In recent economic discussions, the term “stagflation” has resurfaced, sparking debates about its potential resurgence lately. While GDP reports and data show signs, economists remain divided on the possibility. Let’s take a closer look at what stagflation entails, its historical context, and what it could mean for today’s economy and financial markets.

What is Stagflation?

Stagflation describes an economic phenomenon characterized by sluggish growth, high unemployment, and accompanied with inflation.

The term “Stagflation” is a portmanteau of “stagnation” and “inflation,” encapsulating the challenging economic scenario it represents.

Stagnation: Economic growth is sluggish, businesses operate below capacity, and unemployment rates rise, leading to reduced consumer spending.

Inflation: Prices of goods and services rise, making the cost of living more expensive or even unaffordable for some.

The Challenge of Stagflation

This combination of slow growth and high inflation creates a unique challenge for policymakers. Normally, policies to address one issue can worsen the other. For example, stimulating the economy to fight slow growth might increase inflation. Conversely, raising interest rates to fight inflation could slow growth further.

Notably, stagflation defies conventional economic models, such as the Phillips curve, which correlates reduced unemployment with increasing wages in an economy. According to the classic theory, when inflation is high, unemployment is supposed to be low, and vice versa. This suggests an inverse relationship between inflation and unemployment, making it easier for central banks to manage things by adjusting interest rates.

However, stagflation defies this logic. It presents a situation where both inflation and unemployment are high, creating a paradox. This forces central bankers and policymakers to devise new and creative solutions to address the problem.

The Origins of Stagflation

The term “stagflation” was first coined by British politician Iain Norman Macleod during a speech before the House of Commons in 1965. Amid economic stress in the United Kingdom, Macleod referred to the combined effects of inflation and stagnation as a “‘stagflation situation.” This seminal moment marked the inception of stagflation as a recognized economic phenomenon.

“We now have the worst of both worlds —not just inflation on the one side or stagnation on the other, but both of them together. We have a sort of “stagflation” situation.”

(U.K. Parliament, 1965)

Once thought by economists to be impossible, stagflation has occurred repeatedly in the developed world since the 1970s oil crisis.

