The final quarter of the year witnessed a financial showdown among tech giants, including Alphabet (GOOG, GOOGL), Amazon (AMZN), Apple (AAPL), Meta Platforms (META), Microsoft (MSFT), and the impending report from Nvidia (NVDA).

As investors brace for the impact of these Q4 earnings, this article breaks down critical developments and metrics to guide strategic decision-making in the ever-evolving tech landscape.

From Microsoft and Alphabet’s mixed market response to Amazon and Apple’s triumphs, we delve into the key takeaways that investors need to navigate the intricate terrain of Q4 Big Tech earnings.

Microsoft’s AI Boost And Market Reaction

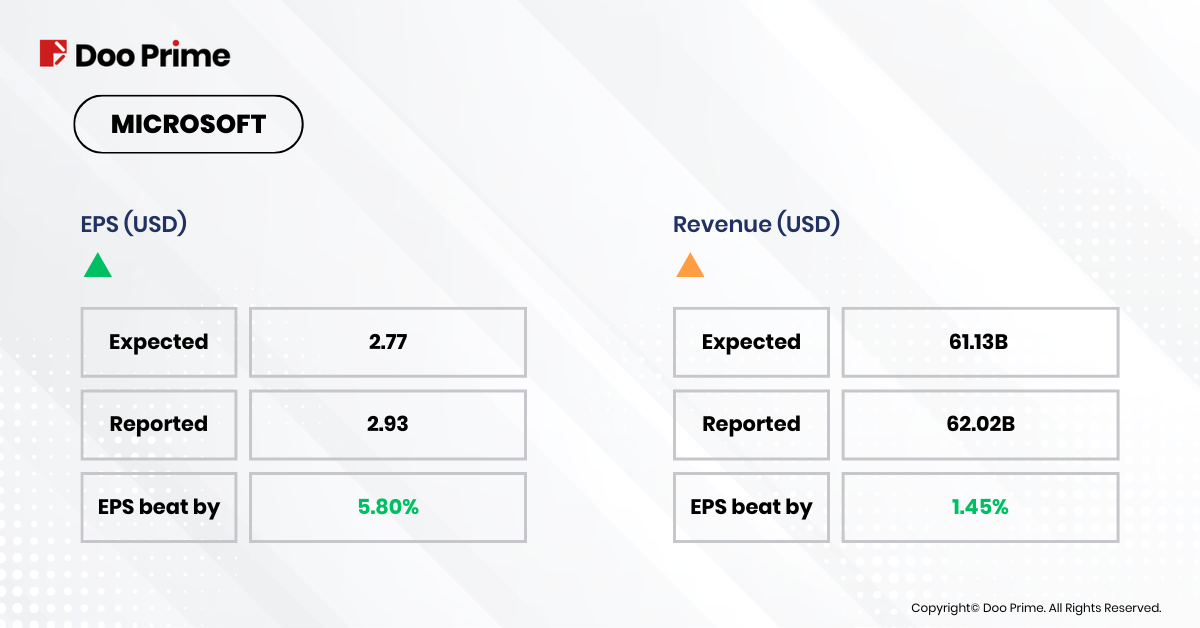

Microsoft’s Q4 2023 results showed an impressive 18% revenue growth and a remarkable 33% jump in earnings per share (EPS). This success was mainly due to the significant growth of its cloud product, Azure, with a 30% surge. The integration of artificial intelligence (AI) also doubled, emphasizing the company’s commitment to futuristic technologies.

Despite outperforming expectations on both revenue and EPS fronts, Microsoft faced a subdued market response. Shares dipped by over 1%, leading to a drop in the company’s market capitalization below $3 trillion. Despite concerns about a lower Q3 revenue forecast, Microsoft stays strong in the cloud business with a focus on AI advancements.

Alphabet’s Challenges Despite Overall Growth

Alphabet reported a mixed bag of results in Q4 2023. While the company beat EPS estimates by 2%, its advertising revenue fell short, leading to a more than 6% drop in share prices. Despite setbacks, Alphabet showed an impressive 14% YoY sales growth, and its cloud business had positive growth.

The discrepancy between performance in the core advertising engine and the flourishing cloud business raises concerns. Investors are closely monitoring Alphabet’s ability to navigate challenges in the advertising segment while capitalizing on the growth potential in other areas.

Positive Outlook For Amazon And Apple

In contrast, Amazon’s Q4 2023 earnings resonated positively with investors. The e-commerce giant surpassed estimates on both revenue and EPS fronts. Amazon Web Services (AWS), its cloud computing arm, continued to drive growth, and advertising revenue exceeded expectations. Consequently, the positive earnings report translated into a rise in stock prices.

