Today’s News

Japan’s plan to redirect a significant portion of its substantial dollar reserves back into yen could significantly impact global financial markets due to the scale of the assets involved.

Image Source: Kyodo News

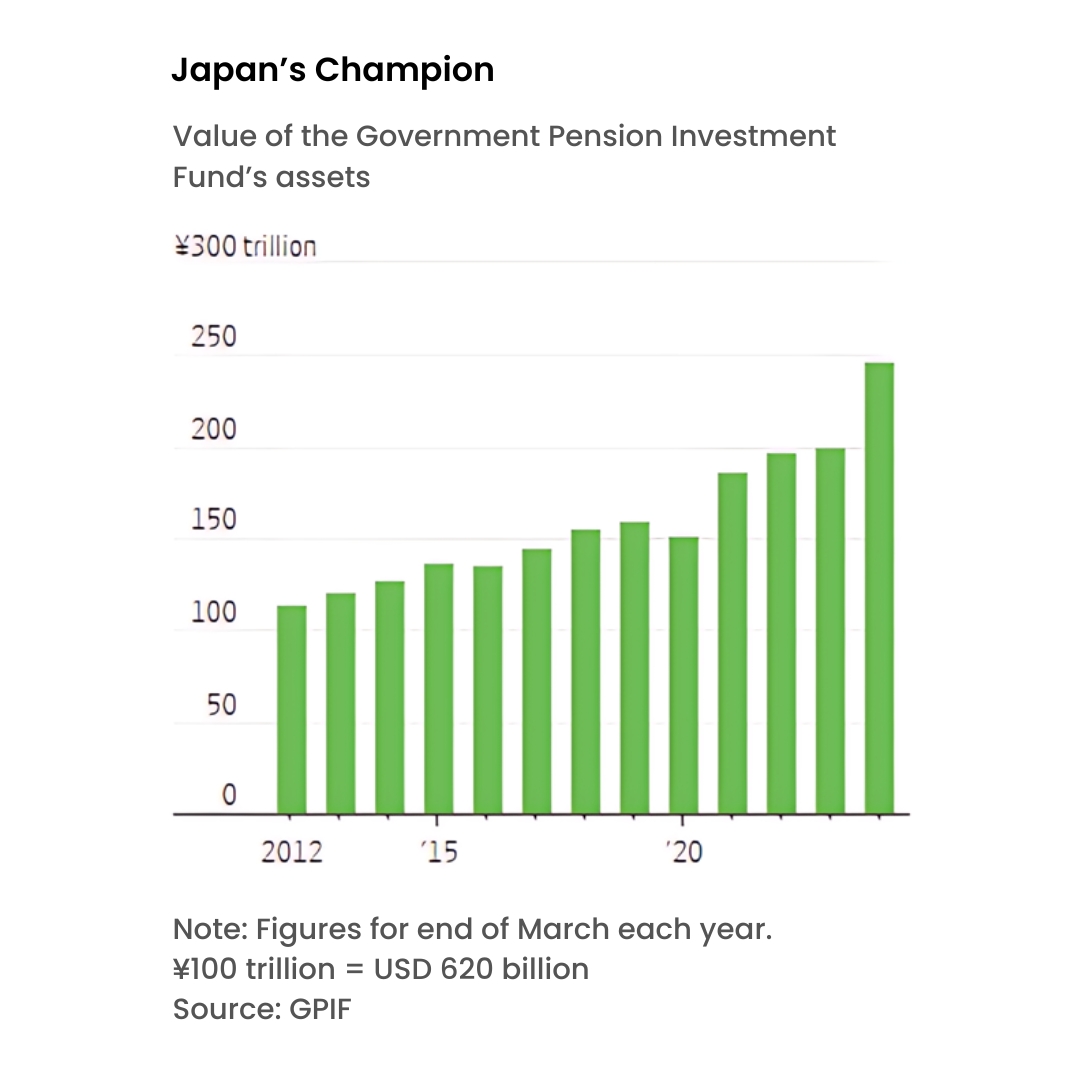

This strategic shift comes as Japan’s Government Pension Investment Fund, one of the world’s largest investors with JPY 246 trillion, equivalent to USD 1.53 trillion in assets, begins its first portfolio review in five years.