Historical Precedents

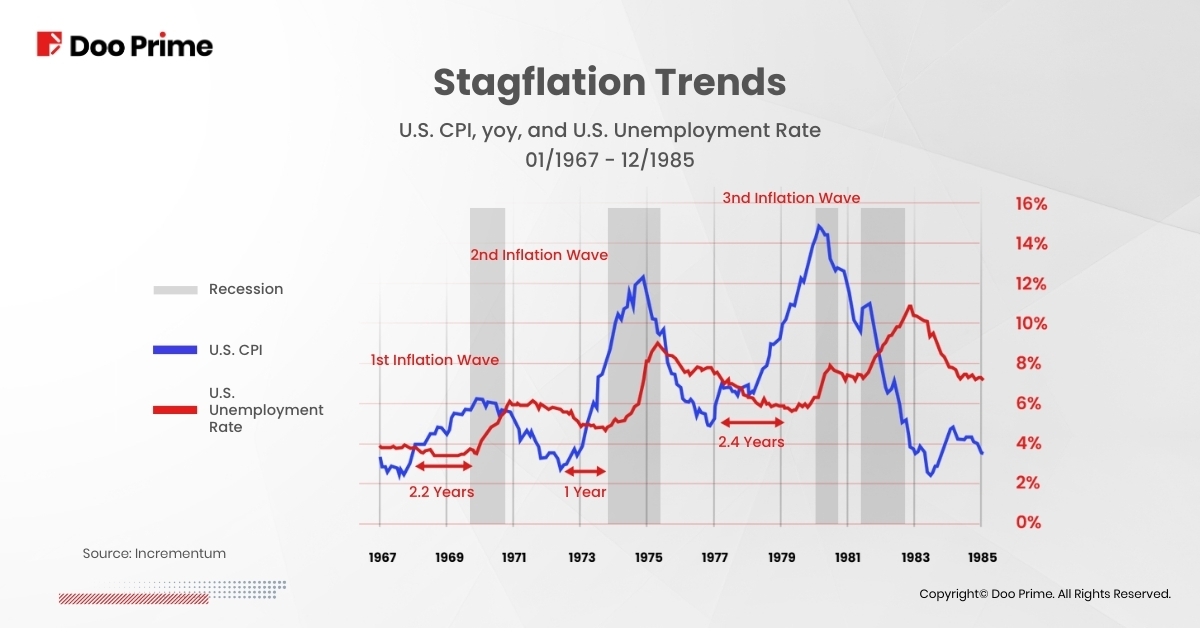

Let’s look back at historical stagflationary periods, such as the Stagflation during the 1970s. This period offers a prime example of stagflation, characterized by three discernible “waves,”, each with its own characteristics. Analyzing these historical waves can offer valuable insights, as shown in the following graph.

As the graph illustrates, stagflation unfolded in inflationary waves during the 1970s. We observe inflation rates climbing higher with each successive wave, accompanied by a concerning upward trend in unemployment rates over the years. Interestingly, the graph suggests variations in the duration of these waves. The first wave spans approximately 2.2 years, while the second wave condenses into a shorter period of roughly 1 year. In contrast, the third wave stretches out to 2.4 years.

Are we on the Verge of Stagflation in 2024?

Analyzing the inflation waves and the U.S. Consumer Price Index (CPI), we find ourselves currently nearing the conclusion of the first wave of stagflation. This signals a critical juncture, with mounting concerns about the potential onset of a second wave.

Currently, the economic climate remains unclear. Despite persistently high inflation and indications of slowing growth, the Federal Reserve Chair Jerome Powell downplayed stagflation concerns, even leaving interest rates unchanged.

He compared the current situation, with unemployment and inflation rates below 4%, to the classic stagflation of the 1970s. “I don’t see the stag, or the ’flation,” he remarked.

Many economists echo this sentiment, emphasizing resilient consumer spending and data suggesting a gradual softening in inflation. They highlight stark differences between today’s environment and the 1970s, marked by oil shocks, strong unions, and removed price controls.

Bank of America Chimes in

Supporting this view, Bank of America analysts argue that recent data shouldn’t be interpreted as stagflation. They point out that the lower-than-expected GDP growth might be due to accounting factors, while strong PCE inflation reflects resilient consumer spending. In essence, they believe these are separate issues, not necessarily indicative of stagflation.

Stagflation’s Impact on Asset Classes

While the debate on a potential return of stagflation continues, let’s first delve into how historical stagflation periods, like the 1970s, impacted various asset classes particularly on gold, Oil, U.S. dollar and stocks.

This will serve as valuable insights into potential trends and strategies for navigating similar conditions in the future.

