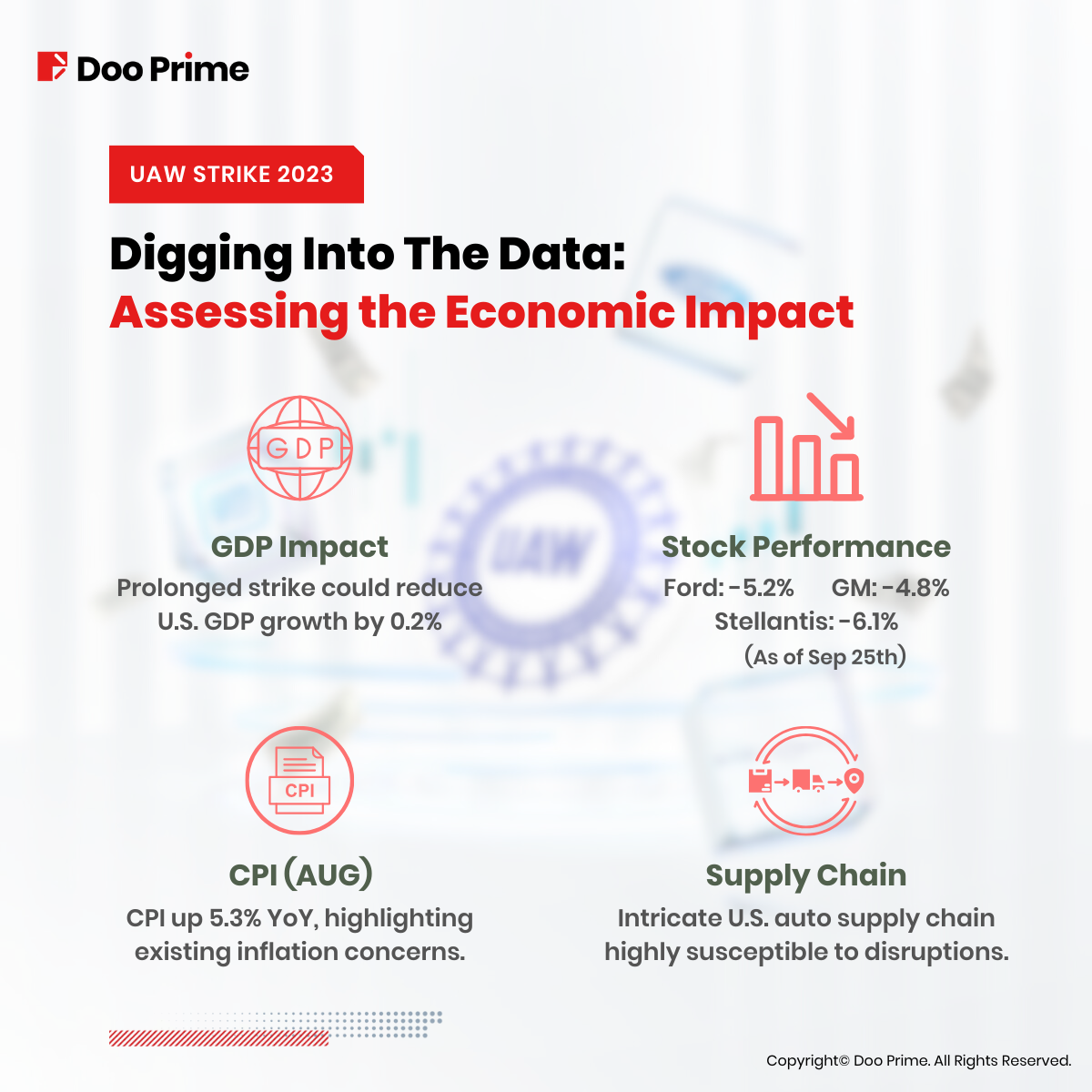

Digging Into The Data: Assessing The Economic Impact

To better comprehend the potential economic consequences, let’s delve into the numbers:

GDP Impact:

The UAW strike, if prolonged, could potentially reduce U.S. GDP growth in the fourth-quarter by 0.2%. The economy, already battling inflationary pressures, would find it challenging to maintain stability in the face of such a setback.

