Today’s News

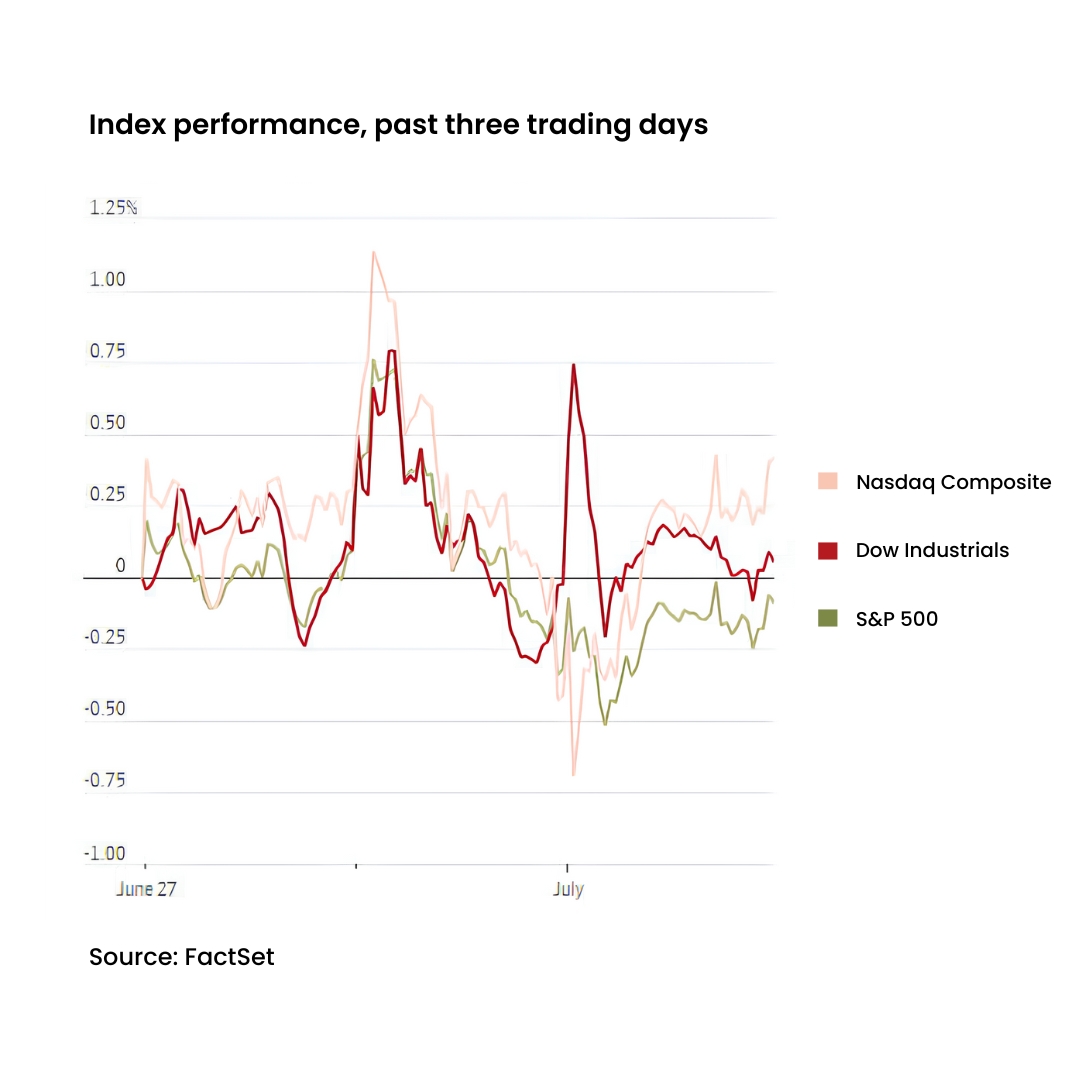

The Nasdaq Composite reached a new high, signaling a strong start to the second half of 2024, buoyed by persistent enthusiasm for artificial intelligence technologies. It marked its 21st record close for the year with a 0.8% rise.

Meanwhile, the S&P 500 saw a modest gain of 0.3%, narrowly missing its recent peak, and the Dow Jones Industrial Average edged up by 0.1%, or 50.66 points.

Image Source: Reuters

This positive momentum extends from a surprisingly strong performance in the first half of the year, driven by optimism about potential interest rate cuts and historical trends of stock market gains during presidential election years. “Stocks tend to do well in an election year because both parties are making promises to their constituency, and that leads to a little bit of euphoria,” explained Daniel Siluk, head of global short duration and liquidity at Janus Henderson Investors. He added, “And when the Fed’s cutting cycle begins, that can also lead to a little bit more risk-taking.”

However, the next phase of the market could see some volatility, Siluk noted. The impending earnings season and potential signs of a softening labor market and weaker consumer demand might affect corporate results.

In company-specific news, Boeing’s stock rose 2.6% after announcing an all-stock deal to acquire Spirit AeroSystems, a major fuselage manufacturer. Tesla’s shares surged over 6% in anticipation of its quarterly delivery report. On the flip side, Chewy’s stock dropped 6.6% after Keith Gill, known as Roaring Kitty, revealed a 6.6% stake in the company, leading to a turbulent trading day.

Image Source: The Wall Street Journal

Image Source: The Economic Times

Economic indicators showed some challenges, with a survey by the Institute of Supply Management indicating a more significant contraction in U.S. manufacturing than expected and a government report showing a slight decline in construction spending.

“We’ve seen some consistent moderation across a variety of macro indicators. If the macro data continues on this trajectory, there will likely be a fair amount of accommodation coming in the form of rate cuts,” stated Michael Hans, chief investment officer of Citizens Private Wealth.

Looking ahead, the U.S. markets will have a shortened trading session on Wednesday and will close on Thursday for the Fourth of July, with the next big update being the June jobs report on Friday. Economists are predicting a slowdown in job additions, which, coupled with signs of cooling inflation, fuels anticipation for potential rate cuts by the Federal Reserve in September. Currently, traders estimate a roughly 60% chance of a rate cut in September, based on the CME Group’s FedWatch tool.

Investors also responded to global political shifts, with France’s CAC 40 gaining 1.1% after initial parliamentary election results suggested a reduced likelihood of a far-right majority, which might have led to increased government spending or a strained relationship with the European Union.

Other News

Blackstone Sells Alinamin to MBK for USD 2.2 Billion

According to Nikkei, Blackstone is set to sell Japanese supplement maker Alinamin to North Asian buyout firm MBK Partners for approximately USD 2.17 billion in part of its strategic expansion.

UniCredit Challenges ECB’s Russia Exit Demands

UniCredit has appealed to the EU General Court against the ECB’s demands to cut its Russia exposure, arguing for clarity and a suspension of the directive amid legal risks to its operations.

UBS Finalizes Merger with Credit Suisse’s Swiss Unit

UBS has completed its merger with Credit Suisse’s Swiss operations, marking a significant step in the integration process. This merger transfers all client accounts and operational responsibilities to UBS.