VIX spikes to levels not seen since the COVID recession, causing the S&P 500 to pull back 10% and renew recession fears. So, what’s behind this sudden wave of panic? Are we headed for a full-blown economic meltdown, or is this just a temporary blip in an otherwise resilient market?

The Perfect Storm: Rising Unemployment and Geopolitical Tensions

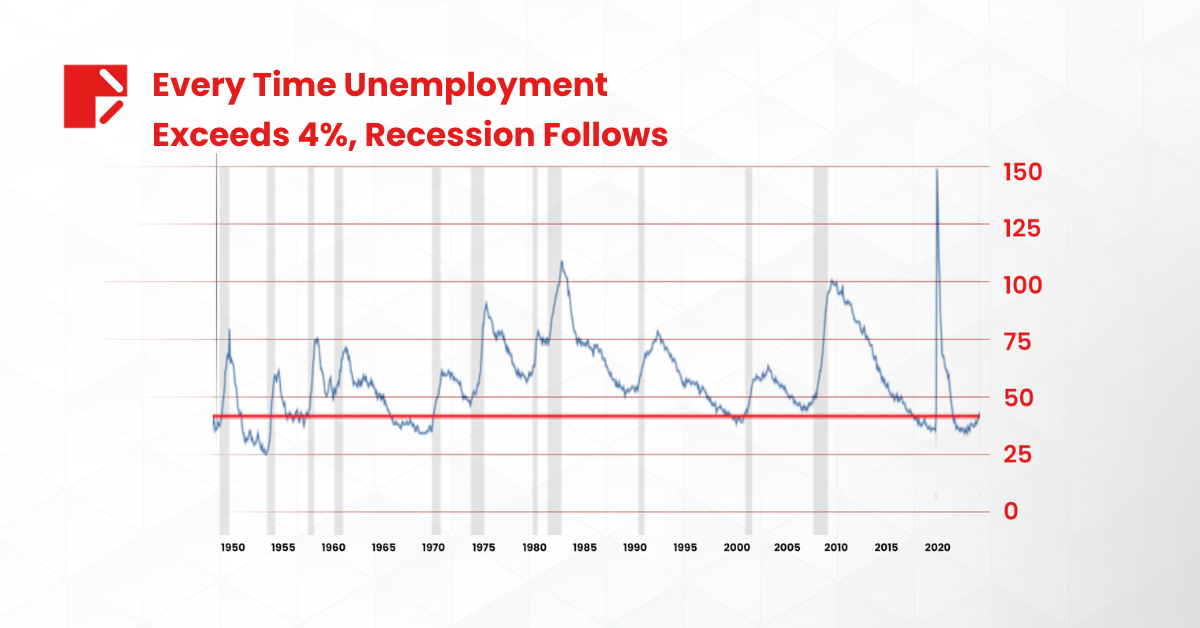

Two major events coincided to create this perfect storm of uncertainty. First up, unemployment rate in the U.S. increased to 4.3% from 3.8% in March. While that might not seem like a big deal at first glance, historically, over the last 75 years, every time unemployment rose for 4 consecutive months, it’s often a sign that a recession could be on the horizon. If this trend continues, we might be in for more than just a rough patch.

Image Source: FRED

But it’s not just the domestic scene that’s got everyone spooked. The geopolitical chessboard is heating up too, particularly in the Middle East. The escalating tensions between Iran and Israel have many experts worried about a potential regional conflict. The Middle East has always been a volatile region, and any flare-up there tends to send ripples through global markets. This uncertainty is adding fuel to the fire, causing investors to get worried and triggering that VIX spike.

