Today’s News

Image Source: Reuters

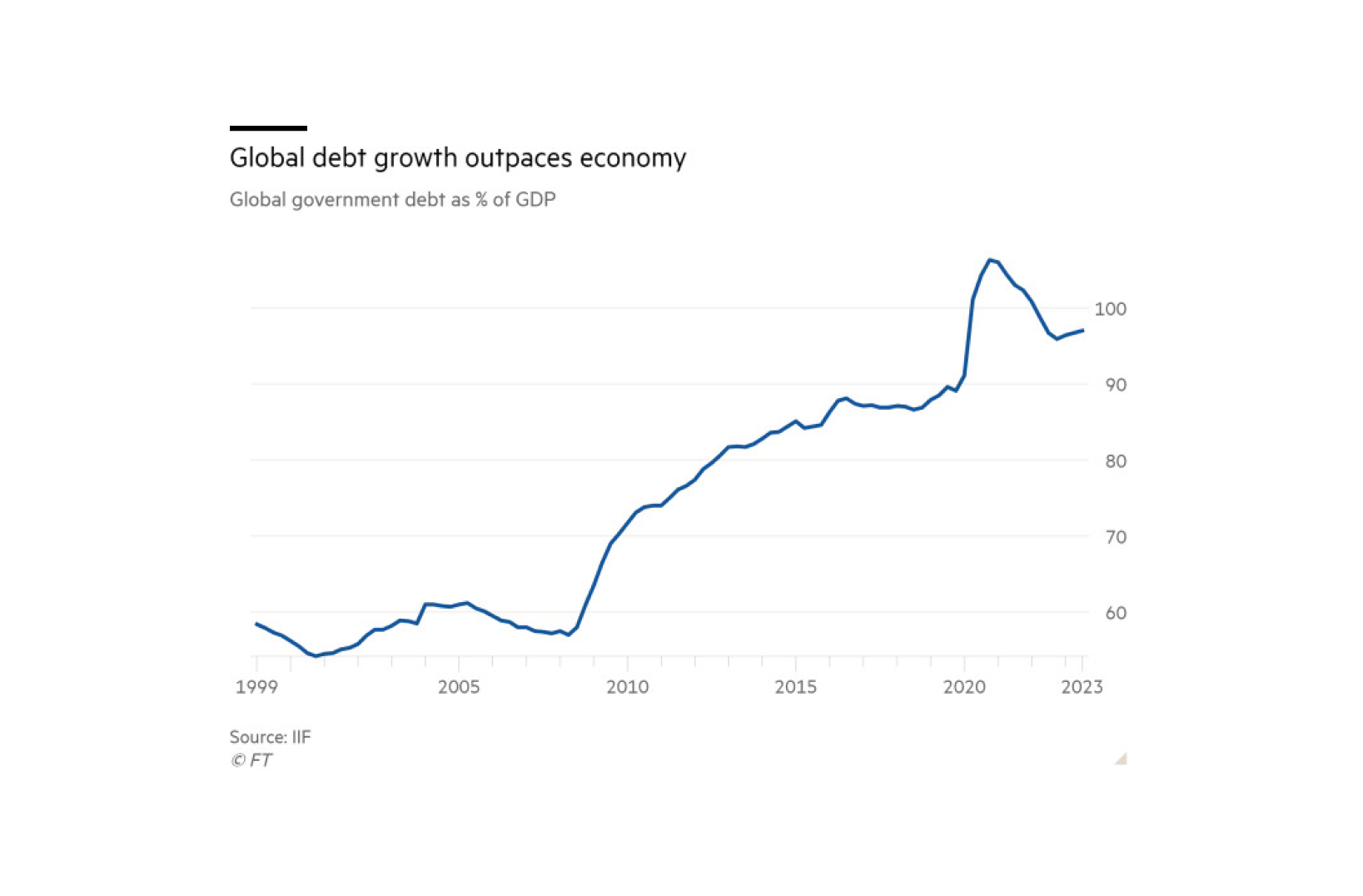

Investors are cautioning governments around the world about the concerning escalation of public debt, highlighting the risks associated with extensive borrowing ahead of elections that might trigger a backlash in bond markets.

