Today News

Image Source: The Wall Street Journal

Stock benchmarks in two of Asia’s largest economies have surged to historic highs, with Japan’s Nikkei 225 rising for a sixth consecutive day, reaching a new multidecade peak. This upward momentum is fueled by expectations that the Bank of Japan will maintain a super-loose monetary policy, potentially bolstering export earnings for Japanese companies.

Simultaneously, in India, strong performances in tech stocks and shares of conglomerate Reliance Industries have propelled the S&P BSE Sensex up over 1%, marking a new record high. The Indian stock market’s vigor is attributed to robust economic growth in recent months.

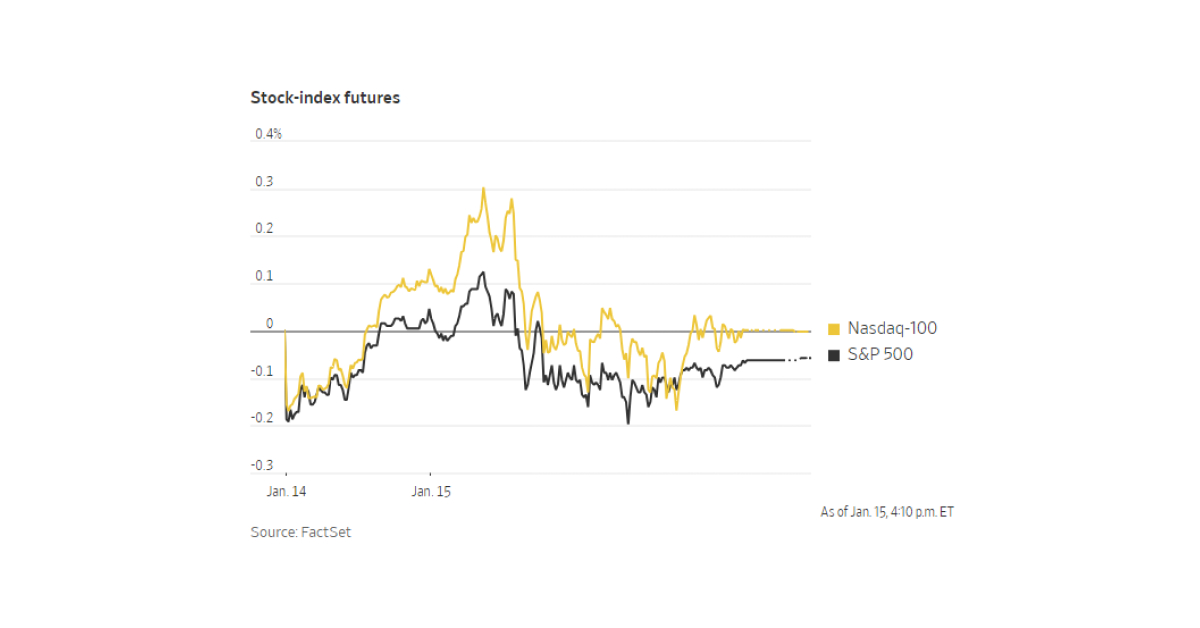

While U.S. equity and bond markets observed closure for Martin Luther King Day, attention turned to forthcoming bank earnings and economic data, anticipated to shed light on the Federal Reserve’s future actions. U.S. stock futures displayed fluctuations on Monday.

Image Source: FactSet

In Europe, stocks experienced a decline, influenced by pressures on resources companies and retailers, exacerbated by Germany’s contracting economy in 2023, driven in part by weakened global demand for industrial goods. The Stoxx Europe 600 fell 0.5%, marking its fourth loss in five trading days.

Crude oil futures experienced a slight decline, settling marginally above USD 78 per barrel. Energy analysts are closely monitoring conflicts in the Red Sea and heightened tensions in other Middle Eastern waterways. On Monday, the U.S. Central Command reported that a Houthi missile struck a U.S. bulk carrier off the coast of Yemen.

The upcoming earnings season takes center stage, with major banks such as Goldman Sachs, Morgan Stanley, and PNC Financial Services set to release results. Recent earnings from large banks like JPMorgan Chase and Bank of America indicated the resilience of consumers and businesses in 2023.

Deutsche Bank strategist Jim Reid emphasized that on the economic front, this week’s spotlight will be on retail sales data on Wednesday. Following last week’s revelation of slower-than-expected growth in producer prices, investors have responded by increasing bets on a potential Fed interest rate cut in March, with interest-rate derivatives suggesting a 70% chance, up from 63% the previous week, according to CME Group.

In the cryptocurrency realm, Bitcoin saw a positive turn after a three-day loss, briefly surpassing USD 43,000, and trading slightly below that level as of 5 p.m. ET.

Other News

Alvarez & Marsal Executive Detained Amid Fraud Charges

Alvarez & Marsal executive Guy Wall was detained in the UAE while overseeing the restructuring of Brooge Energy amid fraud charges. The SEC accused Brooge of inflating revenues by over USD 70 million.

Beijing Urges Not To Sell Amidst Chinese Stock Decline

Beijing is privately advising certain institutional investors not to sell, using “window guidance” to stabilize share prices. These measures, aimed at ending a prolonged market sell-off, have faced criticism for distorting the market and undermining overall investor confidence.

U.K. Car Insurance Quotes Soar, Raising Budget Concerns

U.K. motorists are grappling with a record average car insurance quote of GBP 995 (USD 1262), reflecting a 58% surge from the previous year, as insurers respond to increased claims costs. Concerns arise over the impact on household budgets.