Today’s News

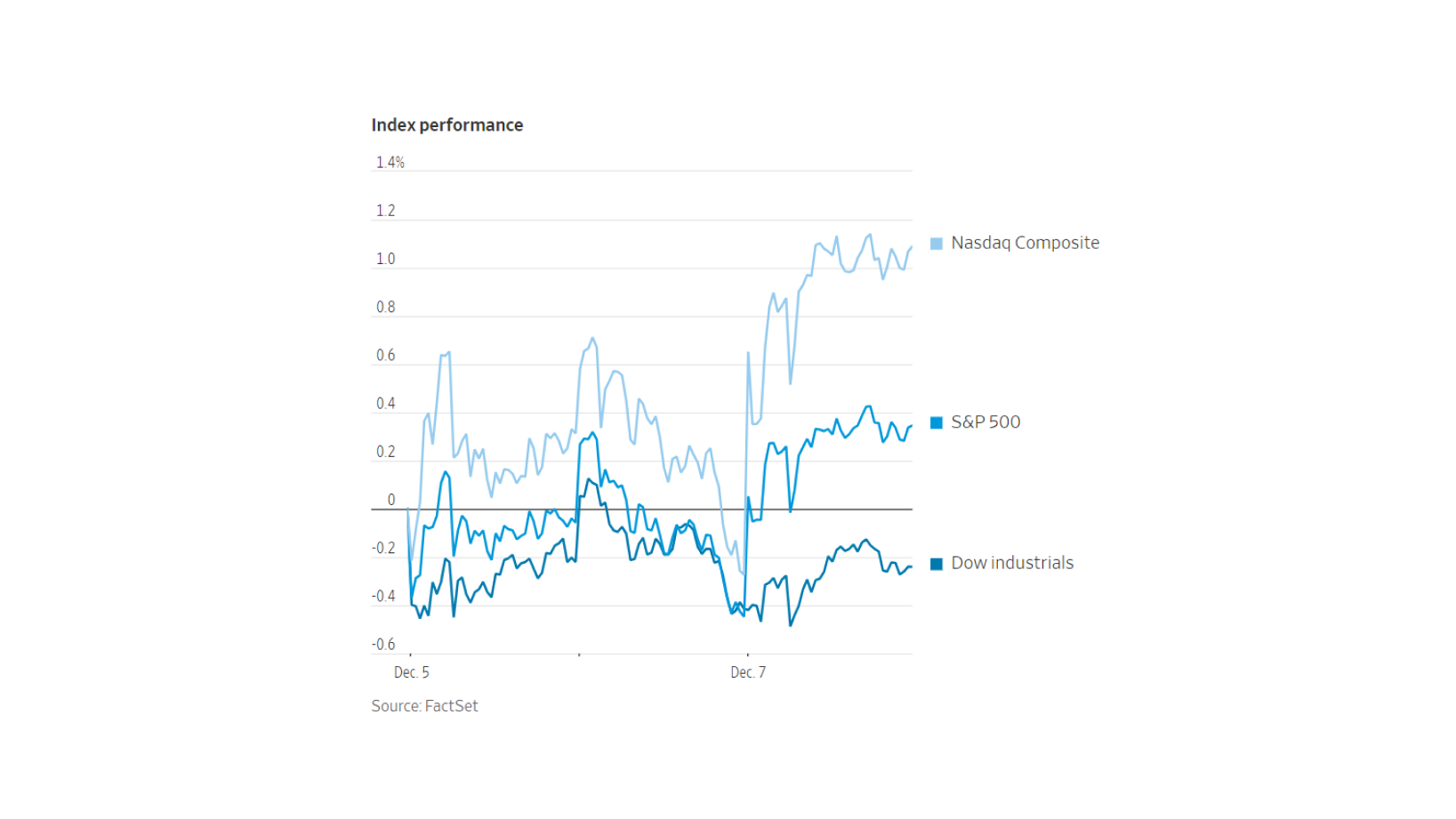

The stock market resumed its upward trajectory, bolstered by a resurgence in tech shares, particularly those of major technology companies that have been pivotal in driving market momentum throughout the year. Thursday saw the S&P 500 surge by 0.8%, reaching its peak for the year, while the Nasdaq Composite, heavily populated by tech stocks, climbed by 1.4%, and the Dow Jones Industrial Average gained 0.2%.