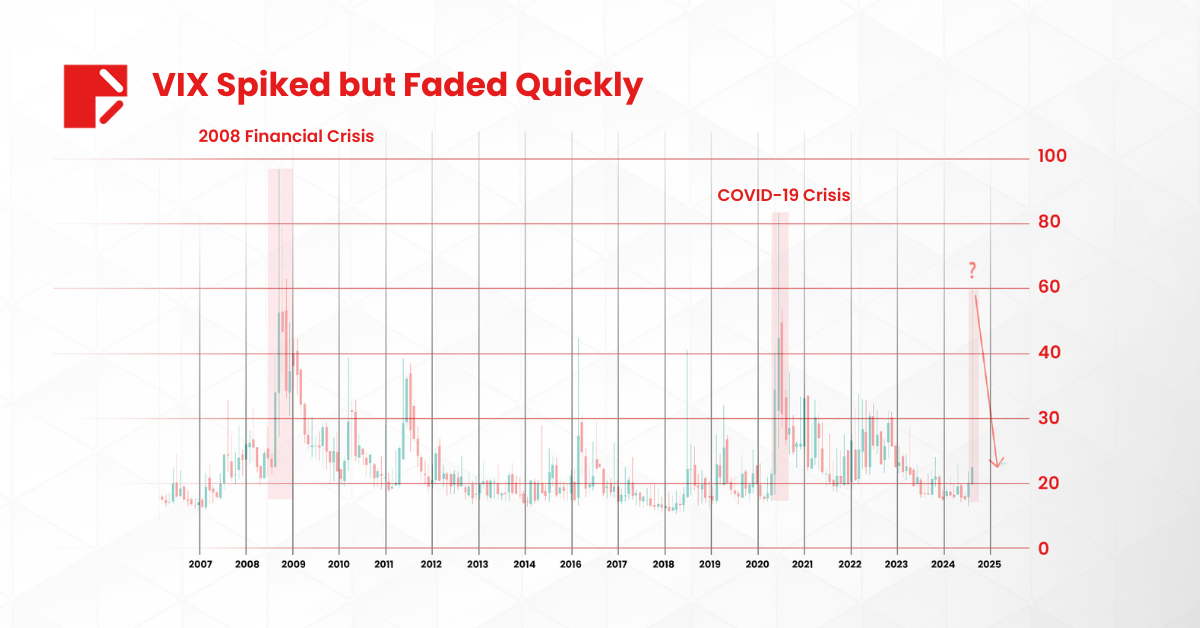

VIX Spikes: Echoes of 1929

With the VIX spiking and economic indicators flashing warning signs, some experts are finding similarities between today’s situation and the Great Depression of 1929. The idea is that we could be on the brink of an unforeseen, catastrophic financial event that would send the global economy into a meltdown. But let’s not get too ahead of ourselves—while the comparison is chilling, it’s essential to take a step back and look at the bigger picture.

The VIX chart below highlights my point: despite a significant spike, the VIX has quickly faded this time, unlike during the 2008 financial crisis and COVID.

Image Source: Trading View

Two Indicators Showing the Pullback Could Be Short-Lived

Despite the rising fears, not all the signs are pointing towards doom and gloom. In fact, there are a couple of indicators suggesting that this market pullback might be more of a temporary blip than a long-term trend.

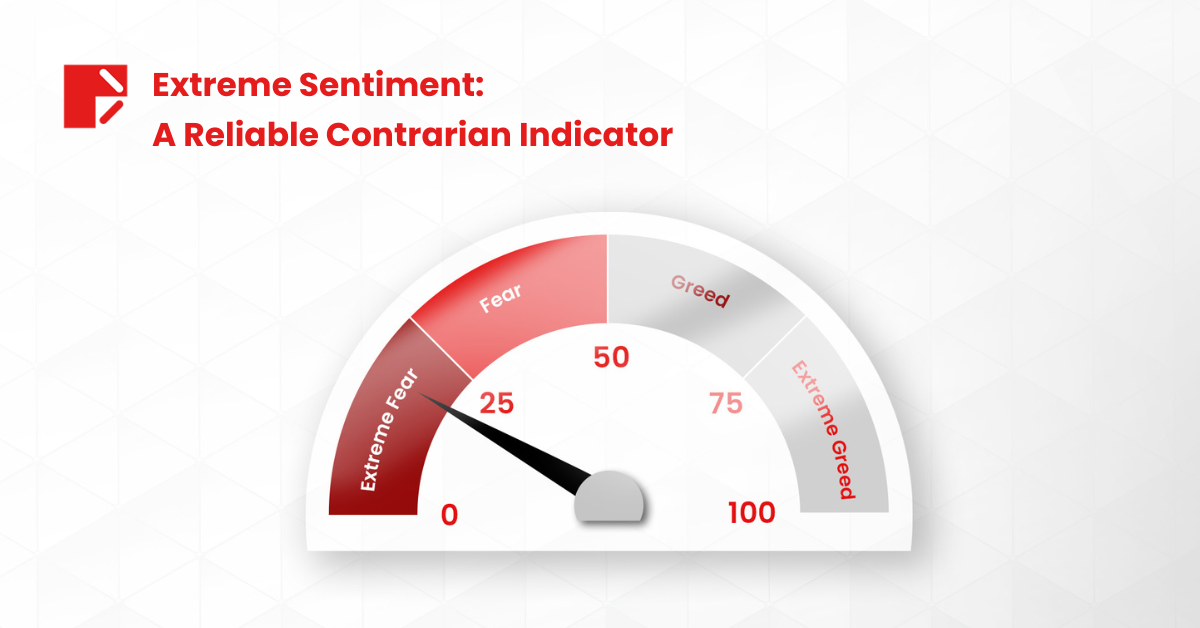

- Fear and Greed Index: This index is a sentiment indicator that shows whether investors are becoming too fearful or too greedy. Right now, it’s deep in the extreme fear territory, which might sound alarming. But here’s the twist—this extreme fear is often a contrarian indicator. When everyone is running for the exits, it might be the time to stay put or even potentially to buy in. Historically, extreme fear has often signaled that a market bottom could be near.