Stock Performance:

As of September 25th, Ford, GM, and Stellantis have experienced notable stock price declines, illustrating the financial unease generated by the strike. Ford’s stock price (F) dropped by 5.2%, GM’s (GM) by 4.8%, and Stellantis (STLA) by 6.1%.

Consumer Price Index (CPI):

The CPI’s year-on-year increase of 5.3% in August highlights existing inflation concerns, and an extended strike could further intensify these pressures.

Supply Chain Complexity:

The U.S. auto industry’s intricate supply chain is highly susceptible to disruptions, and the strike’s ripple effect could impact various sectors beyond automotive manufacturing.

By incorporating these numbers, we gain a more profound understanding of the potential economic and financial consequences of the UAW strike.

The Road Ahead

The UAW strike, spanning Ford, GM, and Stellantis, has indeed thrown the automotive industry into a state of upheaval. While its immediate economic impact has been relatively contained, the potential for escalation and supply chain disruptions cannot be underestimated.

The industry, investors, policymakers, and consumers are closely monitoring how negotiations unfold and how the strike influences the future of automotive manufacturing in the United States and beyond. This strike underscores the delicate equilibrium between labor and management, and its resolution will be pivotal in shaping the future of automotive production.

| About Doo Prime

Our Trading Products

Securities | Futures | Forex | Precious Metals | Commodities | Stock Indices

Doo Prime, an international preeminent online broker under Doo Group, strives to provide professional investors with global CFD trading products in Securities, Futures, Forex, Precious Metals, Commodities, and Stock Indices. At present, Doo Prime is delivering the finest trading experience to more than 130,000 clients, with an average trading volume of more than USD 51.223 billion each month.

Doo Prime entities respectively holds the relevant financial regulatory licenses in Seychelles, Mauritius, and Vanuatu with operation centers in Dallas, Sydney, Singapore, Hong Kong, Dubai, Kuala Lumpur, and other regions.

With robust financial technology infrastructure, well-established partnerships, and an experienced technical team, Doo Prime boasts a safe and secure trading environment, competitive trading costs, as well as deposit and withdrawal methods that support 20+ different currencies. Doo Prime also incorporates 24/7 multilingual customer service and extremely fast trade execution via multiple industry-leading trading terminals such as MT4, MT5, TradingView, and Doo Prime InTrade, covering over 10,000 trading products.

Doo Prime’s vision and mission are to become a financial technology-focused broker, streamlining international global financial products investment.

For more information about Doo Prime, please contact us at:

Phone:

Europe: +44 11 3733 5199

Asia: +852 3704 4241

Asia – Singapore: +65 6011 1415

Asia – China: +86 400 8427 539

E-mail:

Technical Support: en.support@dooprime.com

Account Manager: en.sales@dooprime.com

Forward-looking Statements

This article contains “forward-looking statements” and may be identified by the use of forward-looking terminology such as “anticipate”, “believe”, “continue”, “could”, “estimate”, “expect”, “hope”, “intend”, “may”, “might”, “plan”, “potential”, “predict”, “should”, or “will”, or other variations thereon or comparable terminology. However, the absence of such terminology does not mean that a statement is not forward-looking. In particular, statements about the expectations, beliefs, plans, objectives, assumptions, future events, or future performance of Doo Prime will be generally assumed as forward-looking statements.

Doo Prime has provided these forward-looking statements based on all current information available to Doo Prime and Doo Prime’s current expectations, assumptions, estimates, and projections. While Doo Prime believes these expectations, assumptions, estimations, and projections are reasonable, these forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond Doo Prime’s control. Such risks and uncertainties may cause results, performance, or achievements materially different from those expressed or implied by the forward-looking statements.

Doo Prime does not provide any representation or warranty on the reliability, accuracy, or completeness of such statements. Doo Prime is not obliged to provide or release any updates or revisions to any forward-looking statements.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment, and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please ensure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure and Acknowledgement Notice to learn more.

Disclaimer

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, make no representation or warranties to the information displayed and shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided, and any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.