Antitrust laws, a term perhaps overlooked by many individual investors, are proving to be a huge challenge for global tech behemoths. Giants such as Nvidia, Google, and Apple find themselves ensnared in lawsuits stemming from this regulation.

What exactly are antitrust laws, which corporations are affected, and how might they reshape the global tech landscape? Today’s article aims to delve into each of these aspects, providing a comprehensive analysis of the ongoing impact of these regulations on the tech industry.

What is Antitrust Law?

The word “trust” in “antitrust” refers to a consortium of businesses collaborating to deliberately shape a particular market. Rooted in the Sherman Act and the Federal Trade Commission Act, antitrust laws aim to curb the mergers and acquisitions (M&A) of major firms.

Simply put, antitrust laws are designed to foster competitive market conditions by preventing excessive dominance by one or a few companies within a specific market.

Antitrust laws significantly benefit consumers by fostering competitive markets, ensuring more choices, better quality, and fairer prices while encouraging innovation and preventing monopolistic control.

Big Tech and the Antitrust Wave

In recent years, the tech industry has seen explosive growth, with sectors like AI and semiconductors being led by dominant market leaders. These companies have consistently innovated and captured massive revenue streams.

However, regulatory bodies like the DOJ have stepped in to curb these monopolistic tendencies, initiating a significant antitrust movement against these billion-dollar enterprises.

Let’s examine some of the notable companies facing this growing wave of regulation.

Apple and The Antitrust Challenge

This year began with a significant antitrust lawsuit against Apple, initiated by the DOJ. The lawsuit alleges that Apple engages in restrictive practices that suppress competition and innovation:

- Blocking Apps: Apple has hindered the development of multifunctional apps that could facilitate switching between smartphone platforms.

- Restricting Cloud Streaming: Apple has obstructed cloud-streaming services that allow users to access high-quality games and apps without costly hardware.

- Limiting Cross-Platform Messaging: Apple has degraded the performance and security of cross-platform messaging apps to bind users to iPhones.

- Curbing Smartwatch Capabilities: Apple has restricted third-party smartwatch features, compelling users to remain within its ecosystem to avoid additional costs.

- Restraining Digital Wallets: Apple has blocked third-party digital wallets from implementing tap-to-pay features, stifling their cross-platform potential.

Market Impact

Following the announcement of the lawsuit in March, Apple’s stock (AAPL) immediately fell by 3.32% on the day. By mid-April, the share price hit a new yearly low of $164, marking a near 9% drop within just one week. Currently, Apple’s shares have also declined by 5.4% from their recent peak, amid low trading volumes.

Experts suggest that this lawsuit could be a precursor to more aggressive actions by the DOJ against tech companies this year, setting a precedent that could influence the financial landscapes of these companies moving forward.

Google’s First Lost Antitrust Case

In early August, Google faced a pivotal antitrust ruling when it was found to have violated laws by paying billions to companies like Samsung and Apple to secure its position as the default search engine on their devices. This settlement marked the DOJ’s first significant victory against major tech players.