Image Source: CNN Business

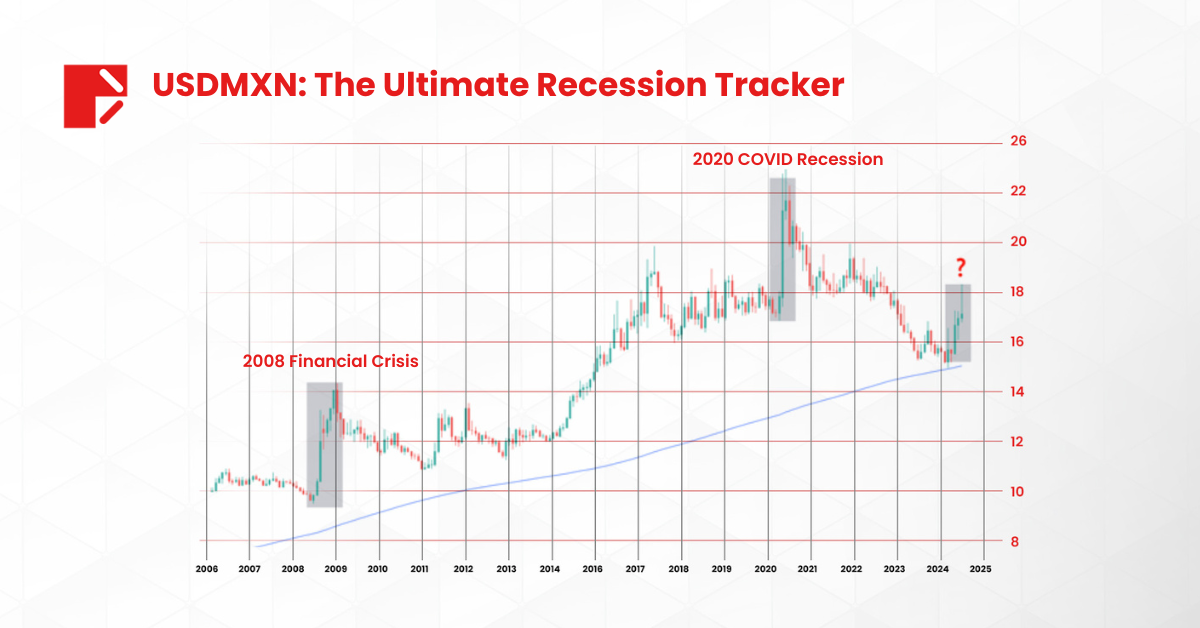

2. The US Dollar Index (DXY): Typically, when we’re on the brink of a recession, the US dollar shoots through the roof. Investors go to the dollar as a safe haven, driving up its value. But that’s not happening right now. The DXY isn’t showing the kind of strength you’d expect if we were really heading into a deep recession.

Interestingly, there’s also a ‘secret’ currency pair that some traders keep an eye on: the USDMXN. In both 2020 and 2008, the USD exploded against the MXN just as the global economy was heading into a recession.

This divergence between the fear in the stock market and the relative calm in the dollar market is a curious signal that perhaps the fears are a bit exaggerated.

Image Source: Trading View

The Big Picture: Economic Cycles and the Path Ahead

While the current situation has more than a few people biting their nails, it’s crucial to remember that the economy operates in cycles. We’ve had recessions before, and while they’re never fun, they’re also not the end of the world. The key is to keep a close eye on the indicators and be prepared for what might come next.

It’s also worth noting that the VIX is a measure of volatility, not necessarily a predictor of doom. Yes, it’s spiked, but that could just mean that the market is adjusting to new information, not that it’s about to collapse.

So, while it’s wise to stay cautious and keep an eye on unemployment and geopolitical developments, it’s also essential not to let fear take the driver’s seat. After all, as they say, markets are driven by two emotions: fear and greed. And if history is any guide, the best opportunities often come when fear is at its highest.

VIX Spikes but Fear Factor Remains Low

The recent spike in the VIX and the accompanying recession fears are certainly cause for concern, but they’re not necessarily a sign that the sky is falling. While there are legitimate risks—rising unemployment and Middle East tensions—there are also indicators that suggest this pullback could be short-lived. As always, staying informed and keeping a level head are the best strategies in navigating these choppy market conditions. So, maybe hold off on building that doomsday bunker, at least for now.

Risk Disclosure:

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer:

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.