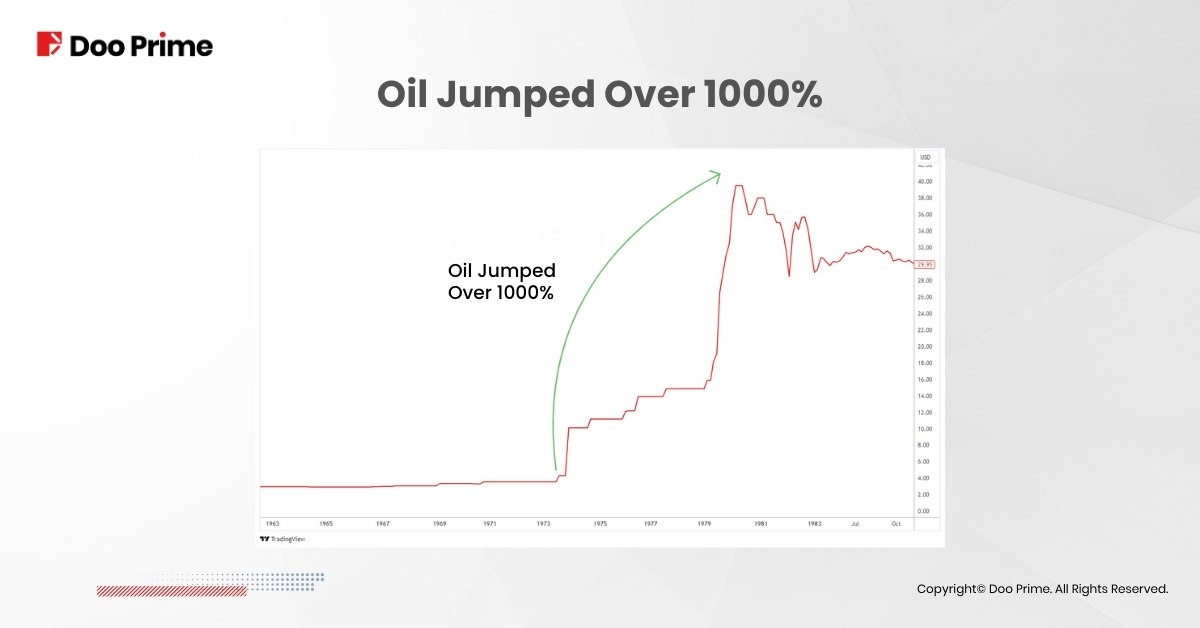

Oil: A Volatile Market

During the stagflation of the 1970s, oil prices experienced significant volatility, soaring by over 1000%. The oil crisis of 1973, sparked by OPEC’s embargo limited oil production and exports from OPEC countries, led to a significant supply shock and consequently, a rapid escalation in oil prices. This surge persisted, peaking between 1980 and 1981, amplifying inflationary pressures globally.