Both the U.S. and the U.K. are projected to witness a significant surge in government debt issuance in the upcoming year, nearing record highs seen during the initial stages of the COVID-19 pandemic. Emerging markets are also anticipated to contribute to the overwhelming volume of bond sales, with their government debt reaching an unprecedented 68.2% of GDP in the preceding year, as per the Institute of International Finance.

Jim Cielinski, Janus Henderson’s global head of fixed income, expressed apprehension, stating that deficits seem “out of control and the real story is that there’s no mechanism for bringing them under control”. He emphasized the imminent concern for markets in the coming 6 to 12 months, terming it as a matter of substantial importance.

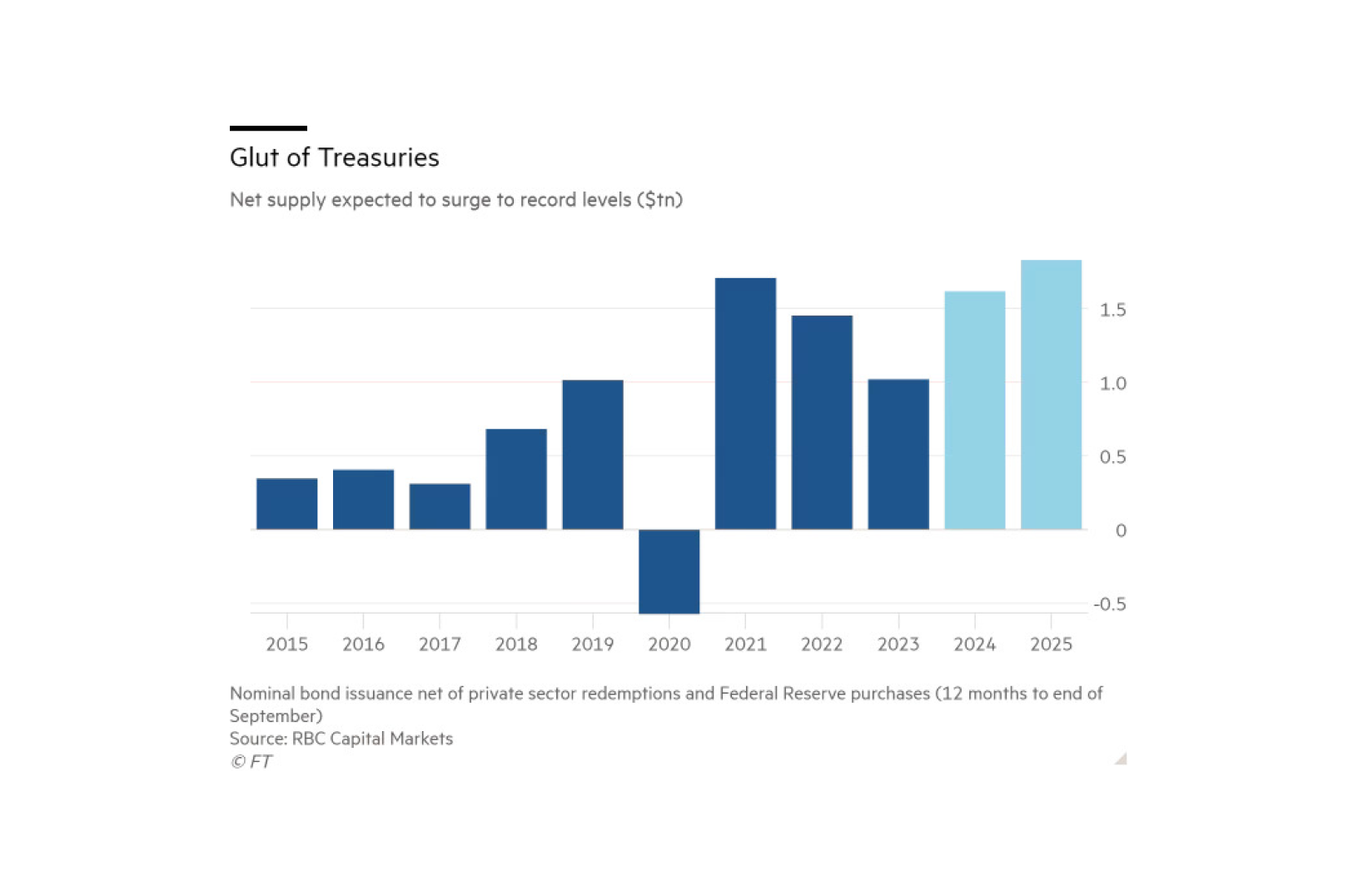

Estimations suggest the U.S. Treasury is set to issue approximately USD 4 trillion in bonds this year, a marked increase from USD 3 trillion the previous year and USD 2.3 trillion in 2018. Adjusted for Federal Reserve purchases and existing debt maturing, net issuance is anticipated to reach USD 1.6 trillion over the next 12 months, making it the second-highest level on record, according to RBC Capital Markets’ calculations.

This substantial borrowing trend is likely to divert attention from the typical focus on future interest rate trajectories, assert fund managers. Robert Tipp, PGIM Fixed Income’s head of global bonds, noted that “We are truly in an unmoored environment for government debt compared with previous centuries”, indicating that presently, “Everyone is getting a pass right now, whether you are in the U.S. or Italy, but there have been some signs recently that investors and rating agencies are starting to think about this again”.

In the U.K., where an election is anticipated, there are expectations of the second-highest year of debt sales, trailing only behind 2020 when the Bank of England intervened during the pandemic’s onset.

Sir Keir Starmer, the leader of the Labour party, which currently holds a significant advantage in the polls, has reduced a commitment to borrow GBP 28 billion (USD 35 billion) annually for the party’s “green prosperity plan” due to apprehensions surrounding the extent of public debt.

