Today’s News

Asian stocks dipped on Tuesday as the U.S. dollar hovered near multi-month highs and bond markets experienced a significant sell-off, signaling investors’ nervousness ahead of the U.S. presidential election. Benchmark 10-year U.S. Treasury yields surged by 11 basis points overnight, and gold hit a record high, surpassing USD 2,740 an ounce on Monday before settling at USD 2,725.

Image Source: Al Jazeera

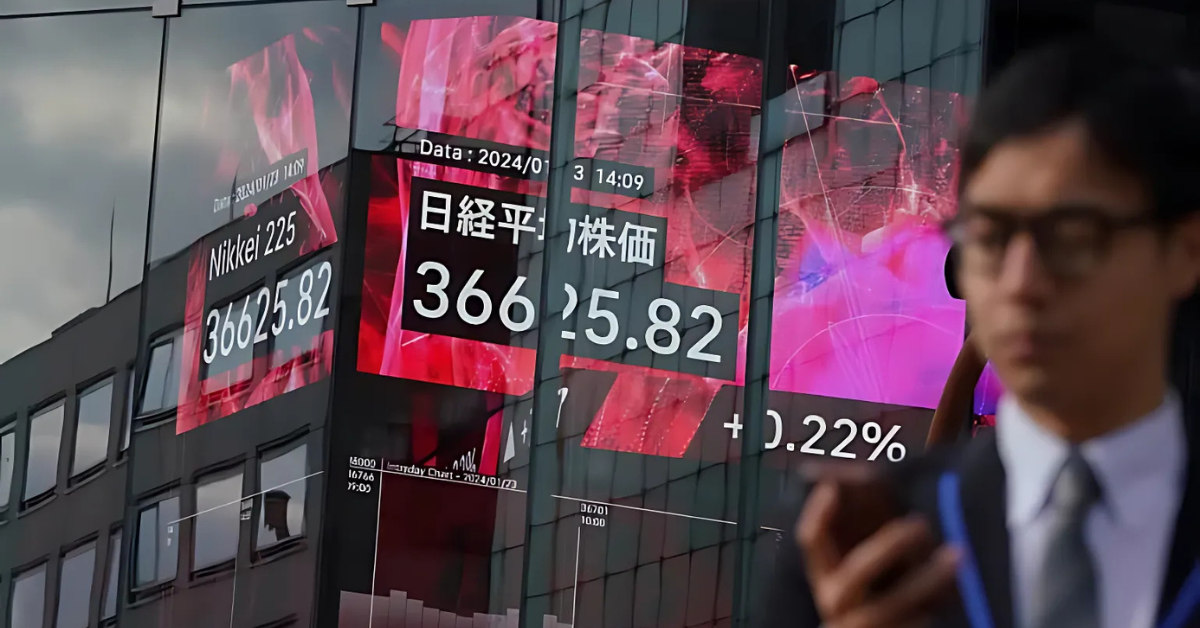

Japan’s Nikkei slid 1.1% in morning trading, reaching its lowest level since early October. MSCI’s broad index of Asia-Pacific shares outside Japan also fell 0.8%, while Wall Street’s key indexes edged down slightly, with futures trending lower in Asia.

The sharp rebound in oil prices, fueled by ongoing tensions in the Middle East following the death of a Hamas leader, added to market jitters, with Brent crude futures rising 1.7% on Monday and stabilizing at USD 73.89 a barrel in Asia.

Image Source: Al Jazeera

Image Source: SBS News

Jack Chambers, a strategist at ANZ, noted that alongside rising oil prices, the looming U.S. election was adding pressure on bond markets. “A secondary consideration could be a bit more focus on the U.S. election and fiscal dynamics,” he said. “Regardless of who wins, you can’t really see a path to fiscal consolidation.”

In Australia, the benchmark S&P/ASX 200 dropped over 1.3%, with shares in grocer Metcash tumbling 6% after Goldman Sachs lowered its price target and warned of potential market share loss. China’s markets remained subdued, with traders waiting for further government action to stimulate the slowing economy.

Currency Markets Steady as Investors Weigh U.S. Election Impact and Earnings Reports

In the currency market, the dollar strengthened, trading near recent peaks. The euro hovered near its lowest level since August at USD 1.0819, while the yen remained weak at 150.67 per dollar. The Australian and New Zealand dollars also remained near multi-month lows, reflecting the broader market sentiment.

Analysts suggested the dollar’s rise may be linked to market expectations of a Donald Trump victory in the U.S. election. Commonwealth Bank of Australia’s Joe Capurso explained that markets are pricing in Trump’s potential policies, which could lead to higher inflation and yields. However, Capurso also noted that a victory for Vice President Harris, currently considered the underdog, could cause a larger market reaction than if Trump wins.

With a relatively light data schedule, investors are focusing on U.S. corporate earnings reports from major companies, including General Motors, Texas Instruments, Verizon, Lockheed Martin, and 3M, for further insight into economic trends.

As investors brace for the outcome of the U.S. election, market volatility is expected to increase, with significant shifts in stocks, bonds, and currencies. For a deeper look at how these developments can shape your trading strategy, see what Doo Prime is offering in conjunction with the U.S. Election here.

Other News

Fed Officials Back Rate Cuts, Vary on Timing

Four Fed policymakers support further rate cuts, with most favoring a gradual approach. San Francisco Fed President Daly pushes for continued cuts, while others suggest caution depending on data.

Oil Prices Dip Amid Middle East Ceasefire Talks

Oil prices fell as U.S. efforts to broker a Middle East ceasefire tempered war-related gains, while concerns over weak Chinese demand continue to weigh on the market. Brent crude fell 0.3%

South Korea’s Economy Likely Grew 0.5% in Q3

South Korea’s Q3 growth is expected at 0.5%, recovering from a previous contraction, supported by strong exports. Annual growth is forecasted at 2.0%, with GDP data due on October 24.

Risk Disclosure:

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer:

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.

The above strategies reflect only the analysts’ opinions and are for reference only. They should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. Doo Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. The market is risky, and investments should be made with caution.