Today’s News

The U.S. dollar declined against several major currencies on Tuesday as markets prepared for key inflation data and a much-anticipated U.S. presidential debate. Despite these events, analysts believe neither outcome is likely to significantly alter the current direction of monetary policy.

Image Source: The Edge Malaysia

Safe-haven currencies, such as the yen and Swiss franc, gained ground amidst a sharp drop in bank shares. This shift came after the Federal Reserve’s regulatory chief announced a plan to increase capital requirements for large banks by 9%, which disappointed investors and critics of the rule. As a result, the S&P 500 banks index fell 2.7% to 408.2, after hitting a one-month low earlier.

Next week, the Federal Reserve is widely expected to cut interest rates for the first time in more than four years. However, the size of the cut remains uncertain. According to LSEG calculations, Fed funds futures show a 67% probability of a 25 basis point (bp) rate cut at the September 17-18 policy meeting, while there is a 33% chance of a 50 bp cut. The odds of a 50 bp cut surged to 50% last Friday following a mixed U.S. labor report.

“The general theme is consolidation. If you look at the one-month chart of the dollar index, we’re basically in the middle of the range,” said Eugene Epstein, head of structured products, North America at Moneycorp in New York. “So we have been grinding higher from the lows in late August and the driver of that has been mainly on the rates front. The market had pretty high expectations on the Fed cut next week … but some of those expectations have been dialed back,” he added.

