Today’s News

For 32 years, Jim Tynan had a homeowners’ policy with Allstate for his 1,200-square-foot condo in Ponte Vedra, Florida. But in January, Allstate informed him they were dropping his coverage. Tynan reached out to ten different agencies, only to find none willing to cover him—until he finally secured a policy at a 50% higher premium.

Image Source: Bloomberg

This experience reflects a growing issue in Florida, where four major hurricanes in the past four years have caused insurance premiums to skyrocket and led some insurers to reduce coverage. As residents work to recover from these storms, many are left wondering if they will still be able to secure insurance in the future.

Tynan, who lives just two miles from the ocean but hasn’t been directly hit by a hurricane, now lives in constant fear of losing his new policy. “I live in fear I will get a letter from my new company telling me they are going to drop me, too,” he said, following the latest hurricane. “It’s very scary.”

Tynan isn’t alone. Six other homeowners from various areas of Florida, including both coasts and the Keys, expressed similar concerns about potential rate hikes, exclusions, and even the complete loss of insurance coverage.

Allstate, in response, stated that they have worked with regulators to protect as many customers as possible. For those who lose coverage, they try to coordinate with other carriers to offer alternatives.

Homeowners across Florida face a precarious situation when it comes to securing insurance. Average premiums in the state have surged nearly 60% between 2019 and 2023, and some major providers have reduced their coverage, leaving many residents reliant on the state-backed insurer, Citizens.

Analysts warn that following Hurricane Milton, which hit Florida’s southwest coast just 12 days after Hurricane Helene struck the northwest coast, there will likely be even more uncertainty in the insurance market.

“This is …certainly going to cause insurers to be concerned about continuing to insure in the market,” said Marc Ragin, an associate professor of risk management and insurance at the University of Georgia.

The state-backed nonprofit insurer, Citizens, is often seen as the last resort for coverage. Florida’s Governor Ron DeSantis has raised concerns about whether Citizens could pay claims if hit by large storms.

Citizens spokesman Michael Peltier assured that Citizens would meet its obligations, as the organization has mechanisms in place to levy surcharges on policyholders and, if necessary, assessments on non-policyholders. Peltier said that the 80,000 claims filed so far due to Hurricane Milton would be paid without needing to levy assessments.

Governor DeSantis’ office emphasized that while Citizens would always be able to pay claims, the cost would come at the expense of all Florida insurance policyholders.

Image Source: Reuters, edited by Doo Prime.

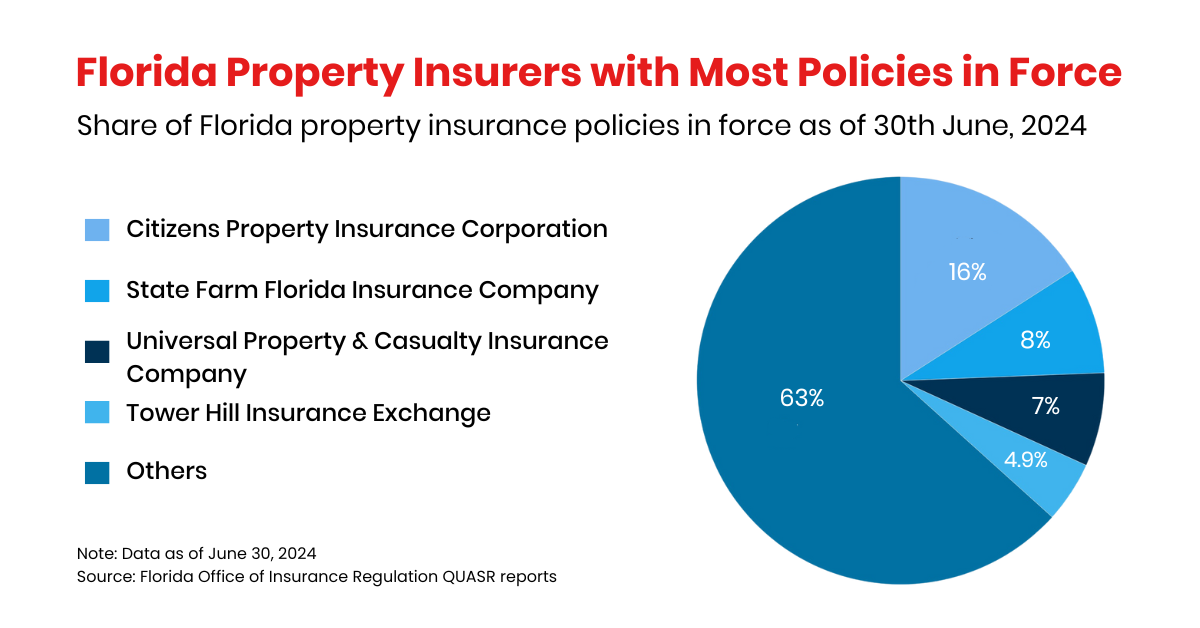

As of June, Citizens had over 1.2 million policies in force, up from around 1.14 million at the end of 2022. Analysts predict that the state insurer may need to take on more policies if private insurers continue to retreat from the market.

“The reality is we may be forced out of our home where we have lived for 35 years,” said Sherri Hansen, a Florida Keys resident, voicing the growing concern among homeowners. “All our eggs are in this one basket.”

For more insights, check out Doo Prime’s in-depth analysis on how Hurricane Milton is impacting major industries like insurance and real estate here.

Other News

Blackstone Beats Profit Estimates, AUM Hits USD 1.1 Trillion

Blackstone’s Q3 profit topped expectations as assets under management reached USD 1.1 trillion, driven by strong private equity and infrastructure performance.

China Hedge Funds Face Losses Amid Market Surge

Major Chinese hedge funds incurred losses as a sharp stock market rally in late September forced them to cover short positions, highlighting the challenges of navigating volatile market conditions.

TSMC Stock Hits Record on AI Demand, Strong Earnings

TSMC shares jumped 6% to a record high after surpassing earnings forecasts, fueled by strong AI demand, despite U.S. scrutiny over potential Huawei chip sales.

Risk Disclosure:

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer:

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.

The above strategies reflect only the analysts’ opinions and are for reference only. They should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. Doo Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. The market is risky, and investments should be made with caution.