Today’s News

The onset of 2024 has sparked a robust sense of optimism within Wall Street concerning the stock market’s trajectory. Last year’s pervasive skepticism was proven wrong as stocks soared through 2023, buoyed by the ascent of artificial intelligence and an unexpectedly resilient economy. Despite widespread anticipation of an impending recession among investors, it never materialized.

With the S&P 500 inching close to a record high, optimism pervades the crowd. This shift in sentiment hinges on investors’ growing conviction that the Federal Reserve’s anti-inflation efforts are tapering off, potentially ceasing the interest rate hikes that had rattled markets in preceding years. The prevailing sentiment now leans towards an anticipation of rate cuts, a stark departure from earlier projections.

Despite the prevailing positivity, potential risks loom on the horizon. A swift decline in rates could follow adverse economic news, and the market’s reliance on a few prominent stocks that drove the 2023 upsurge might fall. Furthermore, geopolitical tensions such as impending U.S. elections and conflicts in Europe and the Middle East could render the global landscape less conducive for investors.

However, the remarkable gains of 2023 and the promise of smoother sailing ahead have dissipated much of the earlier pessimism. David Kostin, Goldman Sachs’ chief U.S. equity strategist, anticipates a 7% return from current S&P 500 levels, setting a target of 5100. He said, “Instead of a higher for longer rate environment, it’s lower and sooner”. Conversely, JPMorgan Chase’s strategists are more bearish, projecting a target of 4200.

The conclusion of the year witnessed a vigorous “everything rally,” propelling prices across various asset classes, including stocks, bonds, gold, and even cryptocurrencies. Corporate bond yields descended to some of the lowest levels while bond prices rallied. The S&P 500 delivered a 24% return, and the 10-year Treasury yield settled at 3.860%, near its initial mark, albeit down from a peak of 5.021% in October. The Cboe Volatility Index, Wall Street’s fear gauge, approached multi-year lows, signaling prevailing market confidence.

Image Source: FactSet

Most investors anticipate the continuation of this favorable climate. A survey by BofA Securities in December found that fund managers were more bullish than at any time since January 2022, correlating with the S&P 500’s previous all-time high. 90% of these participants, overseeing USD 691 billion of assets collectively predicted the Fed would halt interest rate hikes, with a record number of more than 60% anticipating lower bond yields.

