Today’s News

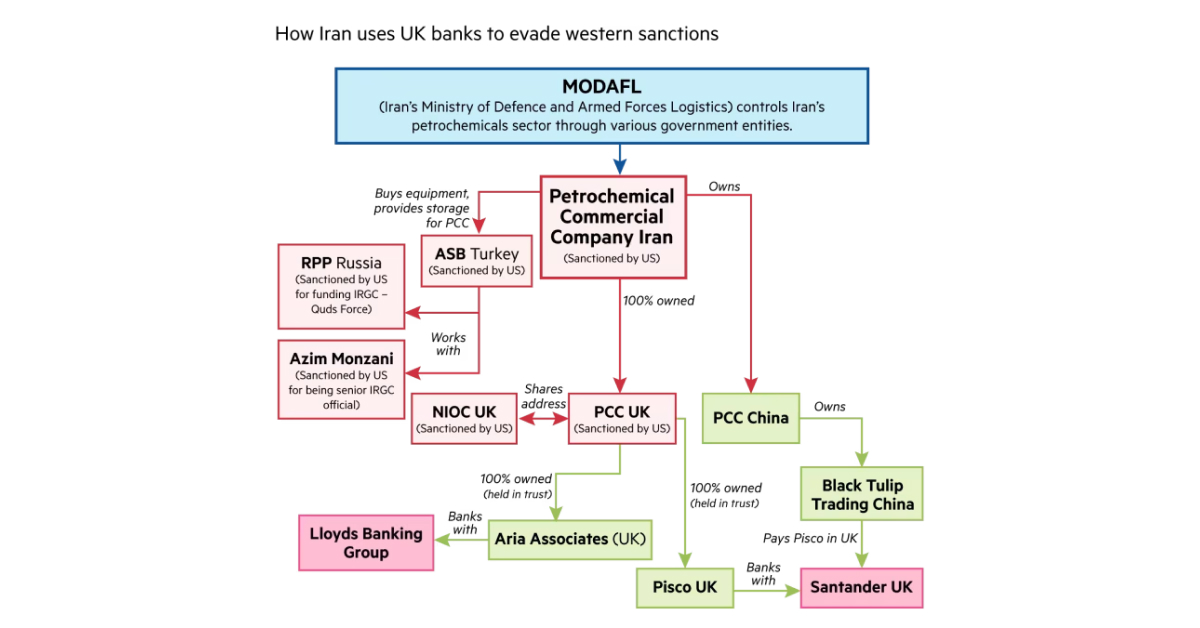

Iran discreetly utilized the services of two major U.K. banks to transfer funds globally as part of an extensive scheme aimed at evading sanctions, allegedly supported by Tehran’s intelligence services. According to documents reviewed by the Financial Times, Lloyds and Santander U.K. facilitated accounts for British front companies, covertly owned by a sanctioned Iranian petrochemicals company located near Buckingham Palace.

The Petrochemical Commercial Company, under state control, played a role in a network that the U.S. accuses of generating hundreds of millions of dollars for the Iranian Revolutionary Guards Quds Force. Additionally, it is alleged to have collaborated with Russian intelligence agencies in fundraising for Iranian proxy militias. Both the Petrochemical Commercial Company and its U.K. subsidiary, PCC U.K., have faced U.S. sanctions since November 2018.

Examining documents, emails, and accounting records, it is revealed that despite being under U.S. sanctions, PCC’s U.K. division persisted in its operations from an office in Grosvenor Gardens, Belgravia. This was accomplished through an intricate network of front entities in the U.K. and other nations.

Image Source: Financial Times Research

These revelations about Iran’s sanctions-evasion tactics in London emerge in the aftermath of the Royal Air Force’s recent participation in U.S. airstrikes against Iranian-backed Houthi rebels in Yemen. Additionally, both the U.K. and U.S. have imposed sanctions on what they label a “transnational assassinations network” overseen by Iranian intelligence, targeting activists and dissidents, including British residents.

