The Yen (JPY) is truly squeezing the financial world. After reaching its 7-month high, Yen triggered a massive sell-off in the global market.

How could just one report, and one interest rate decision have such a profound impact? In this article we will discover the markets’ “surprise” moves and look at some of the main concerns about the current global economic situation.

First, let’s review the performance of the Yen and the Nikkei 225 index.

Yen Peaks, Nikkei 225 Break Out

On the first trading day of the week, August 5th, the USD/JPY index hit its lowest level in seven months at 141.6. This is the deepest and fastest drop of this index in a year. In just four consecutive trading sessions, the Japanese Yen increased by 8% in value, surprising many investors.

Looking at the Nikkei 225, the price action was severely broken in the same session. After closing at 35,909 the previous day, the general index for the Japanese stock market opened at just 35,249 and closed at a disastrous 31,458, with a trading volume of 2.8 trillion. Notably, the last time this index saw a daily volume exceeding 2.8 trillion was in 2016, following the BoJ’s initial application of a negative interest rate (-0.1%).

So, what caused this collapse of the Nikkei?

The Driving Forces Behind the Yen’s Rise

Delving into the reasons behind the Japanese stock market’s “red” state, the main cause is the strong appreciation of the Yen.

“How could this happen?” is probably the question on the minds of traders and investors around the world.

We should understand that the Yen’s surge is simply the inevitable result of the BoJ raising interest rates for the second time since March, with the current rate at 0.25%. Higher interest rates mean that monetary policy is being tightened, and the Japanese government is striving to save the Yen’s value.

However, the BoJ’s interest rate hikes and the Yen’s strengthening have shaken three main pillars long trusted by investors: the US economy’s strength, the AI revolution in major tech companies, and Japan’s low-interest-rate policy.

Let’s explore all these factors.

Investor Confidence Challenged

The US July employment report recently showed that the US economy added 114,000 jobs in July, lower than the economists’ forecast of 175,000 jobs by LSEG. At the same time, the unemployment rate unexpectedly rose to 4.1%.

Moreover, the financial performance of major tech companies, such as Amazon and Intel, fell short of expectations. Despite significant investments in artificial intelligence (AI), these companies have yet to see proportional profits, leading to a sharp decline in their stock prices.

Meanwhile, the bond market continuously sends warning signals. This situation, combined with the Fed maintaining interest rates at their highest levels in over two decades, has led to increased market volatility.

However, there’s another crucial factor at play—the carry-trade market—which illustrates the correlation between the Yen and US market assets.

How Carry-trade Triggered a Massive Sell-off

Do you know carry-trade market?

Carry-trade involves borrowing money in jurisdictions with low interest rates to invest in assets or currencies offering higher returns. Recently, the Yen has become a popular choice due to the BoJ’s ultra-low interest rates.

Investors, both individuals and institutions, actively use the Yen to buy stocks from major US market players, especially those in Magnificent 7, leading to a significant correlation between a large portion of this country’s assets and the Yen.

But how large is it?

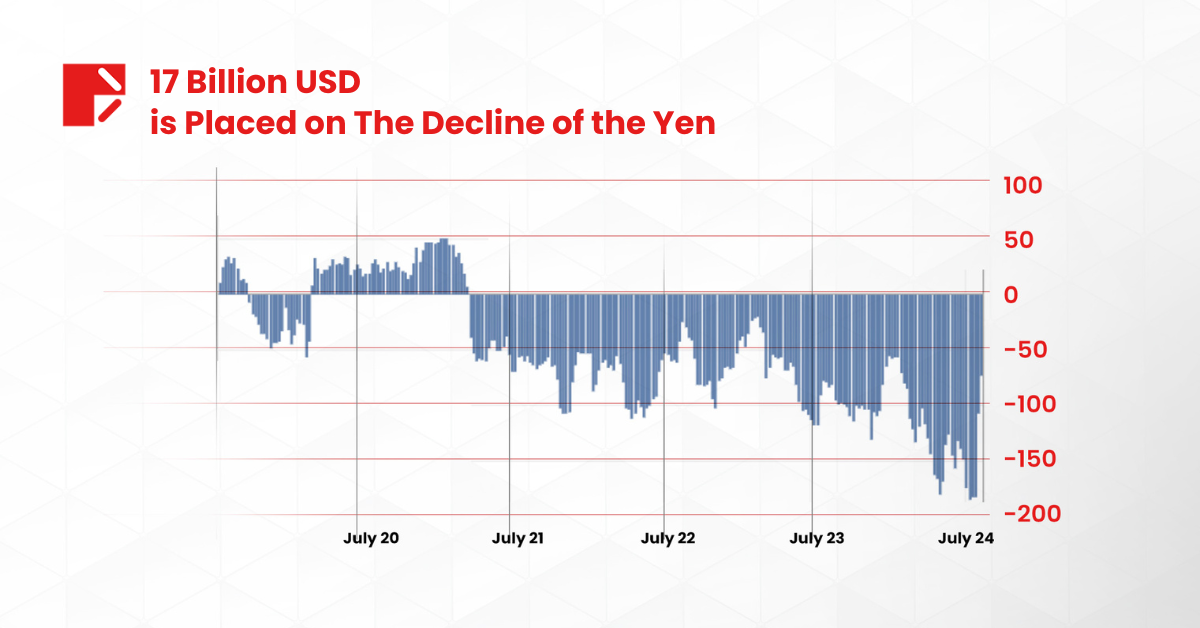

There is no exact figure for the total liquidity of the carry-trade market. Nevertheless, we can gauge the scale by referencing the overall position of Yen futures contracts. Data from the Commodity Futures Trading Commission (CFTC) reveals that, at the beginning of July, hedge funds and speculative investors held over 180,000 contracts anticipating the Yen’s decline, valued at over $14 billion.

This figure represents just the tip of the iceberg. Not only individual investors but also banks and financial institutions have long been actively leveraging the Yen to raise capital. According to data from the Bank for International Settlements (BIS), as of March, Japanese banks had extended Yen loans totaling $1 trillion, marking a 21% increase from 2021.

What is its impact?

Given this extensive scale, it becomes evident that when Yen interest rates rise, many investors face margin calls. They may continue to borrow Yen to meet these calls, further driving up the Yen’s value and creating a feedback loop. Consequently, assets purchased with Yen may also incur losses, prompting a broader sell-off in the US market.

Economic Landscape: The Complexity

It’s clear that the model driving the market sell-off is influenced by a combination of foreseeable factors.

From the beginning of the month, as tech stocks peaked and signs emerged of the BoJ raising interest rates, investors began fleeing the carry-trade market, triggering the first wave of sell-offs.

Subsequently, disappointing financial reports from major US tech companies cast doubt on AI’s growth potential. Concurrently, the Fed maintained high interest rates, the BoJ increased its rates, and a weak US employment report exacerbated concerns.

All of these factors have “blown away” $6.4 trillion from the global market.

Ready to Embrace Volatility

Indeed, whether due to a delayed or unexpected interest rate decision, or an earnings report that falls short of expectations, markets will probably react. This underscores the necessity for investors to understand the interconnections among various industries, the economy, and diverse forms of investments. U.S. assets are influenced not only by Fed interest rates and domestic economic conditions but also by a complex matrix of global macroeconomic connections.

As markets continue to evolve and respond to new economic data and policy changes, staying agile and informed remains paramount. By understanding the broader economic landscape and adjusting strategies accordingly, investors can better position themselves to weather volatility and capitalize on emerging opportunities.

Stay ahead of the curve with Doo Prime’s latest insights on the world economic landscape.

Risk Disclosure:

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer:

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.