Today’s News

Image Source: Eater

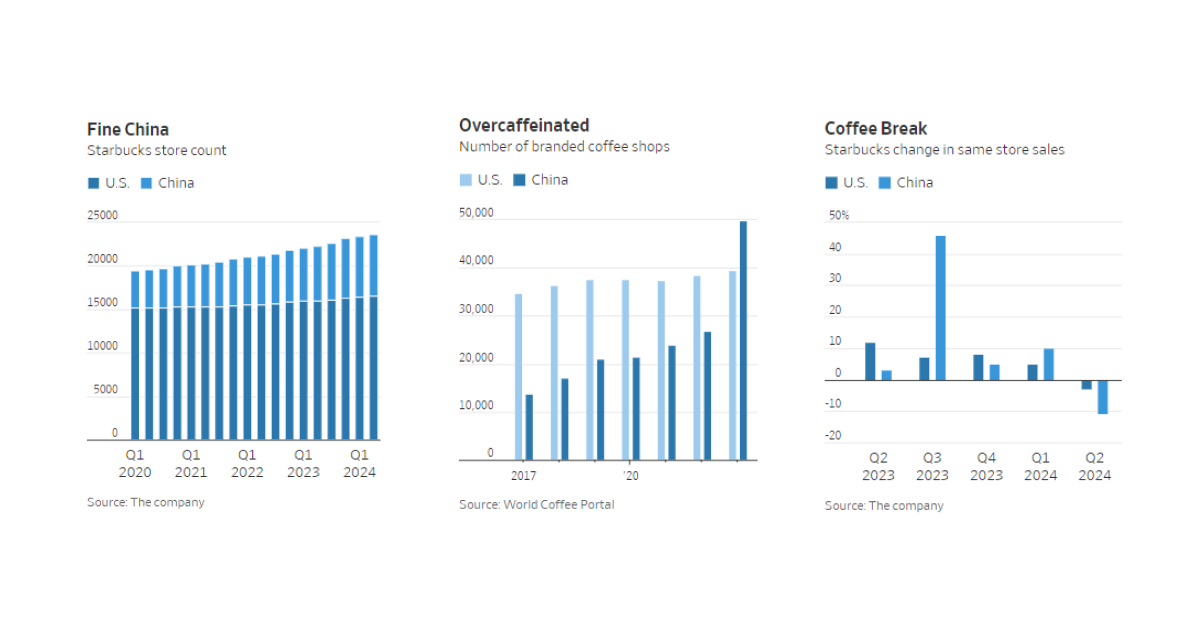

Starbucks, once an American coffee giant, is encountering a new reality as its traditional market stagnates. With U.S. sales on the decline, the company is pinning its hopes on China’s burgeoning coffee culture, a market it helped introduce a quarter-century ago. However, the path forward is strewn with challenges as China’s coffee scene undergoes a rapid expansion, with competitors multiplying and consumer preferences evolving.

Starbucks has enjoyed remarkable growth since its beginning, mushrooming from 165 stores at its IPO in 1992 to a peak valuation of nearly USD 150 billion. However, its journey hasn’t been without setbacks, experiencing significant stumbles on two occasions. Each time, Howard Schultz, the architect of its unprecedented expansion, returned as CEO to steer the ship back on course. Yet, this time, there won’t be a fourth return for Schultz at the helm.

Laxman Narasimhan, barely a year into his tenure as sole CEO, faced a tumultuous week as Starbucks grappled with alarming revelations. Analyst concerns about cautious consumer behavior paled in comparison to the company’s Tuesday disclosures. For the first time since the onset of the COVID-19 pandemic, transactions at North American cafes plummeted significantly, with Morgan Stanley analyst Brian Harbour noting a severity even surpassing that of the global financial crisis.

The situation was compounded by a sharper decline in same-store sales in China. Starbucks shares dived, echoing the depths reached during the height of the pandemic in March 2020. Management offered explanations for the U.S. shortfall, ranging from supply-demand imbalances to weather-related disruptions. However, by Wednesday’s close, the stock lagged behind the S&P 500 index by a staggering 56 percentage points over the course of a year.

During the subsequent investor call, Narasimhan reiterated his ambitious transformation plan dubbed “Triple Shot Reinvention With Two Pumps,” though analyst downgrades persisted despite his efforts.

China’s coffee landscape is in a state of frenzied growth, with the number of branded coffee shops ballooning by 58% in just one year. Notably, Luckin Coffee, Starbucks’ main rival in China, boasts more than double the number of outlets. The competition intensifies as foreign chains, including KFC and McDonald’s, pivot to capitalize on China’s growing thirst for coffee.

Then there is Tea, with its deep-rooted history in China, emerges as a formidable competitor amidst Starbucks’ challenges. Despite rapid expansion and numerous tea chains going public, shares struggle amid intense market rivalry. ChaPanda, the third-largest chain with approximately 8,000 shops, recently listed in Hong Kong, highlighting the saturation with 50 tea shops per kilometer in China’s top shopping areas and 10 shops in each of the top 10 shopping malls.

Yet, in this increasingly crowded market, Starbucks is standing firm on its premium positioning, refusing to engage in price wars despite mounting pressure. Yet, as competition escalates and market share dwindles, questions arise about the sustainability of this strategy.

Despite its challenges, Starbucks remains a formidable player in the global coffee industry. However, with its once-lucrative American market showing signs of saturation and fierce competition in China, the company faces a critical juncture in its quest for continued growth and relevance.

Other News

Buffett’s Apple Shares Strategy Amidst Market Turbulence

Warren Buffett’s bold move into Apple’s stock, initially surprising, has now grown into a substantial yet risky investment for Berkshire Hathaway, sparking concerns amidst Apple’s current challenges and market volatility.

U.S. Crackdown Slows Russian Finance Flows

Tightening restrictions by the United States on banks facilitating trade for Putin’s Ukraine war efforts have impeded financial transactions, leading to decreased trade volumes with key partners like Turkey and China.

Investor Shift to Passive Funds Hampers Active Managers

U.S. active asset managers, like Capital Group and Franklin Templeton, face significant outflows exceeding USD 50 billion in Q1 as investors opt for index tracking funds over stock-picking strategies.