Gold has long been held as a safe haven in the tempestuous waters of the global economy, and recent trends suggest that its allure is only growing stronger.

But what exactly is pushing this precious metal to record peaks? This article examines the key drivers behind gold’s dominance to new record highs.

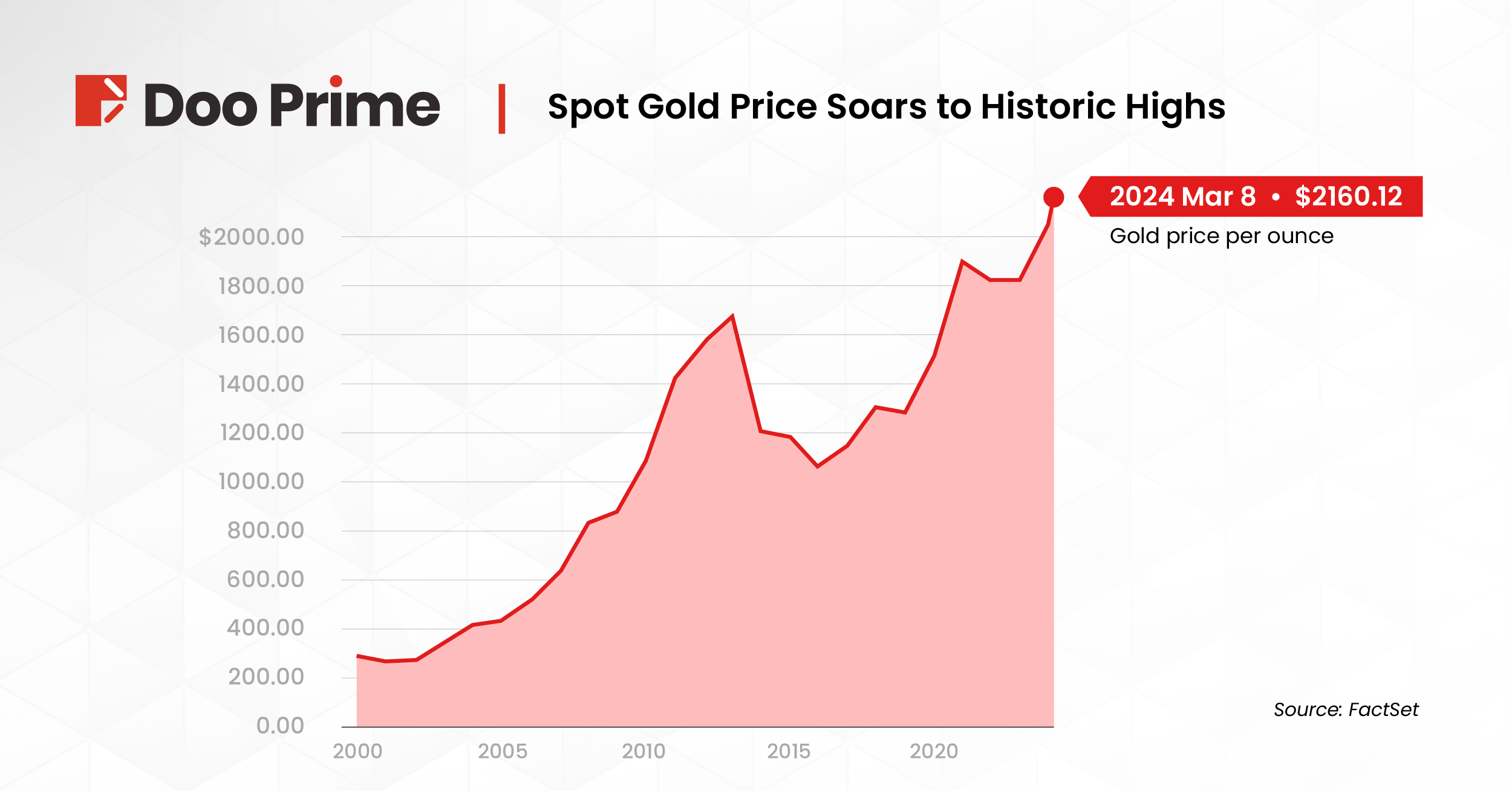

Surge In Gold Prices

Spot gold experienced a noteworthy surge, reaching $2,156.55 and even peaking at an all-time high of $2,161.09 in a single session.