This review is critical as it could involve converting a large portion of the fund’s foreign holdings, predominantly in dollars, back into yen.

Japan’s Unique Pension Strategy

In a world where many pension systems are facing long-term challenges, Japan has taken a distinct approach. It diverts a portion of workers’ earnings—beyond immediate pension needs—into foreign assets like American stocks and bonds.

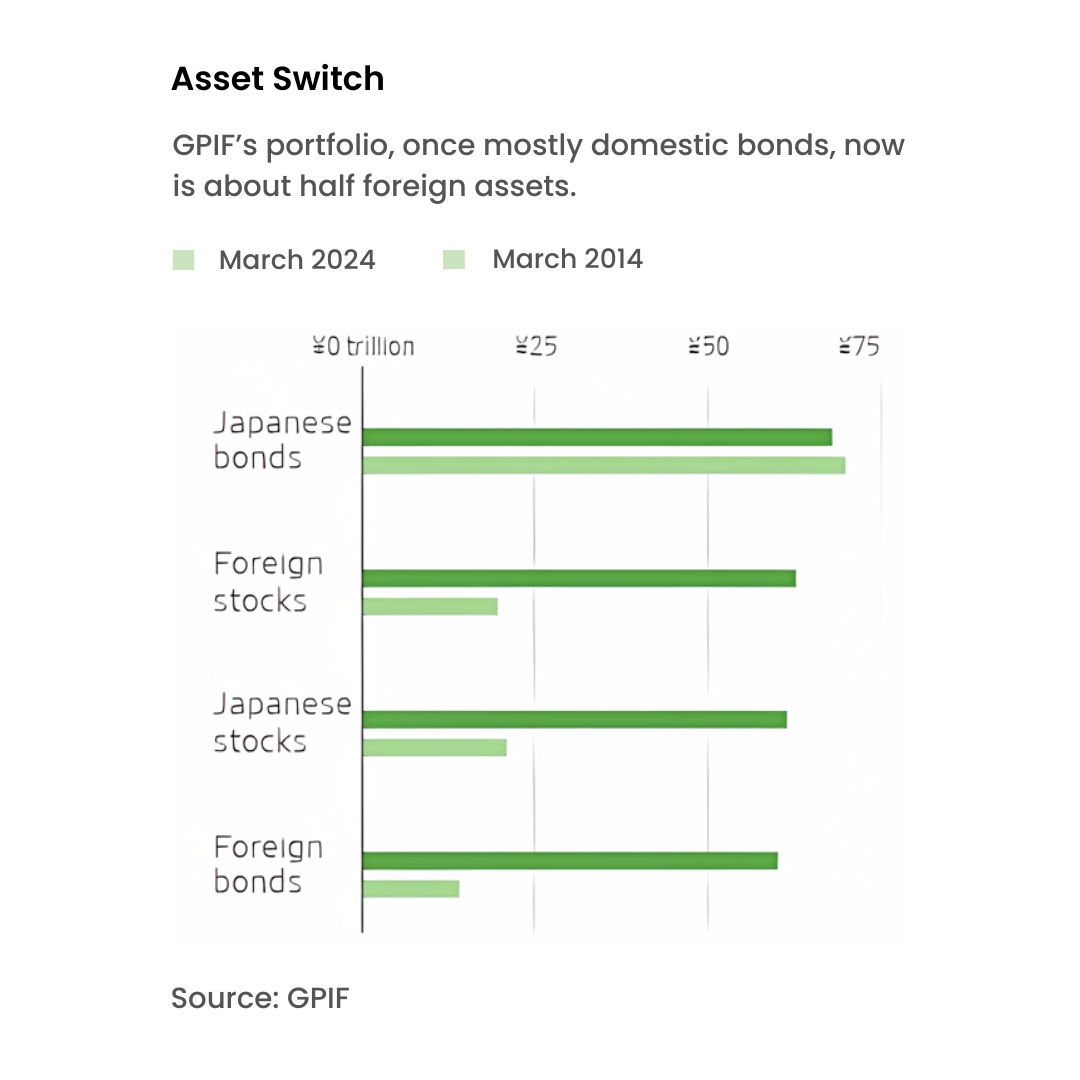

The Government Pension Investment Fund significantly increased its foreign holdings from 23% to 40% in 2014, and further to 50% a few years later. This strategy not only boosted U.S. and Japanese stocks but also encouraged similar investments by other large Japanese institutions.