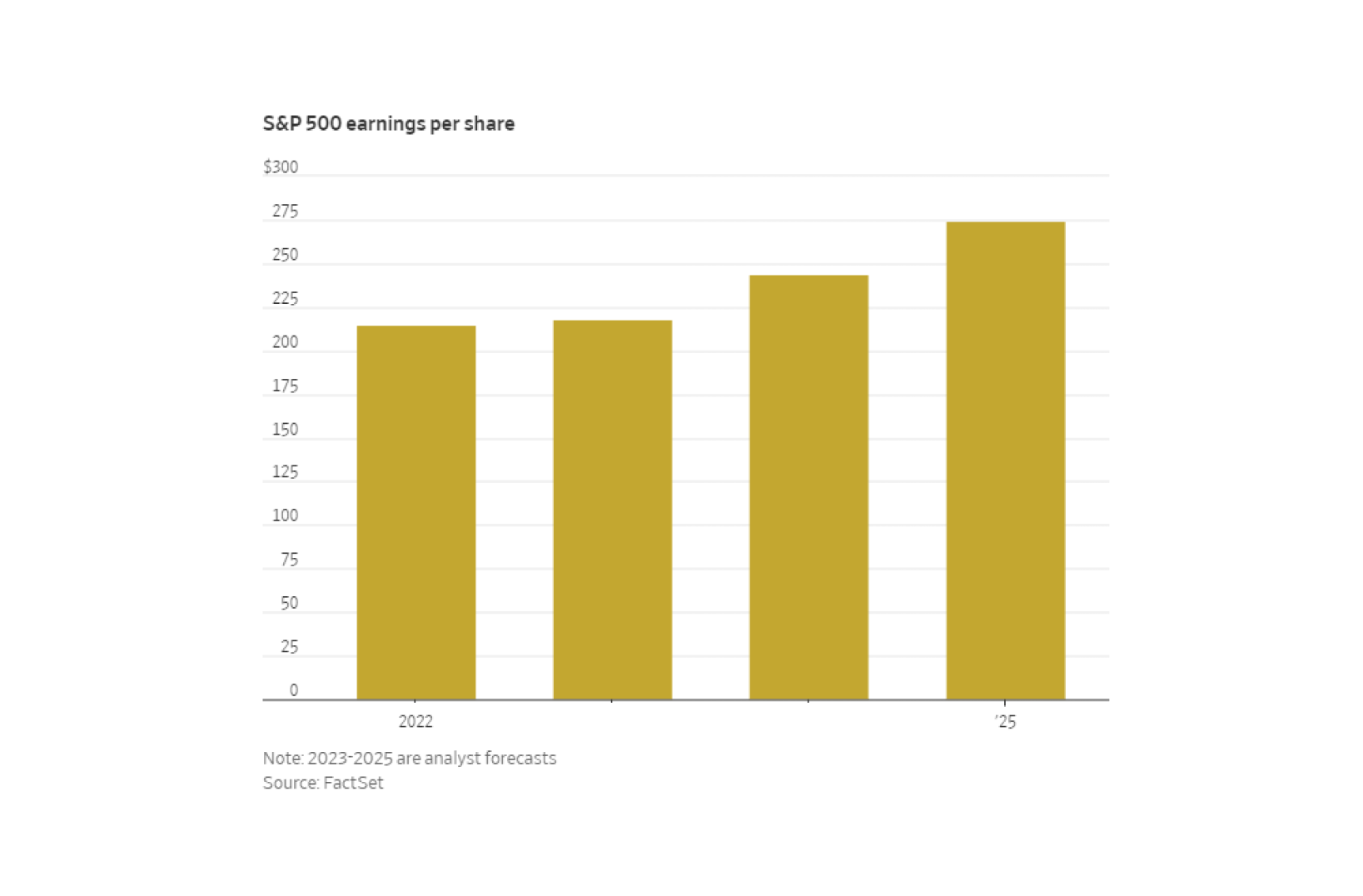

Matt Orton, head of market strategy at Raymond James Investment Management mentioned, “Even with moves we’ve had recently, you still have generationally attractive fixed-income markets”. He underscored the attractiveness of corporate bonds in the current market, likening it to a generational opportunity not witnessed since the 2008-09 financial crisis. The prospect of revitalized earnings also offers a potential boost, with Wall Street forecasting robust corporate profit growth in the new year and beyond.

Earnings, which remained stagnant last year, are poised to offer a significant uplift. Analysts on Wall Street anticipate a resurgence in corporate profits, forecasting robust growth in S&P 500 earnings. Projections indicate an expected earnings growth of 11.6% for the upcoming year and a further increase of 12.5% in 2025, as per data from FactSet.