Even though the Labour party has scaled back its borrowing promises amid concerns over mounting public debt, the U.K.’s Debt Management Office head, Sir Robert Stheeman, stressed the significance of considering market realities in policymaking.

In Europe, NatWest estimates that the ten largest eurozone countries will issue around EUR 1.2 trillion (USD 1.3 trillion) in debt, with a projected 18% increase in net issuance compared to the preceding year.

Amidst a politically charged election year in the US, investors perceive a lack of appetite for fiscal restraint among key contenders. Forecasts from the IMF suggest the US budget deficit as a proportion of GDP is expected to elevate significantly over the next four years, along with a considerable rise in interest payments.

The Institute of International Finance (IIF) has warned of impending elections and geopolitical tensions in emerging economies, expressing concerns over escalated government borrowing and fiscal discipline in countries such as India, South Africa, Pakistan, and the US. It cautioned that adopting populist policies aimed at addressing social tensions could potentially lead to further borrowing, intensifying the burden of interest payments for sovereign debtors already grappling with high levels of debt.

Other News

Teesworks Project Sees Profits Triple Amid Controversy

Teesworks project’s profits surged to GBP 54 million (USD 68 mn) in 2023 after transferring majority ownership to private developers. Controversy arises over dividends and commissions received by the private sector partners amid a government inquiry.

Big Tech Opposes U.S. Oversight On Digital Wallets

Major tech companies, including Apple, Google, Amazon, Meta, and X, challenge the proposed U.S. Consumer Financial Protection Bureau’s regulation of digital wallets. They fear stifling innovation and disadvantaging startups, urging reconsideration.

Big U.S. Banks Set to Lead Corporate Bond Sales Post Earnings

Major U.S. banks, such as Bank of America, BNY Mellon, Citigroup, JPMorgan, and Wells Fargo, are expected to drive a surge in corporate bond issuance following their fourth-quarter earnings reports.