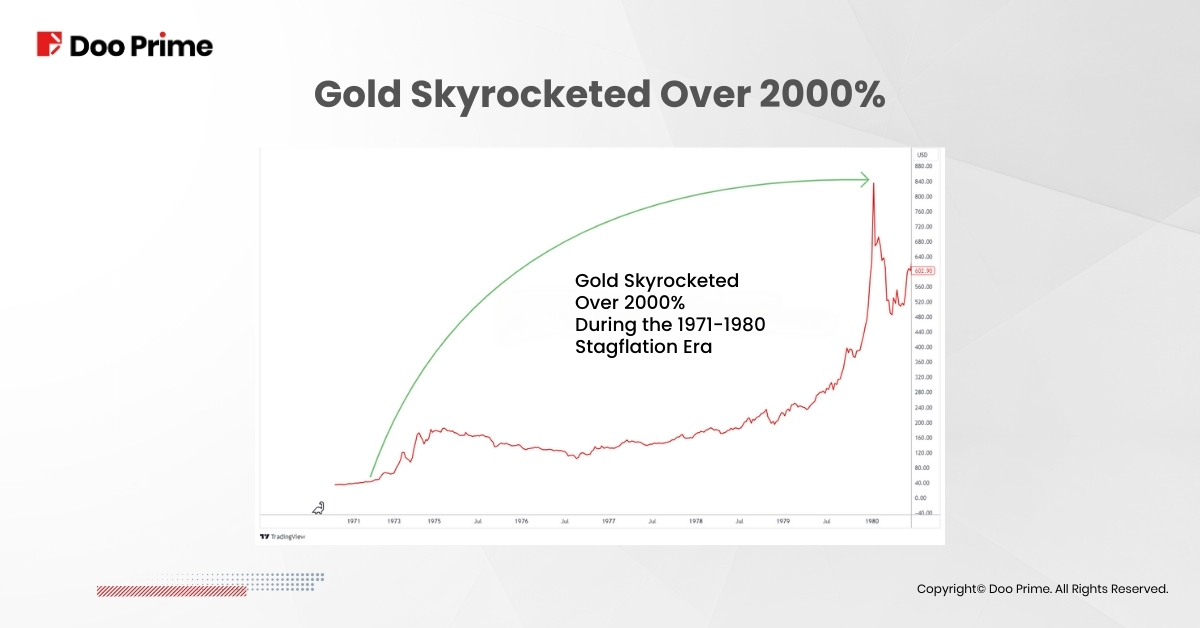

Gold: A Safe Haven Amidst Uncertainty

Gold emerged as a safe haven during the stagflation era, offering investors protection against inflation and currency devaluation. From 1971 to 1980, gold prices skyrocketed by over 2000%, reflecting its status as a reliable store of value during economic turmoil.

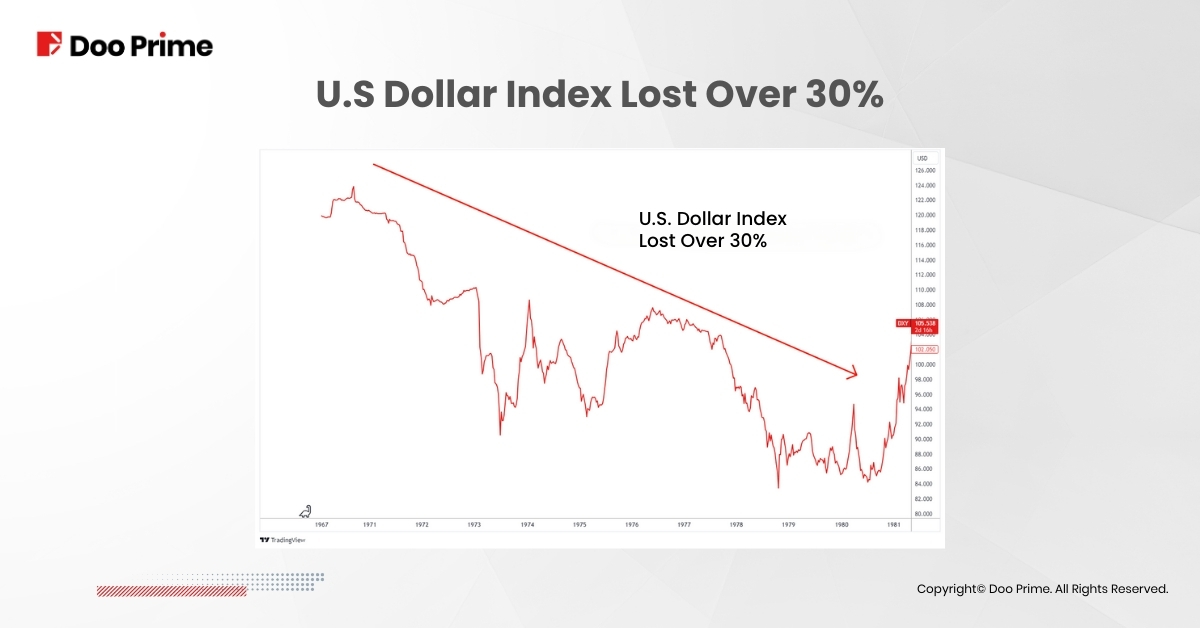

U.S. Dollar: Depreciation in Value

In contrast to gold’s resilience, the U.S. dollar witnessed a significant depreciation during the stagflation period. Over the span of the 1970s to the early 1980s, the U.S. dollar index lost over 30% of its value, mirroring the erosion of purchasing power amidst rampant inflation and economic instability.