U.S. gold futures also climbed, reflecting a growing trend that isn’t just confined to American markets—Dubai gold prices went up, too, with hikes in both 24-carat and 22-carat gold per gram.

Why Is Gold’s Price Going Up?

The surge can be attributed to a combination of macroeconomic factors:

- Weak U.S Economic Data

Recent statistics indicate a potential softening in economic prowess. The U.S. Federal Reserve’s indications of potential rate cuts in the coming months signal a lack of confidence in the economy, boosting gold’s appeal as a safe haven asset.

- Powell’s Indication for Potential Rate Cuts

The Federal Reserve Chair’s openness to reducing interest rates has been a positive signal for gold investors. Lower interest rates make gold more attractive to investors as it doesn’t produce a yield.

- Inflation Concerns

With central banks around the world printing more money in an effort to stimulate their economies, there are growing concerns about inflation. Gold has long been seen as a hedge against inflation and this sentiment is reflected in its recent surge.

- Futures Buying

A significant chunk of the price movement was possibly due to considerable buying in the futures market. The continuous uncertainty in the market has led investors to seek refuge in gold futures as a hedge against potential losses.

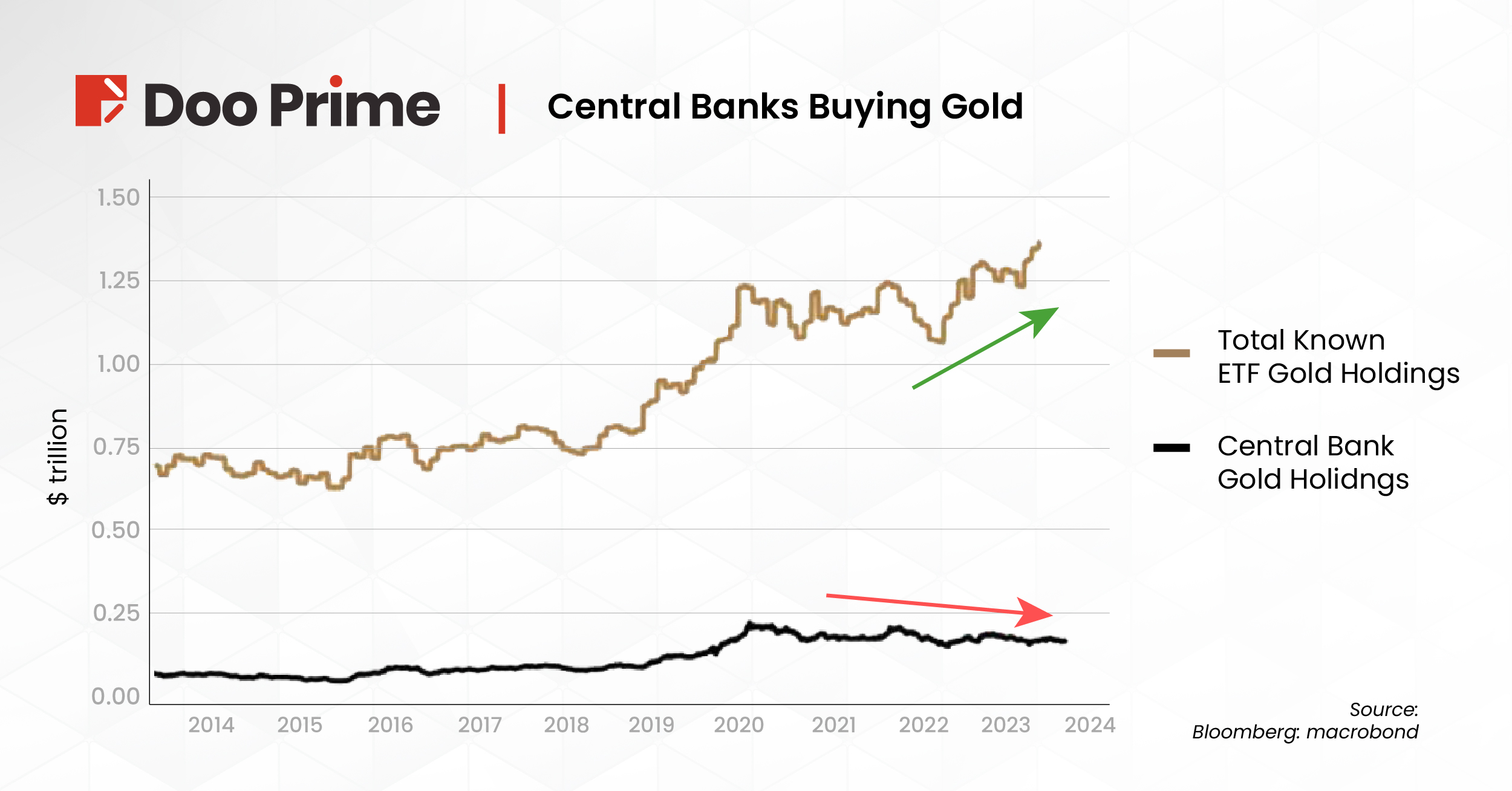

- Central Bank Purchases

Central banks around the world have been increasing their gold reserves, with purchases reaching their highest levels in three years. This indicates a strong belief in the long-term value of gold and its role as a reserve asset.

- Geopolitical Tensions

Uncertainty surrounding global trade agreements and political instability in various regions have also contributed to the spike in gold prices. With no clear resolutions in sight, investors are turning to gold as a safe haven asset.

Market Outlook

Experts predict a promising future for gold, with targets pegging around $2,300 in the near term. However, they also caution that after such spikes, price corrections are standard, and some consolidation is likely.

Central bank purchases are anticipated to continue as insurance against geopolitical uncertainties, and the sluggishness of China’s economy could further prevent global growth, reinforcing gold’s status as a safe investment for financial institutions.

Broader Market Trends