Image Source: Wall Street Journal

Following a period of relative stalling at the start of December, stocks regained their upward momentum, fueled once again by speculation surrounding the potential of artificial intelligence (AI) – a significant driver behind this year’s market gains.

Among the standout performers, Advanced Micro Devices (AMD) emerged as the best-performing stock in the S&P 500, closing the day with a remarkable 9.9% surge. This surge came on the heels of the chip maker’s announcement that tech giants like Microsoft, Meta Platforms, and Oracle have either adopted or are in the process of adopting its new AI chips. Google’s parent company, Alphabet, soared over 5% after unveiling its forthcoming AI system set to launch early next year.

Other tech giants such as Amazon.com and Meta also saw significant gains, each climbing more than 1.5%. Meanwhile, Nvidia, a key player in the AI sector, experienced a 2.4% increase in its share price.

Nancy Tengler, Chief Executive of Laffer Tengler Investments, emphasized, “We are in a digital, cloud-computing, generative-AI supercycle,” expressing bullish sentiments toward tech firms transitioning toward AI, despite their high valuations. Tengler also highlighted the role of stock buybacks in supporting share prices, particularly for large tech companies like Microsoft.

Image Source: Associated Press

Additionally, a rapid decline in Treasury yields contributed to the upswing in tech shares by amplifying the perceived value of their expected future profits among investors. Although the yield on the benchmark 10-year Treasury note remained relatively stable at 4.129%, a little changed from 4.121% Wednesday, its earlier ascent to 5% had previously exerted downward pressure on stocks. However, the market has since factored in a soft landing for the economy and anticipated interest rate cuts by the Federal Reserve in the upcoming year. Traders in interest-rate derivatives currently project a greater than 50% chance of a rate cut at the Fed’s March meeting.

The year-to-date performance of the S&P 500 reflects a 19% increase, while the recent decrease in yields has notably eased financial conditions in the mortgage market. According to mortgage giant Freddie Mac on Thursday, mortgage rates have dipped to slightly above 7%, marking the first time in approximately four months. This decrease reflects a nearly one-percentage-point drop from their recent high.

However, Jimmy Chang, Chief Investment Officer at Rockefeller Global Family Office, cautioned that the recent decrease in yields might conflict with the Fed’s objectives, as inflation has yet to approach the central bank’s 2% target.

The upcoming release of the Labor Department’s employment report on Friday is awaited by investors for insights into the economy’s health. Economists surveyed by The Wall Street Journal anticipate a rise in payrolls by 190,000 in November, up from 150,000 in October, while expecting the unemployment rate to remain steady at 3.9%.

Elsewhere, Thursday witnessed a boost in airline stocks following JetBlue Airways’ improved fourth-quarter sales outlook, citing robust holiday travel demand. Shares of major carriers like American Airlines, Southwest Airlines, and Delta Air Lines all surged by more than 3%.

Overseas, stock markets saw a predominant downward trend, with the Stoxx Europe 600 Index slipping by 0.3%, Japan’s Nikkei 225 declining by 1.8%, and Hong Kong’s Hang Seng falling by 0.7%. Simultaneously, the Japanese yen strengthened against the dollar, fueled by speculation surrounding the potential termination of the country’s negative interest-rate policy by its central bank. Oil prices experienced a slight dip, with Brent crude, the international benchmark, closing at USD 74.05 a barrel.

Other News

Labour Introduces 10 Financial Sector Advisers

Labour’s Tulip Siddiq introduces 10 financial advisors, signaling a shift in the party’s business approach. Promising collaboration, they aim to craft new sector policies, diverging from past anti-business perceptions linked to prior left-wing leadership.

Lawmakers Slam Post-Brexit Financial Sector Reforms

Lawmakers are critical of Britain’s post-Brexit financial reforms, citing delays and minimal impact, with Finance Minister Jeremy Hunt’s touted “Edinburgh Reforms” falling short of expectations, as per a report by parliament’s Treasury Select Committee.

Global Competition Spurred By U.S. Clean Energy Spend

The United States’ substantial investment in clean energy and technology triggers a worldwide race for incentives, with Europe and other nations strategizing to counterbalance the Biden administration’s industrial policies.