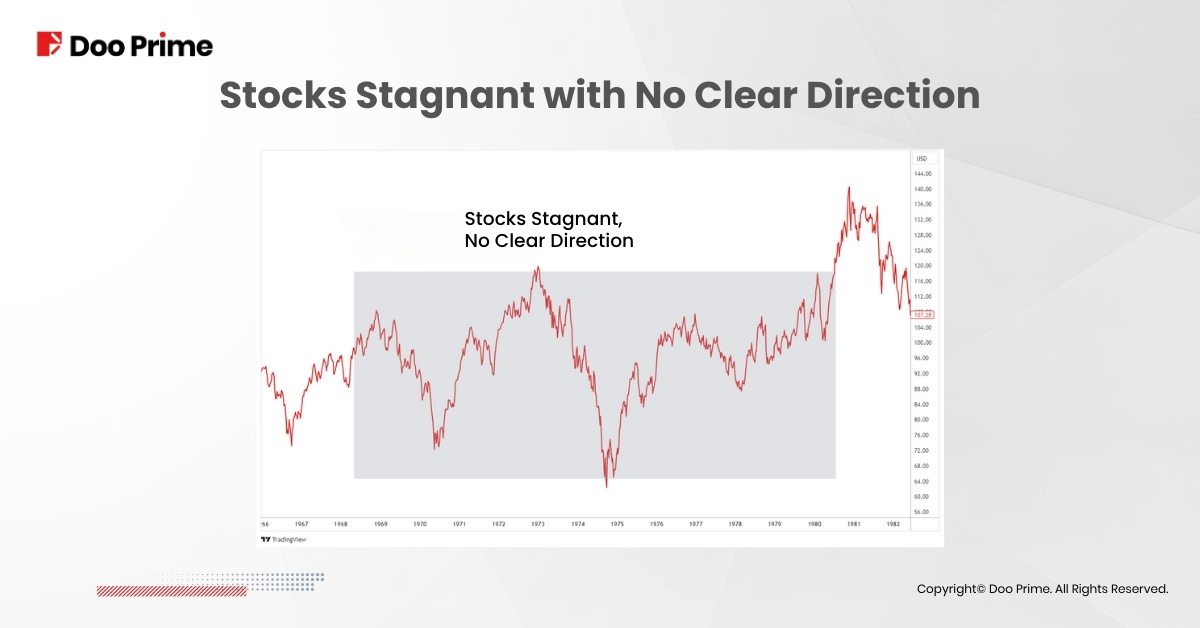

Stocks: No Clear Direction

The stock market performance during the 1970s stagflation period was lackluster. While there were some pockets of opportunity, overall, stocks exhibited stagnant growth with no clear directional trend. The combination of high inflation and economic uncertainty dampened investor sentiment, leading to a period of sluggishness in the stock market.

Investing in a Stagflationary Environment

Understanding how different asset classes behaved during historical stagflation periods can provide valuable guidance for your investment strategies. However, it’s important to bear in mind that past performance does not guarantee future results. Before making any investment decisions, it’s crucial to conduct thorough research, evaluate your risk tolerance, and seek advice from a financial advisor.

Risk Disclosure

Trading in financial instruments involves high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding the investor’s initial investment could incur within a short period of time. The past performance of a financial instrument is not an indication of its future performance. Investments in certain services should be made on margin or leverage, where relatively small movements in trading prices may have a disproportionately large impact on the client’s investment and client should therefore be prepared to suffer significant losses when using such trading facilities.

Please make sure you read and fully understand the trading risks of the respective financial instrument before engaging in any transaction with Doo Prime’s trading platforms. You should seek independent professional advice if you do not understand any of the risks disclosed by us herein or any risk associated with the trade and investment of financial instruments. Please refer to Doo Prime’s Client Agreement and Risk Disclosure and Acknowledgement Notice to find out more.

Disclaimer

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future performance. Doo Prime and its holding company, affiliates, subsidiaries, associated companies, partners and their respective employees, make no representation or warranties to the information displayed and shall not be liable for any direct, indirect, special or consequential loss or damages incurred a result of any inaccuracies or incompleteness of the information provided, and any direct or indirect trading risks, profit, or loss arising from any individual’s or client’s investment.