Today’s News

Image Source: RBC-Ukraine

Japan unexpectedly slipped into a recession at the close of the previous year, losing its position as the world’s third-largest economy to Germany. This development has also cast uncertainty on the timeline for the central bank’s departure from its decade-long ultra-loose monetary policy.

Analysts caution about a potential contraction in the current quarter, citing factors such as weakened demand in China, sluggish consumption, and production halts at a unit of Toyota Motor Corp. The latest economic data highlights challenges on the path to recovery.

Yoshiki Shinke, senior executive economist at Dai-ichi Life Research Institute, emphasizes the notable sluggishness in consumption and capital expenditure, crucial components of domestic demand. He points out, “The economy will continue to lack momentum for the time being with no key drivers of growth.”

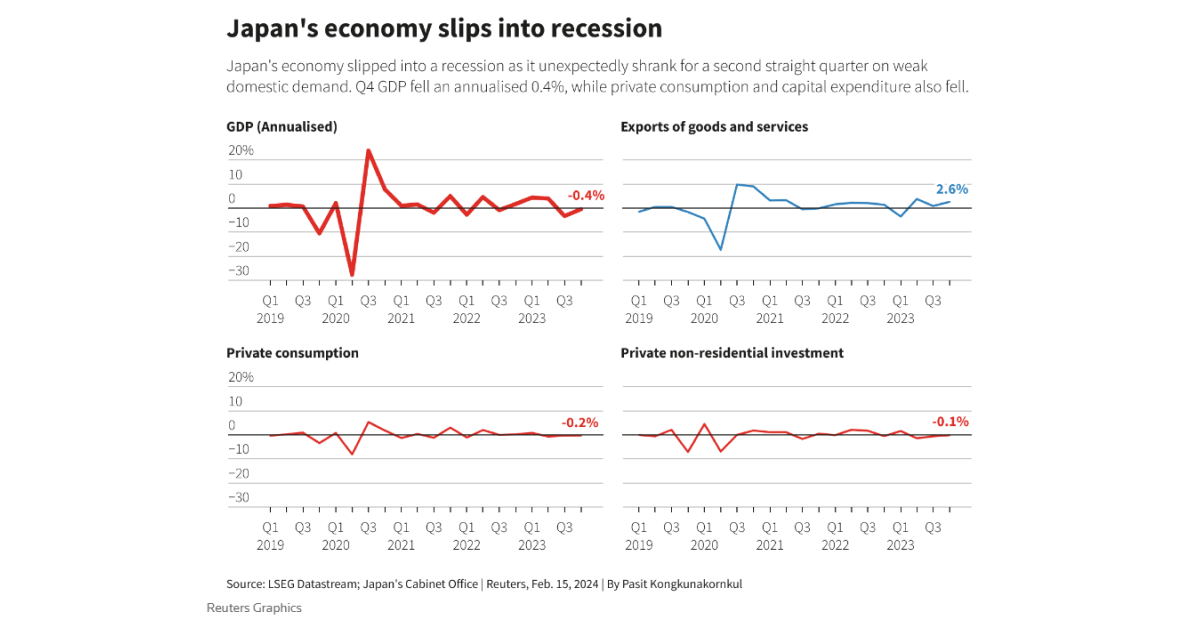

According to government data, Japan’s gross domestic product (GDP) fell an annualized 0.4% in the October-December period, contrary to market expectations of a 1.4% increase. Two consecutive quarters of contraction typically define a technical recession.

Despite expectations for the Bank of Japan (BOJ) to phase out its massive monetary stimulus this year, the weak data raises doubts about the BOJ’s forecast that rising wages will support consumption and maintain inflation around its 2% target.

Stephan Angrick, senior economist at Moody’s Analytics, notes, “Two consecutive declines in GDP and three consecutive declines in domestic demand are bad news, even if revisions may change the final numbers at the margin. This makes it harder for the central bank to justify a rate hike, let alone a series of hikes.”

Economy minister Yoshitaka Shindo emphasizes the necessity of solid wage growth to support consumption, which he describes as “lacking momentum” due to rising prices. He adds, “Our understanding is that the BOJ looks comprehensively at various data, including consumption, and risks to the economy in guiding monetary policy.”

The yen remained steady following the data release, and the Nikkei rose 0.8%, possibly on expectations that the BOJ may continue its massive easing program for a longer duration than anticipated.

On a quarterly basis, GDP slid 0.1%, compared to median forecasts of a 0.3% gain. Private consumption, accounting for over half of economic activity, fell 0.2%, while capital expenditure, another key growth engine, fell 0.1%. External demand, or exports minus imports, contributed 0.2 percentage points to GDP.

The BOJ has been preparing to end negative rates by April and overhaul other aspects of its ultra-loose monetary framework. However, the weak economic data suggests a cautious approach to subsequent policy tightening.

Marcel Thieliant, head of Asia-Pacific at Capital Economics, reflects on the divergence between GDP contraction and positive business surveys and a robust labor market. He concludes, “Either way, growth is set to remain sluggish this year as the household savings rate has turned negative.”

While Japan’s tight labor market and strong corporate spending plans could suggest a potential early exit from ultra-loose policy, the overall economic outlook remains uncertain.

Other News

South Korea Unveils USD 57B Corporate Aid Package

South Korea unveils a 75.9 trillion won (USD 56.97 billion) financial support program, featuring cheap policy loans for key industries and aid for small businesses affected by high-interest rates.

NatWest Set To Confirm Paul Thwaite As CEO

NatWest is expected to announce Paul Thwaite as permanent CEO, crucial for governance stability ahead of a potential government-led retail share sale in the summer.

Berkshire Hathaway Trims Apple Stake

Warren Buffett’s Berkshire Hathaway sells 10 million Apple shares, representing 1.1% of its holding, in the last quarter of 2023. The move follows Buffett’s admission of a potential error in an earlier decision to reduce its Apple stake.