Today’s News

Goldman Sachs Group Inc. has downgraded Indian equities to neutral from overweight, citing a slowdown in economic growth that is expected to affect corporate earnings.

Image Source: The Brand Hopper

In a note issued on Tuesday, strategists including Sunil Koul explained that while the long-term structural outlook for India remains positive, economic growth is decelerating in various sectors.

This has led to a deterioration in earnings sentiment, with an accelerating pace of earnings-per-share cuts and a weak start to the September-quarter results season, all of which are negatively impacting profits.

Goldman Sachs also highlighted high valuations and a less supportive economic environment as factors that could limit the near-term upside for Indian stocks. The cautious outlook reflects growing concerns over the sustainability of corporate earnings as consumer spending weakens and commodity prices rise.

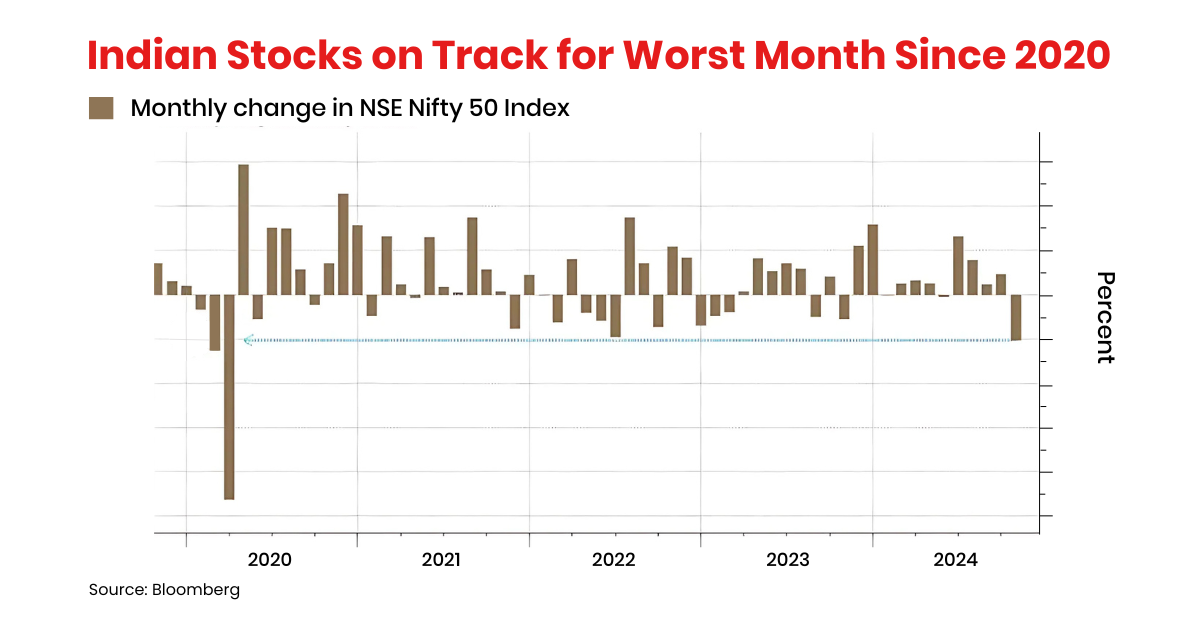

India’s stock market, which recently reached record highs, is already showing signs of strain. The benchmark NSE Nifty 50 Index has fallen more than 5% in October, setting it on course for its worst month in over four years.

Image Source: Bloomberg, edited by Doo Prime

“A large price correction is less likely due to support from domestic inflows, but markets could experience a ‘time correction’ over the next three to six months,” the strategists said. Goldman Sachs has also revised its 12-month target for the NSE Nifty 50 Index down to 27,000 from the previous 27,500, implying a 10% upside from Tuesday’s closing level.

The Nifty index is currently trading at 20 times its 12-month forward earnings, above its five-year average of 19.4 times. Foreign investors have sold $7.8 billion worth of Indian equities this month through Monday, marking the largest outflow since March 2020, according to Bloomberg data.

Goldman had initially raised Indian stocks to overweight late last year, citing strong earnings growth over two years despite global macroeconomic challenges.

Other News

Stocks Slip, Dollar and Gold Surge Ahead of U.S. Election

Asian stocks stumbled as investors remain cautious ahead of the U.S. election, while the dollar and gold prices surged on safe-haven demand.

TI Profit Beats Forecast, Boosted by China Auto Demand

Texas Instruments’ Q3 profit exceeded expectations, fueled by China’s EV market growth, while industrial market weakness affects Q4 forecast.

Tokyo Metro Shares Surge 47% in Trading Debut

Tokyo Metro’s stock soared by 47% in its trading debut after its IPO was oversubscribed 15 times, raising JPY 348.6 billion (USD 2.29 million).

Risk Disclosure:

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer:

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.

The above strategies reflect only the analysts’ opinions and are for reference only. They should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. Doo Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. The market is risky, and investments should be made with caution.