According to documents analysed by the Financial Times, after facing U.S. sanctions, the Petrochemical Commercial Company (PCC) utilized U.K.-based companies to receive funds from Iranian front entities in China while masking ownership through “trustee agreements” and nominee directors. One such company, Pisco U.K., registered to a house in Surrey, used a Santander U.K. business account. Although officially owned by a British national, Abdollah-Siauash Fahimi, internal documents leaked by the Iranian opposition site WikiIran reveal Pisco’s full control by PCC, with Fahimi serving as a trustee.

Fahimi, using a PCC email address, corresponded with company officials in Tehran and served as a director of PCC U.K. from April 2021 until February 2022. In 2021, Pisco’s Santander account received a transfer from the Chinese company Black Tulip, identified in internal PCC records as another trustee company controlled by a PCC employee. Last year, the U.S. Treasury accused Iranian petrochemical companies of employing multiple front entities to evade sanctions by channeling sales through Asia.

While Santander refrained from commenting on specific client relationships, citing a strong focus on sanctions compliance, a person familiar with the situation revealed the bank’s closure of Pisco’s account.

Another PCC front company in the U.K., Aria Associates, holding an account with Lloyds, is officially owned by Mohamed Ali Rejal, the deputy chief executive of PCC U.K. Emails show Rejal’s involvement in coordinating payments from China, with explicit instructions writing “Please make sure that there should not be any indication of PCC or PCC (U.K.).”

Despite these revelations, PCC U.K., Rejal, and Fahimi have not responded to requests for comment.

Image Source: Bloomberg

Lloyds Banking Group declined to comment on individual customers but asserted compliance with sanctions laws, citing legal restrictions on commenting on the submission of suspicious activity reports. Tory chair of the Commons foreign affairs committee, Alicia Kearns, expressed ongoing concerns, saying, “For years I have repeatedly raised my concerns about our need to shut down cut-outs of the IRGC operating in the U.K. This investigation proves once again that more needs to be done.”

Labour chair of the Commons business and trade committee, Liam Byrne, condemned the situation, stating that “This is, frankly, a shocking failure to act in lockstep with our allies to shut down the financing of a hostile regime. It beggars belief that a business sanctioned by the U.S. is freely trading in London.”

David Asher, a senior fellow at the Hudson Institute and former U.S. State Department official, highlighted the use of London as a financial center by IRGC-connected entities, criticizing U.K. banks for continuing business with them. He said, “For U.K. banks to continue doing business with them is not only a major risk but is inconsistent with stated policy towards the Iranian regime”.

European banks facing breaches of U.S. sanctions on Iran, such as Standard Chartered and UniCredit, have incurred substantial penalties, exceeding USD 1 billion. Additional documents reveal PCC’s engagements, including contracts for equipment procurement with the Turkish company ASB, which faced U.S. sanctions for collaborating with senior IRGC officials. Audit reports for PCC U.K. in 2021 indicate the maintenance of large trading balances with PCC in Iran, enabling continued operations despite Western banks being restricted from conducting business with the sanctioned company.

Moreover, PCC U.K.’s Belgravia office serves as the registered address for NIOC International Affairs (London) Ltd, a division of Iran’s U.S.-sanctioned national oil company. Washington has long alleged direct financial support from this entity to the IRGC and Iranian military activities.

Other News

Tech Rally Pushes S&P 500 To New Record

Meta’s historic market-cap gain and positive earnings from major tech firms propel S&P 500 to new highs, while a robust jobs report leads to a spike in bond yields. Chevron and Exxon Mobil see substantial profits, while Charter Communications and Skechers face declines.

Tech-Driven Growth Funds Rise 3%

In January, large-cap growth funds, led by tech stocks, gained 3%, contributing to a strong 2023 rally. Despite a flat overall stock fund performance, optimism prevails, while caution is advised regarding Federal Reserve rate cut expectations in 2024.

Iraq Bans Eight Banks From U.S. Dollar Transactions

Iraq restricts access against eight local banks on U.S. dollar transactions to curb fraud and money laundering. The move is part of a broader crackdown on currency smuggling, targets banks including Al Huda Bank, accused of diverting funds to Iranian-backed groups.