Apple’s Q1 2024 earnings demonstrated resilience and strength, beating analyst expectations for both revenue and EPS. Despite a slight miss in iPhone sales, the company’s Services revenue reached an all-time high, signaling a shift toward recurring income. With a record number of active devices, Apple remains a robust player in the tech landscape.

Meta’s Impressive Performance And Investor Enthusiasm

Meta Platforms surpassed expectations in Q4 2023, leading to a remarkable 20% surge in stock prices. Both revenue and EPS exceeded analyst estimates, with revenue growing by 25% year-over-year. The company announced its first-ever quarterly dividend and a substantial $50 billion stock buyback, adding to investor excitement. While continued investment in the metaverse is evident, concerns linger about its profitability.

Post-Earnings Analysis: Magnificent Seven’s Dominance Reinforced

The latest earnings reports from Microsoft (MSFT), Meta Platforms (META), and Amazon (AMZN) have once again solidified their dominant positions in the market. These giants, along with their peers in the ‘Magnificent 7’ group – Apple, Alphabet, Tesla, and Nvidia – continue to lead the market.

While Tesla faced disappointment, the other Mag 7 members showed remarkable growth in Q4 reports. Alphabet and Apple, despite not impressing the market greatly, achieved Q4 earnings growth rates of +51.8% and +13.1%, respectively.

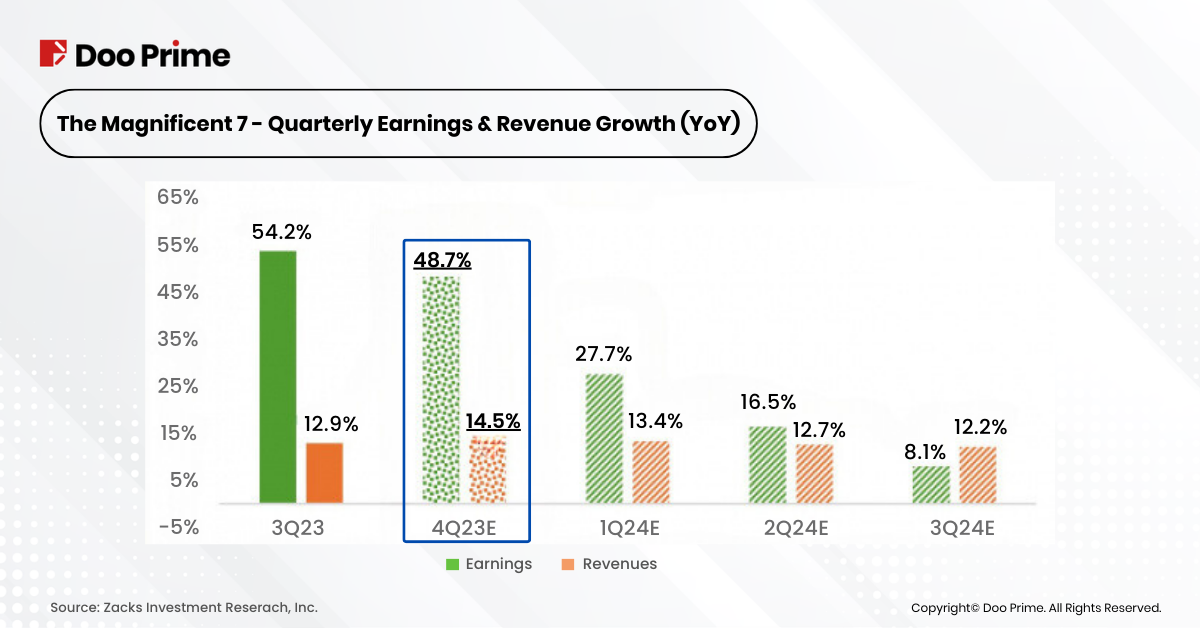

Considering estimates for Nvidia, set to release its December-quarter results on February 21st, and the actual results for the other six members of the group, the collective Q4 earnings for the Mag 7 are anticipated to rise by +48.7% compared to the same period last year, with revenues up by +14.5%.

The chart below shows the group’s Q4 earnings and revenue growth compared to the previous and expected quarters.

Mag 7 companies make up 28.6% of the S&P 500 index’s total market capitalization, contributing 19.5% to the index’s total earnings in 2024. In the Q4 of 2023, the Mag 7 group held a more significant weightage, accounting for 23.1% of all S&P 500 earnings.