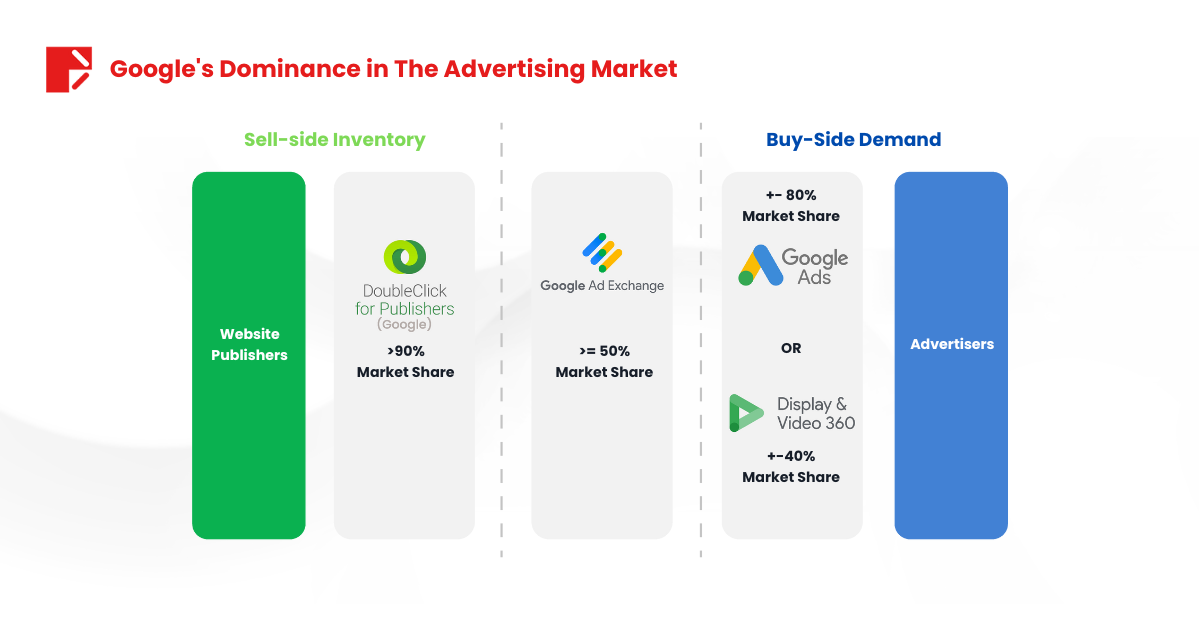

On September 9, the DOJ ramped up its efforts by launching a second investigation into Google, accusing it of attempting to monopolize the online advertising sector. Google dominates this market by charging fees to publishers for ad placements and to advertisers who run campaigns through Google Ads or Display & Video 360. See the below image.

As a result of these developments, Google’s parent company, Alphabet Inc., saw its shares drop by over 6% in just two trading sessions. Additionally, Google faces the risk of being broken up, with key services like AdWords, Chrome, and potentially Android under scrutiny for anticompetitive practices.

Nvidia is on The List

Following Google, Nvidia is the next tech giant under the scrutiny of the U.S. Department of Justice (DOJ). Last week, the DOJ issued subpoenas to Nvidia and several other companies as part of an intensified effort to gather evidence of antitrust violations, particularly in the rapidly expanding AI market.

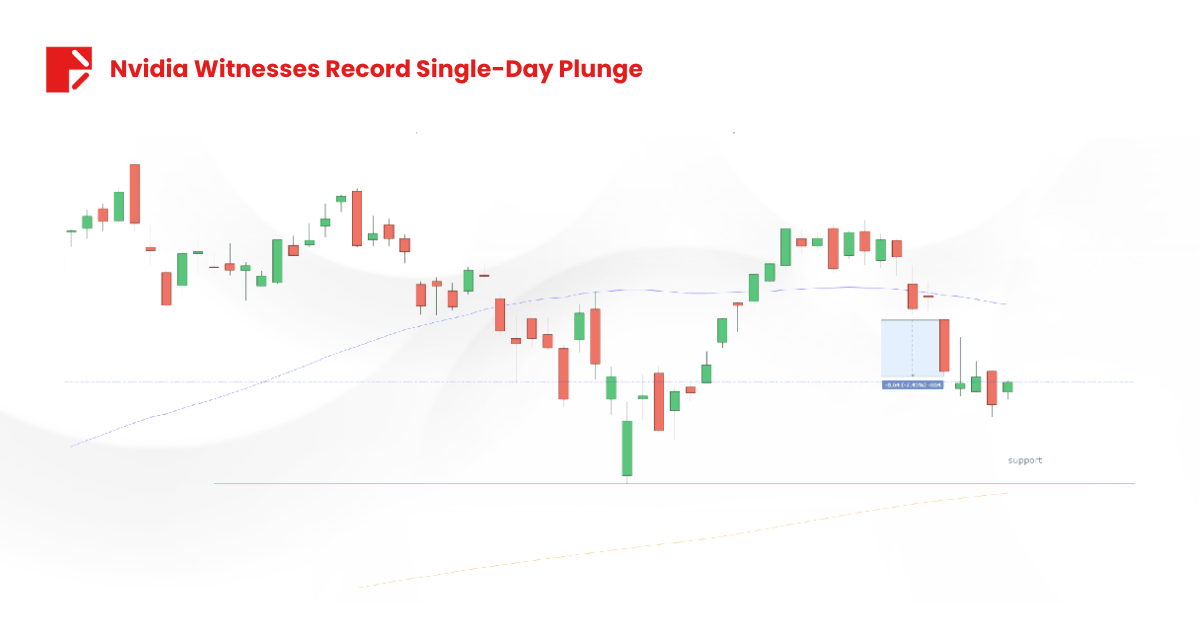

This news heavily impacted investor confidence in Nvidia’s future stability, causing a significant drop in its stock price. After the announcement, Nvidia’s shares plummeted by 22.8%, reducing its market capitalization by nearly $700 billion in just one week.