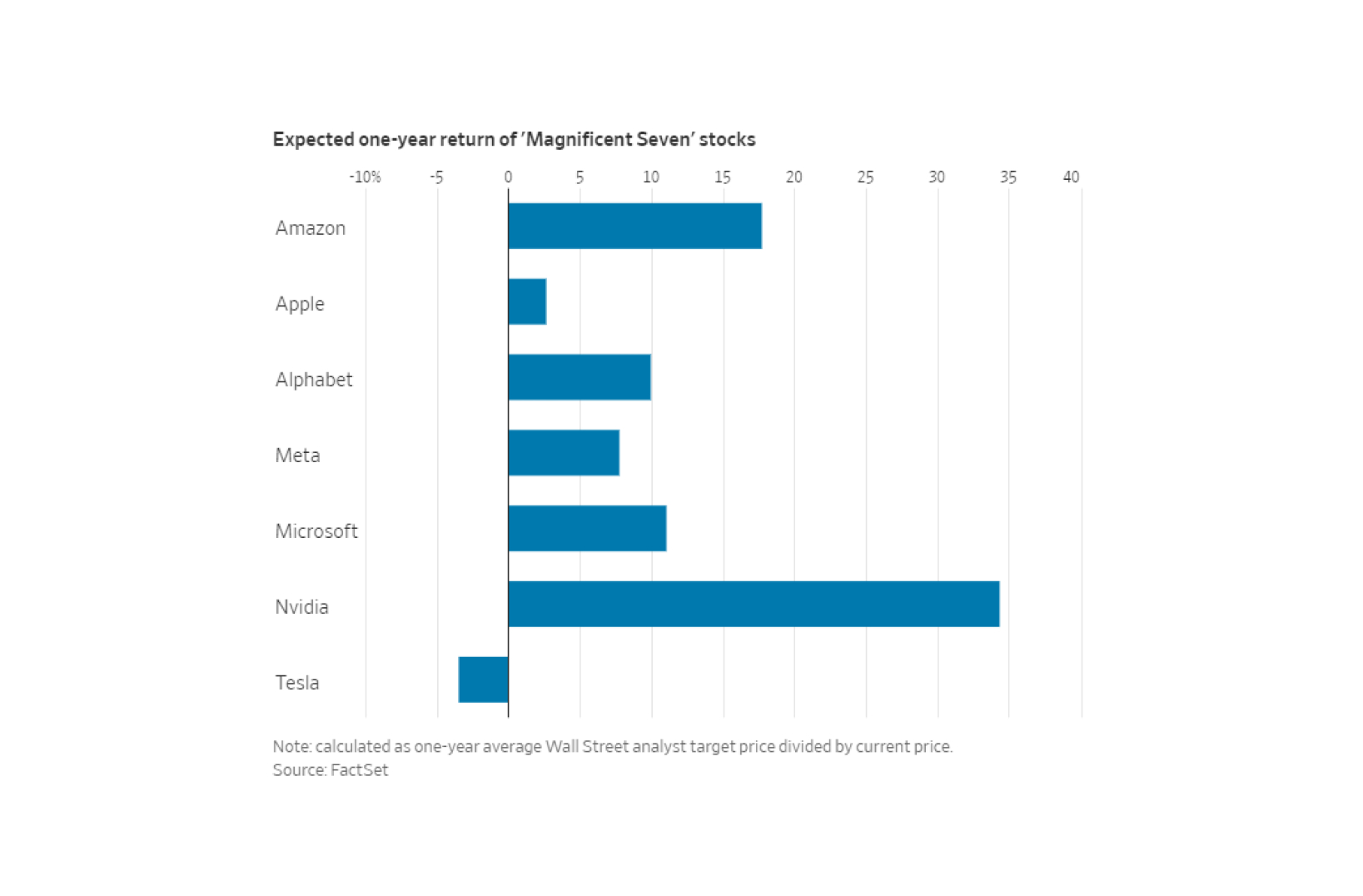

While overall sentiment toward stocks and bonds remains positive, some investors exhibit skepticism toward the “Magnificent Seven,” a cluster of major technology companies that dominated the 2023 market. Nearly half of survey respondents identified owning shares of these seven firms as the most overcrowded trade on Wall Street, raising concerns about limited upside potential.

“Magnificent Seven” stocks

Image Source: FactSet

Estimates compiled by FactSet reveal that the average one-year price target for stocks among the ‘Magnificent Seven’ is approximately 11% higher than the closing price of Friday. Among these stocks, Nvidia stands out with the highest anticipated return, expected to reach about 34%. On the contrary, Tesla is trailing behind, with analysts projecting a decline of 3% in its stock value.

Tony Roth, chief investment officer at Wilmington Trust, suggested that several other sectors, including financials, healthcare, and energy stocks, offer attractive valuations. He said, “I certainly would not underweight them, but I’m not sure they will outperform the rest of the market. The other 493 stocks are in a catch-up trade”.

Uncertainties stemming from the U.S. presidential election in November and potential shifts in fiscal policy could pose risks, but historical data indicate a favorable market performance in election years.

However, the primary risk factor remains disappointment over interest rates. Fed officials’ projections of anticipated rate cuts in 2024, potentially differing from market expectations, could lead to significant market fluctuations. Despite this, some strategists view market volatility as an opportunity rather than a detriment.

“I just think there’s still going to be challenges with the market perhaps being ahead of where the Fed is.” said Raymond James’s Orton. “And that’s OK, because volatility presents opportunities.”

Other News

HSBC Completes Retail Banking Sale in France

HSBC’s subsidiary, HSBC Continental Europe (HBCE), successfully sold its retail banking business in France to Crédit Commercial de France (CCF), a My Money Group subsidiary, completing the transaction on January 1.

BNP Paribas Settles Swiss Franc Loan Case

BNP Paribas reaches an agreement with CLCV to compensate between 400 million and 600 million euros (USD 662.3 million) after legal issues surrounding its consumer credit unit’s misleading practices in Swiss franc mortgages.

Climate Activists Block Amsterdam Highway Against ING

Around 300 Extinction Rebellion activists were detained by Amsterdam police after blocking a major highway to demand ING’s immediate cessation of fossil fuel financing, alleging the bank’s primary role in funding fossil fuel projects.