With their substantial earnings power and robust growth profiles, the Mag 7’s market leadership remains unchallenged. Notably, Analysts had been revising estimates for the group even before December-quarter results, contributing to positive momentum.

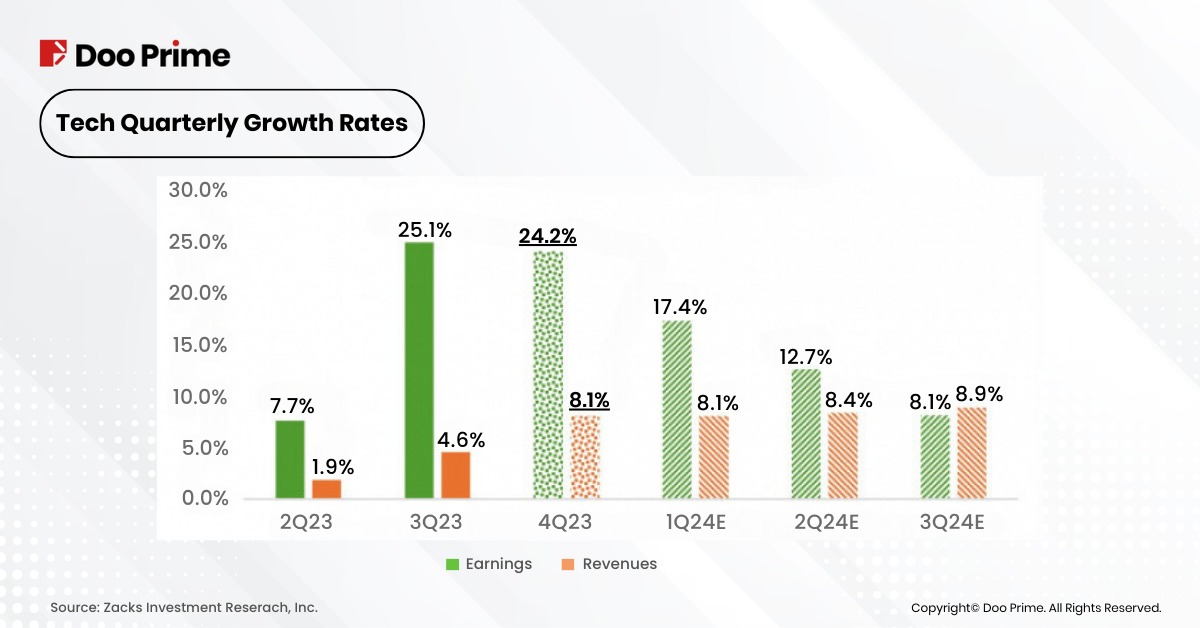

Beyond these big players, the tech sector as a whole is expected to see a Q4 earnings increase of +24.2% from the same period last year, with a +8.1% rise in revenues.

The chart illustrates the sector’s Q4 earnings and revenue growth expectations, providing context for recent quarters and future projections.

Navigating Earnings Surprises And Market Shifts

In the wake of recent earnings reports, Microsoft outperformed expectations, particularly in the lucrative cloud unit Azure, which surged by 30% compared to the previous year when OpenAI had yet to shape our landscape. This overshadowed Google’s cloud business, which, though still strong, only grew by 24% year-over-year.

However, the positivity for Microsoft took a hit in after-hours trading as stocks dipped up to 2%, driven by a cautious quarterly outlook. In the current high-valuation environment, anything short of extraordinary seems to be perceived as weak. This sentiment extended to the market, with Google and AMD experiencing nearly 6% declines after falling short of expectations.

The question looms: Are we witnessing the initial signs of profit-taking and a broader market correction? The S&P 500 has been scaling new heights this January, propelled largely by the Big Tech rally. Nvidia, emblematic of the AI surge, soared by almost 35% in the first month of the year, setting a fresh record.

Even though market conditions leaned towards overbought and valuations stretched, investors poured in. Yet, the stumble in earnings could potentially trigger awaited profit-taking across U.S. tech stocks. Even a gentle stance from the Federal Reserve might struggle to reassure investors if this correction unfolds.

Despite last year’s interest rate hikes, technology stocks, usually influenced by Federal Reserve rates, remained resilient. The dominance of AI in the market may overshadow economic developments, leading to profit-taking despite potential financial improvements.

As we navigate this juncture, it’s clear that AI’s allure is not immune to market dynamics, and caution is key in the days ahead.