Today’s News

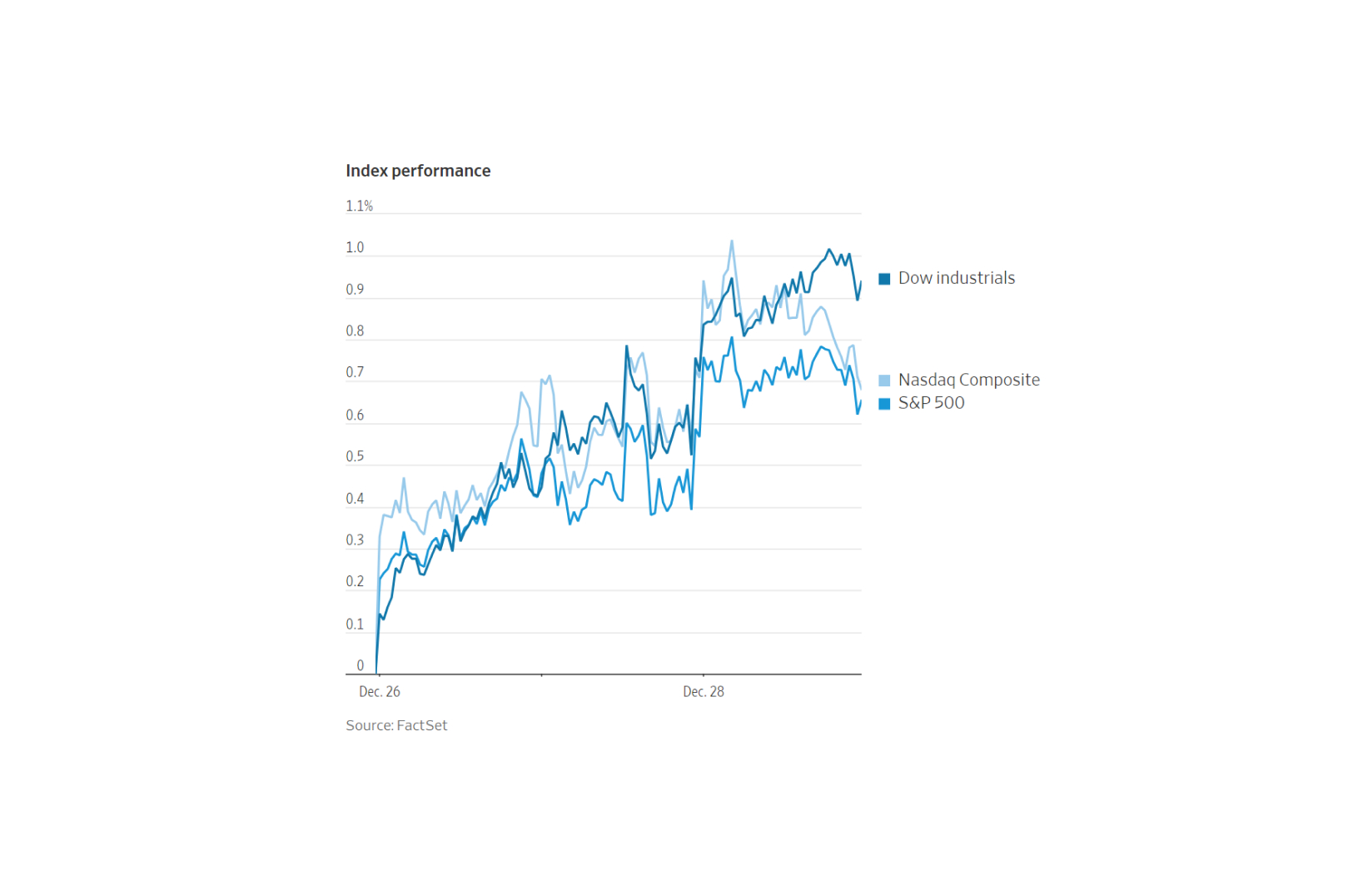

On Thursday, stocks experienced an upward trend, propelling the S&P 500 toward its ninth consecutive week of gains, marking its most extended weekly winning streak in nearly twenty years. The broader S&P 500 index gained 0.04 points, while the tech-heavy Nasdaq Composite faced a slight decline of 0.03. Conversely, the Dow Jones Industrial Average made gains, rising by 0.1%, equivalent to 54 points.