While gold shines, other precious metals exhibit more varied performance, with silver witnessing gains and platinum and palladium experiencing minor losses. These movements emphasize the interconnected and sometimes unpredictable nature of market responses to broader economic conditions and central bank activities.

Gold’s Resilience

Even as U.S. stock markets thrive and the S&P 500 surges, gold’s value has also been rising. This is particularly noteworthy since gold typically thrives in risk-averse climates and not alongside booming stock markets.

One explanation is the disparity between the economic growth of the U.S. and that of other significant economies like Germany, Japan, and the UK, with the latter experiencing underwhelming growth and stock market performance.

Driving Demand Beyond the West

Interestingly, the primary support for the price increment appears not to come from Western investors but from China. Fears surrounding China’s economic stability, especially considering its real-estate woes, have persuaded investors there to hedge with gold.

Within the U.S., gold’s appeal may be linked to concerns over inflation, portfolio diversification post-stock rallies, and international tensions that outcome from geopolitical strife.

The Future of Gold Prices

With the current macroeconomic climate and ongoing tension in global affairs, many analysts predict gold prices to remain steady or even continue to rise. While factors such as interest rate cuts and geopolitical tensions may cause fluctuations, the overall trend seems to be towards a sustained increase in gold demand.

As central banks continue to stockpile gold reserves and investors seek safe-haven assets to hedge against economic downturns, the future looks bright for gold. Additionally, technological advancements have made it easier and more accessible for investors of all levels to add some exposure to gold in their portfolios.

With its long-standing reputation as a store of value and proven track record of weathering market turmoil, gold remains a valuable addition to any well-diversified investment portfolio. As the saying goes, “in times of crisis, gold shines brightest”, and this sentiment is likely to hold true for years to come.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and the client should therefore be prepared to suffer significant losses when using such trading facilities.

Please ensure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure Statement to learn more.