Today’s News

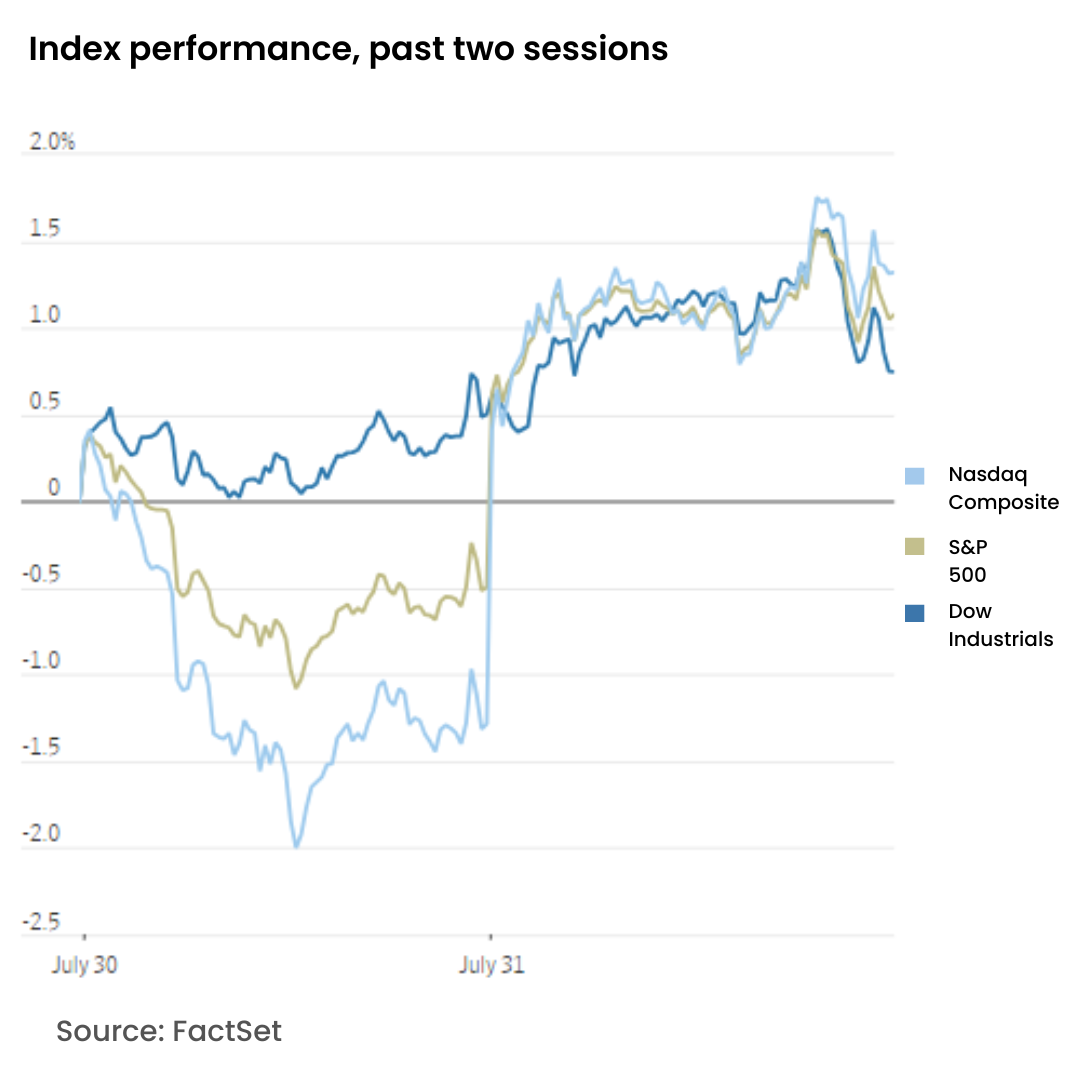

Stocks and government bonds experienced significant gains on the last day of July, marking a strong close to a fluctuating month in global markets.

Image Source: Investor’s Business Daily

All major U.S. indexes started the day with notable increases, maintaining their upward trajectory after the Federal Reserve opted to keep interest rates steady. Federal Reserve Chair Jerome Powell hinted at a potential rate cut in September, if inflation continues moving lower.

Image Source: Reuters

The Nasdaq Composite soared by 2.6%, recording its best performance since February, while the S&P 500 advanced by 1.6%, and the Dow Jones Industrial Average modestly increased by 0.2%.

Despite leading the month’s gains with a 10% increase, the Russell 2000 index of smaller companies grew by just 0.5% on the day, slightly underperforming compared to other indexes.

Following the Fed’s decision, government bond yields fell, with the 10-year Treasury yield dropping to 4.107%, marking its largest monthly decline of the year.

Portfolio manager Zhiwei Ren from Penn Mutual Asset Management expressed high confidence in a September rate cut, noting, “The market definitely likes that.”

This upbeat market sentiment was bolstered by recent positive economic indicators, including a report that U.S. economic growth exceeded expectations last quarter, and a steady decline in inflation. Fed officials at the meeting recognized these improvements in their ongoing battle against inflation.

Investors are now looking ahead to the upcoming monthly jobs report for further insights into the labor market’s condition. The anticipation of lower future interest rates has energized cyclical market segments and smaller U.S. stocks, which are generally more affected by borrowing costs.

For July, the S&P 500 and Dow saw overall monthly gains of 1.1% and 4.4%, respectively, although the Nasdaq slightly declined by 0.8%. Despite some volatility throughout the month, Wednesday’s trading indicated sustained investor interest in major tech firms.

Notably, Nvidia’s shares surged by 13%, and Micron Technology’s by 7.1%, with other semiconductor firms also seeing gains, reversing some of the month’s earlier losses.

In international markets, the Japanese yen and bond yields increased following the Bank of Japan’s decision to raise interest rates and announce a plan to cut back on bond purchases.

Other News

Citi Violates Federal Reserve Safeguard Rule

Citigroup has repeatedly breached Federal Reserve’s Regulation W, which limits transactions with affiliates to protect depositors.

UBS Sues Bank of America Over Mortgage Costs

UBS is suing Bank of America for USD 200 million, claiming it failed to cover legal costs tied to Countrywide Financial’s risky mortgages.

Powell Says Fed Decisions Unaffected by Politics

Summary: Federal Reserve Chair Jerome Powell stressed that the Fed’s decisions are solely based on economic data, not political influences.

Risk Disclosure:

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer:

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.

The above strategies reflect only the analysts’ opinions and are for reference only. They should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. Doo Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. The market is risky, and investments should be made with caution.