U.S. Dollar Index

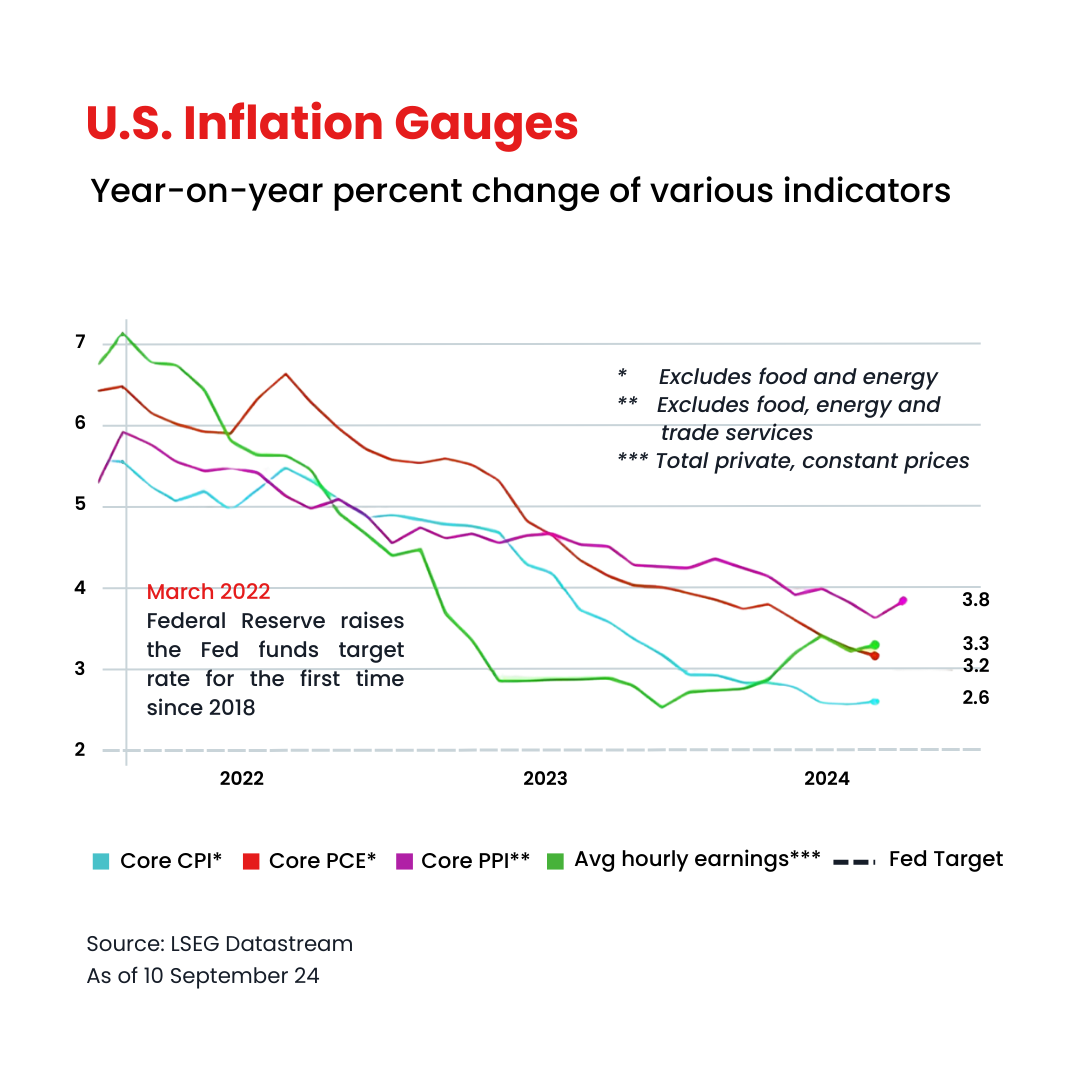

Investors are also focusing on the U.S. Consumer Price Index (CPI) report for August, which is due on Wednesday. While the Federal Reserve has indicated it is prioritizing employment over inflation, it remains confident that inflation is trending downward. According to a Reuters poll, the headline CPI is expected to have risen by 0.2% month-on-month in August, unchanged from the previous month. Year-on-year, the CPI is forecast to increase by 2.6%, down from 2.9% in July.

In late afternoon trading, the dollar fell 0.5% against the yen to 142.35, not far from the one-month low of 141.75 reached on Friday. The greenback declined 2.7% against the yen last week. Analysts do not expect the Bank of Japan to raise rates or provide clear guidance during its policy meeting next Friday. Meanwhile, the dollar slid 0.3% against the Swiss franc to 0.8466.

Declining oil prices have also contributed to global uncertainty, boosting safe-haven currencies like the yen and Swiss franc. Global benchmark Brent crude futures fell to their lowest level since December 2021 on Tuesday, following OPEC+’s revised down demand forecast for 2024 and 2025, which overshadowed concerns about supply disruptions from Tropical Storm Francine.

The euro saw a slight dip, falling 0.1% to USD 1.1024. Investors remain watchful of political developments in Europe, including a stalemate in France and growing uncertainty in the European Union after recent German regional elections. Attention will be on the European Central Bank’s messaging following its policy meeting on Thursday, as traders expect 63 basis points of ECB easing this year.

The dollar index, which measures the greenback’s strength against six major currencies, was relatively flat at 101.63 and is up 0.1% so far this year.

Markets are also closely watching the U.S. presidential debate between Republican nominee Donald Trump and Democratic Vice President Kamala Harris, set for later on Tuesday. Investors anticipate the dollar could strengthen if Trump wins, as his policies on tariffs and higher fiscal spending could support the currency and drive up interest rates.

Elsewhere, the British pound edged up 0.1% to USD 1.3081 after data showed robust employment growth in the UK. In China, imports fell short of forecasts, growing just 0.5%, following Monday’s weaker-than-expected inflation data, underscoring ongoing weak domestic demand. The Chinese yuan eased slightly against the dollar, which rose 0.1% to 7.1193, although losses were limited by stronger-than-expected export data.

Other News

Oracle Shares Surge 10% on AI Cloud Boost

Oracle shares jumped over 10% as strong AI-driven cloud demand lifted Q1 results, narrowing the gap with cloud leaders. The company’s cloud revenue grew 21%, beating market estimates.

Fed Expected to Cut Rates by 25 Basis Points

A Reuters poll indicates the Fed will cut interest rates by 25 basis points on September 18 and twice more in 2024, amid signs of economic slowdown and nearing inflation targets.

Japan Nominates Masato Kanda to Lead ADB

Japan nominates ex-currency diplomat Masato Kanda as its candidate for Asian Development Bank president, following Masatsugu Asakawa’s planned departure in February 2025.

Risk Disclosure:

Securities, Futures, CFDs and other financial products involve high risks due to the fluctuation in the value and prices of the underlying financial instruments. Due to the adverse and unpredictable market movements, large losses exceeding your initial investment could incur within a short period of time.

Please make sure you fully understand the risks of trading with the respective financial instrument before engaging in any transactions with us. You should seek independent professional advice if you do not understand the risks explained herein.

Disclaimer:

This information contained in this blog is for general reference only and is not intended as investment advice, a recommendation, an offer, or an invitation to buy or sell any financial instruments. It does not consider any specific recipient’s investment objectives or financial situation. Past performance references are not reliable indicators of future performance. Doo Prime and its affiliates make no representations or warranties about the accuracy or completeness of this information and accept no liability for any losses or damages resulting from its use or from any investments made based on it.

The above strategies reflect only the analysts’ opinions and are for reference only. They should not be used or considered as the basis for any trading decisions or as an invitation to engage in any transaction. Doo Prime does not guarantee the accuracy or completeness of this report and assumes no responsibility for any losses resulting from the use of this report. Do not rely on this report to replace your independent judgment. The market is risky, and investments should be made with caution.