Image Source: Wall Street Journal

Despite substantial gains, this approach of investing pension funds in foreign markets is seen as risky and suggests a lack of confidence in the Japanese yen, contrasting with the U.S. Social Security Trust Funds, which exclusively hold U.S. government bonds.

The U.S. had previously considered a plan to allow investments in stocks within Social Security, but the idea was scrapped during President George W. Bush’s administration.

As Japan’s long-term interest rates have risen, Takahide Kiuchi from the Nomura Research Institute suggested, “raising the weight of domestic bonds is a natural direction for normalizing the situation.”

Kiuchi, who was part of the Bank of Japan’s policy board when the foreign asset strategy was initiated, reflected on the past motivations: “I think there was also an element then of wanting a cheaper yen,” Kiuchi said.

“Now absolutely no one is looking for that.”

Image Source: Wall Street Journal

The Japanese yen has weakened significantly, prompting the government to sell dollars to stabilize it, even though the pension fund continues aggressive dollar investments based on policies from 2014.

Stefan Angrick from Moody’s Analytics commented on the potential for reversing this strategy, noting, “Seeing how they shifted in one direction 10 years ago, I think it makes sense that they would be able to do the same thing now” in the opposite direction.

He added that the large dollar reserves could act as “a form of insurance,” stating, “and if you want to use that money at a point in time when things get tough, then that moment is now, right?”

If the Government Pension Investment Fund of Japan reallocates 10% of its holdings from foreign currencies to yen, it would involve transferring approximately USD 150 billion.

Angrick and Kiuchi have pointed out that such a major reallocation may not necessarily stabilize the yen, given the vast and unpredictable nature of the forex markets.

Image Source: Bloomberg

At a recent press conference, GPIF President Masataka Miyazono declined to specify upcoming changes in the fund’s strategy but mentioned that an analysis of long-term returns from different asset classes was underway. “The yen depreciated against the dollar and euro in the previous fiscal year, which had positive effects on our investment performance,” Miyazono stated, emphasizing that the strategy was not intended to capitalize on the weak yen for gains.

The new investment strategy is set to be implemented in April next year, although it’s noted that the fund often adjusts its allocations in advance to ensure a smoother transition. Morgan Stanley analysts expect the fund to increase its domestic stock holdings, especially as the Nikkei Stock Average has been performing strongly.

Miyazono reiterated, “The fund wasn’t trying to exploit the weak yen to increase returns.” As Japanese companies increase dividends and buybacks and become more receptive to foreign investors, the fund can argue that repatriating funds serves the financial interests of its beneficiaries.

The strategy must be justified as the fund’s mandate is to maximize returns for future pensioners without being influenced by governmental policy objectives. Toshiyuki Takahashi, formerly of the government pension system and now with the Japan Research Institute, stressed the importance of diversification and a long-term investment perspective, cautioning against reactive measures to short-term market movements.

Other News

French Stocks Rise Despite Political Uncertainty

Following the leftist alliance in France’s parliamentary elections, French stocks initially dipped but recovered, reflecting the political uncertainty that may challenge the far-right’s influence.

S&P 500, Nasdaq Record Ahead Powell Testimony

As Wall Street awaits pivotal events including Jerome Powell’s Congressional testimony and key earnings reports, the S&P 500 and Nasdaq have reached new highs, and market calm persists.

Swiss Watchdog Lists UBS for Observation Post Merger

Switzerland’s price regulator has placed UBS under observation post its merger with Credit Suisse, focusing on potential increases in loan costs due to the bank’s enhanced market power.