What Next for Tech?

Short-Term Impact

Experts believe that market leaders will not easily relinquish their positions due to the DOJ’s actions. Historical precedents suggest that the impact of such investigations typically causes only a temporary wave of concern. The lengthy process of these investigations, often spanning several years, means that initial worries fade as the focus shifts back to the companies’ ability to generate revenue.

With the substantial resources at their disposal, it’s challenging to envision a bleak future for the tech industry. Despite potential short-term setbacks from regulatory scrutiny, the sector’s inherent strength and capacity to innovate and monetize suggest that it will continue to thrive.

Technology Isn’t a “Bubble”

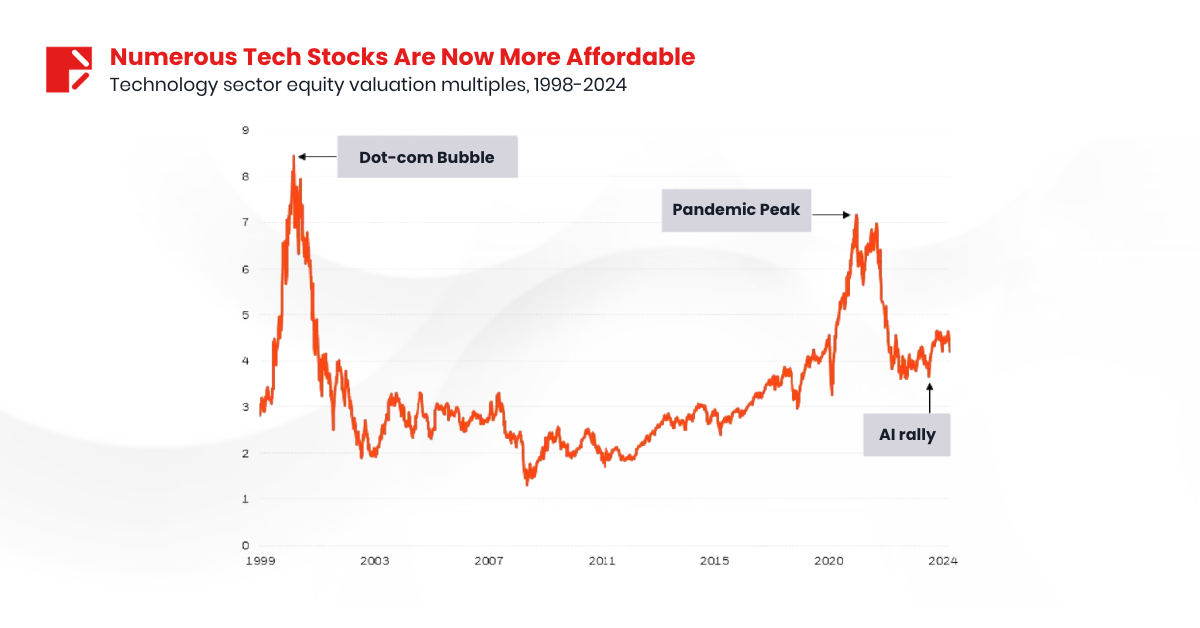

Despite the astounding growth, some believe the AI boom is just another bubble, like the dot-com bubble or post-pandemic tech surge. However, a look at the charts shows that compared to those times, today’s tech stock values are still reasonable, with an average profit growth forecast of 20%.

Overall, the growth prospects for the tech sector and AI specifically remain robust. Experts at Blackrock believe that “the development of AI and all its branches makes investing in this market a highly proactive venture.”

Conclusion

Amid recent antitrust investigations, a temporary downturn in the tech sector was inevitable. Since markets operate in cycles, investors should focus more on the industry’s long-term prospects, innovations, and demands rather than recent declines. Additionally, the ability of these companies to adapt and manage legal risks should also be considered.

As society progresses with technology at its core, it’s hard to imagine a future market where AI and related enterprises do not perform well. Therefore, be confident in your decisions, react adaptively to new information, and adjust to challenges from both macro policies and the internal dynamics of the companies you invest in.

Read more our Weekly Market Dive articles!

Risk Disclosure:

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer:

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.