As 2023 draws to a close, the markets are concluding the year on a remarkable note. All three major indexes are poised for their ninth consecutive week of gains. If the S&P 500 maintains this trajectory, it would signify its lengthiest winning streak since January 2004, nearing its all-time high achieved in January 2022 by a margin of merely 0.3%.

With just one trading session remaining in the year, the S&P 500 has surged by 25%, reflecting a robust performance over the course of the year.

Year-End Market Dynamics and Sentiment

In a year-end rally, optimism prevails, bolstered by the belief that the Federal Reserve will effectively manage inflation without triggering a significant economic slowdown.

Michael Green, the Chief Strategist at Simplify Asset Management, remarked, “Nobody who has caught this rally wants to incur a taxable event. If nobody wants to sell, prices will push higher on low volume.”

Investors seem motivated to hold on to their gains until the new year to avoid taxable events, thereby contributing to the market’s upward momentum on low trading volumes. As the year concludes, trading typically sees reduced activity due to the holiday season, potentially amplifying market movements.

Economic Trends and Market Fluctuations

Despite minor deviations from anticipated figures, recent economic indicators suggest a gradual cooling of the economy. Jobless claims slightly exceeded expectations, standing at 218,000, slightly surpassing the economists’ anticipated figure of 215,000, as reported by the Labor Department on Thursday. This slight increase serves as the latest indication that the economy is gradually moderating its pace.

Matt Dmytryszyn, Chief Investment Officer at Telemus Capital, remarked, “As the data has come in this year, you have to acknowledge that the soft landing probability has increased. But a lot is still to be determined about the economy’s ultimate fate.” He mentioned his fund’s strategy of bolstering its position in shares of energy and industrial firms amid these economic shifts.

According to data released by mortgage giant Freddie Mac on Thursday, the average rate on a 30-year fixed mortgage decreased to 6.61%. This marks a notable drop of over a percentage point from the recent peak of 7.79% recorded in late October, which had been the highest rate seen in 23 years. Notably, this rate has consistently declined for nine consecutive weeks, reflecting a sustained downward trend in mortgage rates.

Reflecting an inverse trend, bond yields rose as prices fell, with the benchmark 10-year Treasury note reaching 3.849% from 3.788%. Similarly, crude oil prices experienced a 3.2% decline to settle at USD 71.77 a barrel, impacting the S&P 500 energy sector, which slipped 1.5%. Gold futures, after a four-day winning streak, dipped 0.5%.

Within the S&P 500, Match Group emerged as a top performer, climbing 2.6%, while Tesla faced a decline of 3.2%, marking the index’s biggest setback.

In global markets, Asian stocks surged as Beijing signaled a potential easing of its stringent stance on videogame makers, which had unsettled markets in the previous week. Hong Kong’s Hang Seng Index rose by 2.5%, and the Shanghai Composite gained 1.4%.

Other News

U.K. Investors Withdraw From London Equities

U.K. retail investors are on track to withdraw nearly GBP 12 billion ( USD 15.2 bn) from London-listed equities by 2023 end, marking the highest outflow in over two decades. Reasons include the cost of living, mortgage rates, and weaker market performance against the U.S.

U.S. Mortgage Rates Hit Lowest Since May

U.S. 30-year fixed-rate mortgages continued their nine-week decline, hitting 6.61% – the lowest since May. The drop, from a 22-year high in late October, aligns with indications from the Federal Reserve signaling a pause in rate hikes and a forthcoming reversal in 2024.

S&P 500 Eyes Eighth Straight Santa Rally

The S&P 500 is poised for an eighth Santa Claus rally, backed by a 0.8% surge in the initial period. Despite prior concerns, investor optimism over AI and expected Fed rate cuts fueled this year’s 25% rise. Analysts anticipate a positive 2024 start.